Quant (shortened form of Quantitative) funds base their investment decisions based on mathematical models or quantitative algorithms. Mathematic models can be used to determine which stock to buy or sell, at what price or when to buy or sell, asset allocation, how to rebalance and other portfolio management strategies / tasks. Quant funds are very popular in the West, especially the United States. Nearly a quarter of all stock trades in the US comprise of quantitative or algorithmic investments.

DSP Quant Fund

DSP Mutual Fund launched the DSP Quant Fund about a year back. They have Rs 212 Crores of assets under management (AUM) as on 31st May 2020. Their expense ratio is 1.29%. The scheme has a rigorous quantitative approach to stock selection and portfolio construction. Beginning with the universe of companies from the S&P BSE 200 (the scheme benchmark), the scheme’s quant model filters these companies using a 3-step process:-

- Companies with high debts, inefficient capital allocation or stocks that indicate high volatility are removed in an unbiased way

- Companies are evaluated on factors such as Quality (Return on Equity, Earnings etc), Value (Dividend Yield, Free Cash Flow Yield etc) and Growth (Estimated earnings growth etc) and the best ones are chosen

- Each selected stock is weighted appropriately to reduce stock & sector concentration and liquidity risk

How robust is the Quant model of the scheme?

- In 10 out of the past 14 calendar years, the model of DSP Quant Fund outperformed its benchmark

- 100% of time the scheme model outperformed its benchmark over any 5 year, 7 year or 10 year periods

- 100% of time the scheme model delivered >12% average annual returns (CAGR) over any 7 year or 10 year period

- A long-term SIP in the DSP Quant Fund model would have outperformed a similar SIP in the benchmark S&P BSE 200 TRI by 4% XIRR

- In both years when BSE – 200 TRI delivered negative returns (2008, 2011), the model still performed better

Though back testing result can serve as useful reference, we must reiterate here that, historical performance may or may not be sustained in the future. Since the scheme has completed a year, in rather difficult market circumstances, we analyzed the performance of the scheme in the last 1 year.

Performance of DSP Quant Fund

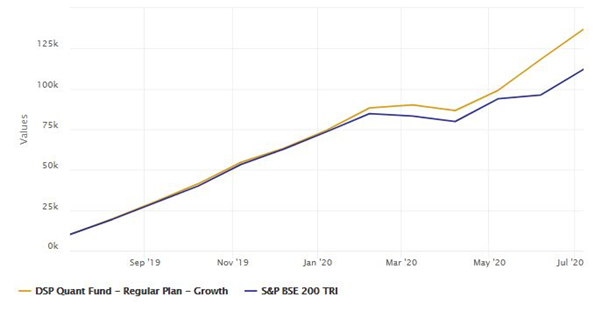

The chart below shows the growth of Rs 10,000 lump sum investment in the scheme versus the benchmark index BSE 200 TRI in the last 1 year. You can see that the scheme outperformed the benchmark.

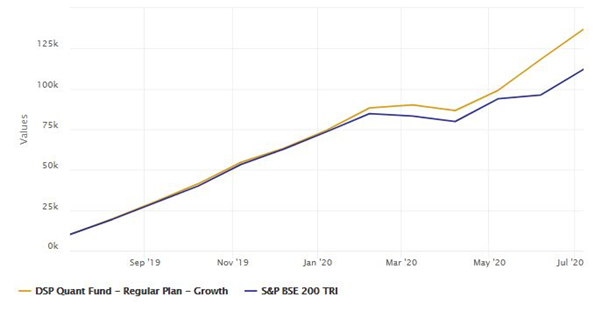

The chart below shows the growth of Rs 10,000 monthly SIP in the scheme versus the benchmark index. You can again see that the scheme outperformed the benchmark in SIP returns.

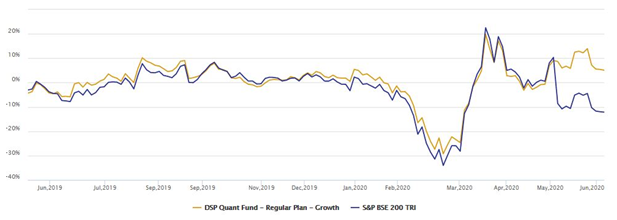

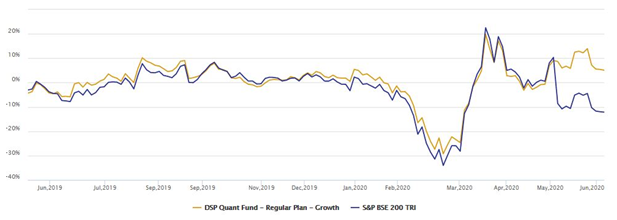

The chart below shows the 1 month returns of the scheme versus the benchmark since the inception of the scheme. You can see that the scheme outperformed the benchmark on a fairly consistent basis. BSE 200 TRI gave negative rolling monthly returns nearly 49% of instances in the last year or so, whereas DSP Quant Fund gave negative rolling monthly returns only around 36% of instances.

The scheme has clearly outperformed the benchmark in down markets. The average monthly rolling return of the scheme in the last 1 year was 0.45% versus -2.1% for the benchmark. While the down market performance of the scheme was definitely superior, you can see that the scheme matched the benchmark in up markets. Though 1 year is a relatively short period of time to evaluate scheme performance, the rolling returns of the scheme in different market conditions provides a glimpse into the robustness of the quant model of the scheme.

Who should invest in DSP Quant Fund

- Investors who have disciplined approach to investing

- Investors who are patient and can remain invested for 7 years or more

- Investors with moderately high to high risk appetites to digest high short term volatility

- Monthly SIP is the ideal way to invest in this scheme over a long investment horizon

- Investors can also take advantage of the price correction due to COVID-19 to tactically invest in lump sum. If you are worried about near term volatility you can invest through 3 – 6 month STP

Why invest in DSP Quant Fund?

- Quant investing is an emerging trend and will gather momentum in the years to come.

- The investment strategy has been back tested with extremely encouraging results

- Even the actual performance of the scheme versus benchmark in difficult market conditions prevailing over the last 1 year supports the investment hypothesis and model

- The scheme has a large cap bias. Large cap exposure not only reduces volatility / increases portfolio stability, but large caps also provide market leadership and have historically led the broader market in recoveries from bear markets.

Conclusion

Investors can allocate a portion of their portfolio to DSP Quant Fund either through SIP or lump sum with a long investment horizon. If you have a question or need guidance, our financial advisors are always on the standby to help you with your investment needs.