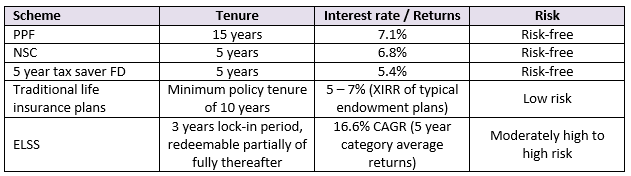

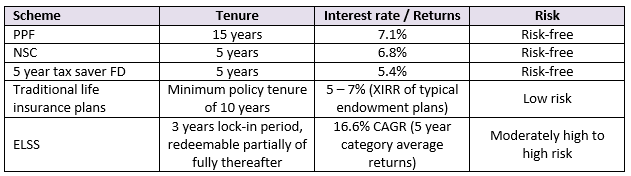

Tax payers can claim deductions of up to Rs 1.5 lakhs every year from their gross taxable income by investing in various schemes allowed in Section 80C of Income Tax Act 1961. 80C investments like Public Provident Funds (PPF), National Savings Certificates (NSC), tax saver term deposits etc are risk free investments. Equity Linked Savings Schemes (ELSS) and Unit Linked Insurance Plans (ULIPs) are subject to market risks.

Equity Linked Savings Schemes or ELSS Mutual Funds are diversified equity funds with a lock-in period of 3 years. These funds diversify across different industry sectors and market capitalization segments. You can start investing in ELSS with a minimum of Rs 500 only. There is no upper limit of investments in ELSS; however, you can claim tax deduction of up to Rs 1.5 lakhs u/s 80C only. You can invest in SIP either in lump sum or through SIP. If you are investing in ELSS through SIP, then each SIP installment will be locked in for 3 years.

Comparison of ELSS with other 80C options

Why invest in ELSS mutual fund in 2022?

- Historical data shows that equity, as an asset class, has the potential of giving superior returns in the long term. In the last 20 years (ending 30th November 2021) Nifty 50 TRI has given 16.5% CAGR returns.

- Since ELSS funds can invest across market capitalizations segments, there is opportunity for fund managers to create alphas by investing in a bigger universe of stocks. You may like to read tax saving tips to grow your wealth

- The 3 year lock-in period of ELSS enables fund managers to invest in high conviction stocks for a long period of time because of relatively less redemption pressure.

- ELSS is the most liquid investment option u/s 80C. ELSS has lock-in period of 3 years, whereas minimum lock-in period of other 80C investment options is 5 years.

- ELSS is one of the most tax efficient investment options u/s 80C. We will discuss taxation of ELSS later in this article.

- You can invest small amount in ELSS by way of SIPs. Please read this should you invest in lumpsum or SIPs in mutual funds.

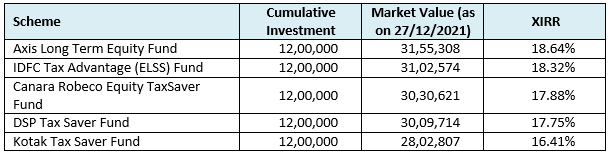

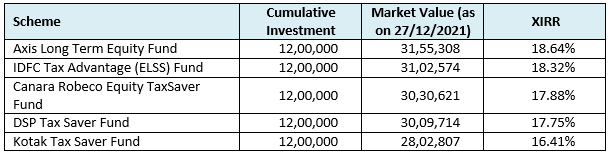

Wealth creation by ELSS

The table below shows how much wealth you could have accumulated through a monthly SIP of Rs 10,000 in select top performing ELSS funds over the last 10 years (ending 27th December 2021). Please note the schemes in the table below have been selected purely for illustrative purposes and should not be taken as investment recommendations. Past performance may or may not be sustained in the future. You should consult with your Eastern Financiers financial advisor to select schemes suited for your risk appetite and tax planning needs.

Taxation of ELSS mutual fund

Capital gains of up to Rs 1 lakh in ELSS investments is tax exempt in a financial year and taxed at 10% plus surcharge and cess thereafter. If you invest in the IDCW option of ELSS funds, then the dividends received by you in a financial year will be added to your income and taxed as per your income tax slab.

You should also read our blog did you know all about tax benefits of mutual funds in India

Who should invest in ELSS mutual fund?

- Investors looking to save taxes by investing in schemes eligible u/s 80C. You can save up to Rs 46,800 per year in taxes by investing in ELSS funds.

- Investors who are looking for capital appreciation or wealth creation over long investment tenures.

- Investors should have minimum 3 year investment horizons for ELSS. Though you redeem your ELSS units partially or fully after the completion of 3 years from the date of investment, we recommend that you remain invested for minimum 5 years.

- Investors should have moderately high to high risk appetites for ELSS. These funds can be volatile in the short term, but in the long term have the potential of giving superior returns.

- Tax saving investments u/s 80C must be made before 31st March of a financial year, if you want to claim the benefits for the same year. You must plan accordingly.

You should consult with your Eastern Financiers financial advisor regarding your tax planning and discuss if ELSS mutual fund is suitable for your tax planning and long term investment needs.