Taxpayers can claim deduction of up to Rs 1.5 Lakhs from the taxable income by investing in certain eligible investment schemes under Section 80C of Income Tax Act 1961. The total amount of investment made by the investor in 80C schemes can be claimed as deduction from gross taxable income. Investors can save up to Rs 46,780 in taxes by making tax saving investments. Employee Provident Fund (EPF), Voluntary Provident Fund (VPF), Public Provident Fund (PPF), National Savings Certificates, Tax Saver Bank Fixed Deposits, Senior Citizens Savings Schemes, life insurance plans, mutual fund Equity Linked Savings Schemes (ELSS) etc. are eligible for tax savings under Section 80C of The Income Tax Act 1961.

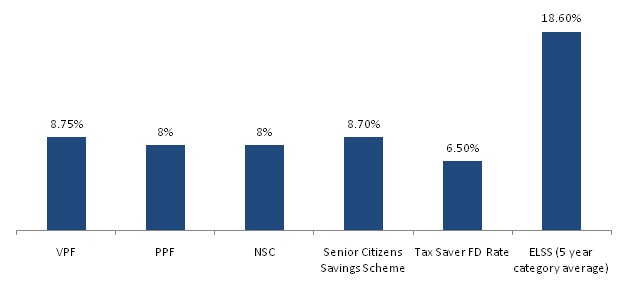

Returns of different tax saving investment schemes

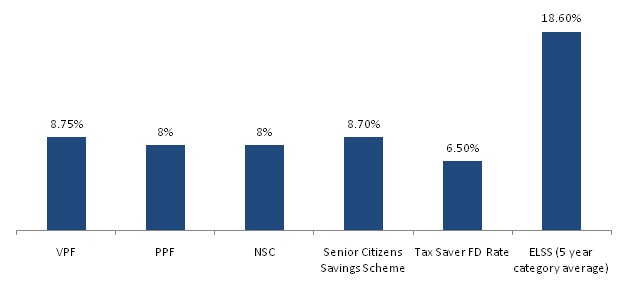

Some 80C schemes offer fixed rates of return based on interest rates prevailing at the time of investment, while others like Unit Linked Insurance Plans (ULIPs) and ELSS are market linked. The chart below shows the current interest rates offered by different 80C schemes; ELSS return is category average annualized returns over the last 5 years.

Investors should note that there is no guarantee of returns or assurance of capital safety in ELSS mutual funds. If capital safety is your most important concern then ELSS is not for you. However, for investors with appetite for risk, ELSS mutual fund is the best investment option for creating wealth over long investment tenors. Historical data shows that, equity is the best performing asset class in the long term. Rs 1 Lakh invested in the BSE – Sensex twenty years back would have grown to Rs 14.2 Lakhs, while the same money invested in FD would have grown to just Rs 4.1 Lakhs.

What is ELSS mutual fund?

ELSS mutual fund is nothing but a diversified equity mutual fund scheme with a lock-in period of 3 years and tax saving benefits under section 80C. You can invest in ELSS either in lump sum or through systematic investment plan(SIP) mode. In our view, SIP is a better mode of investment for ELSS mutual funds because it can help you remain disciplined in your tax planning. Often we see investors making 80C investments at the last minute to save taxes; while they are able to achieve their tax saving objective, they lose out on returns. SIP in ELSS mutual funds ensures that you invest throughout the year and benefit from remaining invested longer.

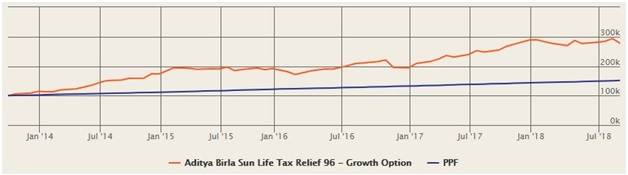

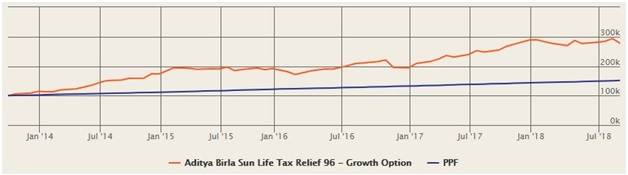

As discussed earlier over long investment tenors, ELSS is the best 80C investment option for wealth creation. The chart below shows the returns of Rs 1 Lakh lump sum investment in Aditya Birla Sun Life Tax Relief 96, an Equity Linked Savings Scheme (ELSS) versus PPF over the last 5 years. The ELSS investment grew to nearly Rs 2.8 Lakhs while the PPF investment grew to Rs 1.5 Lakhs only.

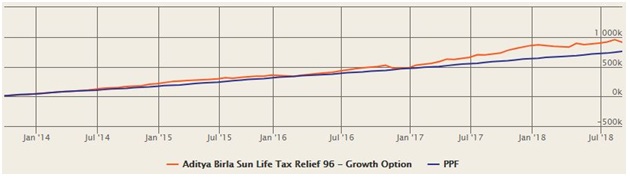

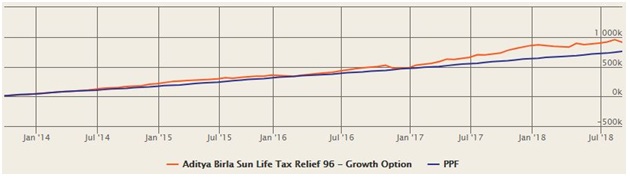

The chart below shows the returns of Rs 10,000 monthly SIP in Aditya Birla Sun Life Tax Relief 96, an Equity Linked Savings Scheme versus Rs 10,000 monthly deposit in PPF over the last 5 years. Your ELSS investment would have grown to Rs 9.1 Lakhs, while the PPF investment would have grown to Rs 7.6 Lakhs only.

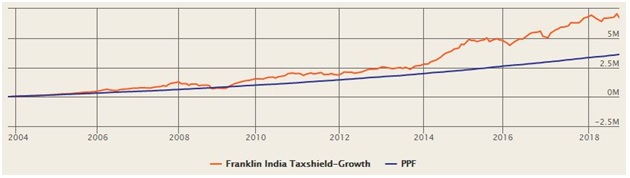

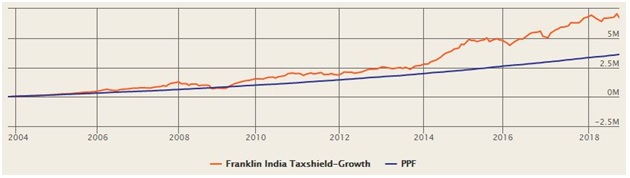

Over longer investment tenors, ELSS would have outperformed PPF by an even bigger margin. The chart below shows the returns of Rs 10,000 monthly SIP in Franklin India Taxshield, an ELSS fund versus Rs 10,000 monthly deposit in PPF account over the last 15 years. The ELSS investment would have grown to a corpus of Rs 67 Lakhs (with a cumulative investment of just Rs 18 Lakhs), while the PPF investment would have grown to Rs 36 Lakhs only.

From a wealth creation perspective, ELSS mutual fund is simply the best 80C investment option over long tenors.

Tax Benefits

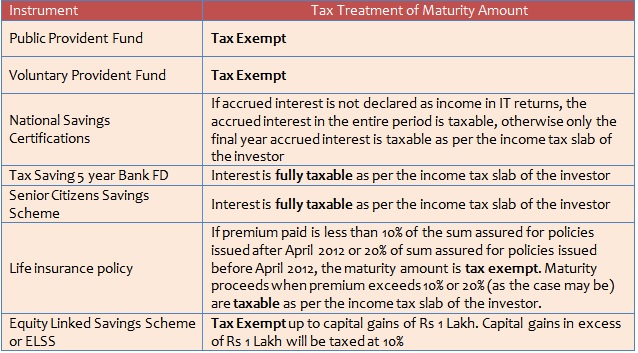

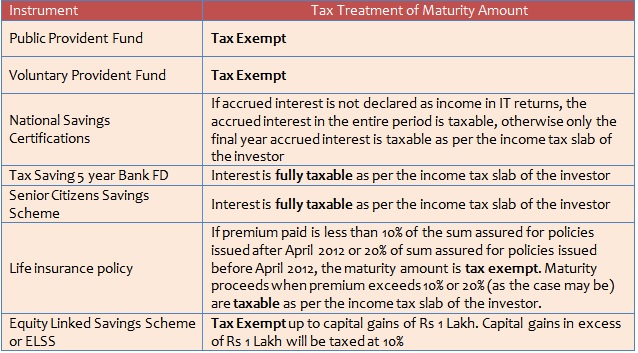

Taxpayers usually think only about tax savings when making 80C investments. While tax savings is the primary objective of making 80C investments, returns should also be an important consideration for taxpayers. The final return of an investment is affected by the tax treatment of the maturity amount. Equity Linked Savings Scheme is one of the most tax friendly 80C investment options.

Liquidity

When making tax saving investments, taxpayers are often resigned to the fact that their money will have to be locked in for a long period of time at low rates of returns, in order to save taxes. In Voluntary Provident Fund your money is locked in till your retirement. In Public Provident Fund (PPF) the money is locked in for 15 years. Minimum term of National Savings Certificates (NSC) is 5 years. Senior Citizen Savings Scheme (SCSS) has a term of 5 years; premature withdrawals are allowed, but charges apply for premature withdrawals. Term of life insurance plans range from 15 to 25 years; premature withdrawals are allowed but charges may apply (depending on the plan). Minimum lock-in period of life insurance ULIP plans is 5 years. Equity Linked Savings Schemes (ELSS) has a lock in period of 3 years only - it offers the highest liquidity among all 80C schemes. Though we do not recommend redeeming your ELSS investment after 3 years, ELSS gives you the flexibility of planning your investments without constraints.

Conclusion

Making tax saving investments is an important activity in the fiscal calendar of all taxpayers. A mutual fund ELSS scheme is one of the best tax saving investment options for investors with high risk appetite. With ELSS mutual funds you can create more wealth than any other 80C investment options, over a sufficiently long investment tenor. ELSS is also one of the most tax friendly investment options under Section 80C. ELSS also offers the maximum liquidity and flexibility compared to other 80C investment options. If you want to save taxes and create wealth, please contact us at lordscal@easternfin.com