We all have heard about Mutual Fund Systematic Transfer Plan (STP) – STP helps your transfer units/ amounts from one fund to the other in the same AMC at certain frequencies. The most popular use of STP is to park the lump sum amount in a liquid or ultra-short term fund or low duration fund and transfer a fixed amount to an equity / hybrid aggressive fund at a certain interval, say daily, weekly, fortnightly or monthly. STP helps investors ride the market volatility and benefit from rupee cost averaging as they buy units at different price points over the chosen period of time.

Read this to know more about STPs – what is mutual fund systematic transfer plan and how it works

However, there is another way, though not very popular, of using STPs for building an almost risk free portfolio. Today, we will discuss that – STP – Transfer of Profits

How it works

You can invest a lump sum amount in a liquid/ ultra-short term/ low duration fund (Transferor scheme) and transfer the profits of this investment to an equity fund/ Hybrid aggressive/ or for that matter any fund(Transferee Scheme) of your choice in the same AMC at a certain frequency – say, weekly, fortnightly or monthly. To opt for this option, you need to sign and submit the STP transaction form while making the lump sum purchase to the AMC.

On receipt of your application, The AMC will activate this request (usually it takes around two weeks to process the request). Thereafter, the gains will start transferring from the Transferor Scheme to the Transferee Scheme at a frequency chosen by you while maintaining the original investment amount in the Transferor Scheme. The AMC redeem units upto the extent required for transferring the profit amount from the Transferor Scheme to the Transferee Scheme.

Why it is useful

It could be useful for following reasons –

- Investors who do not want to take much risk with their investments and happy with slightly higher returns over fixed deposits.

- Investors who are very concerned about the principal amount invested.

- Investors who are interested in investing in equity mutual funds but do not want the original investment amount to go down.

- Can works as a smart asset allocation strategy for ageing investors.

- Long term investors who want to build equity portfolio without taking risk on the principal investment amount.

Understanding through an example

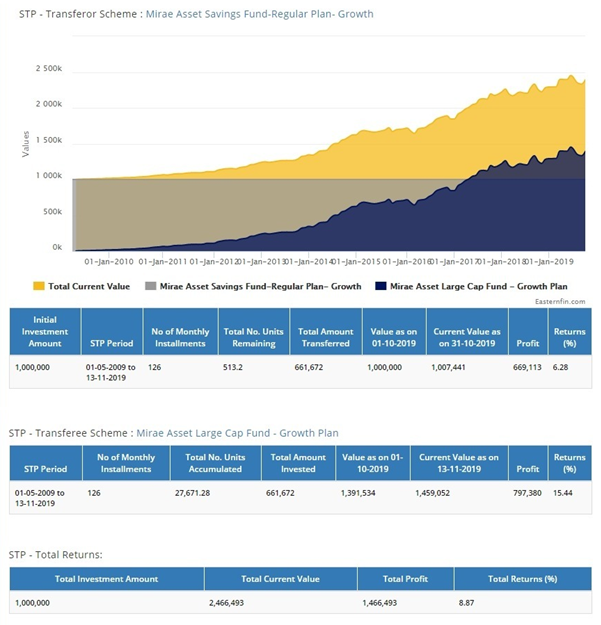

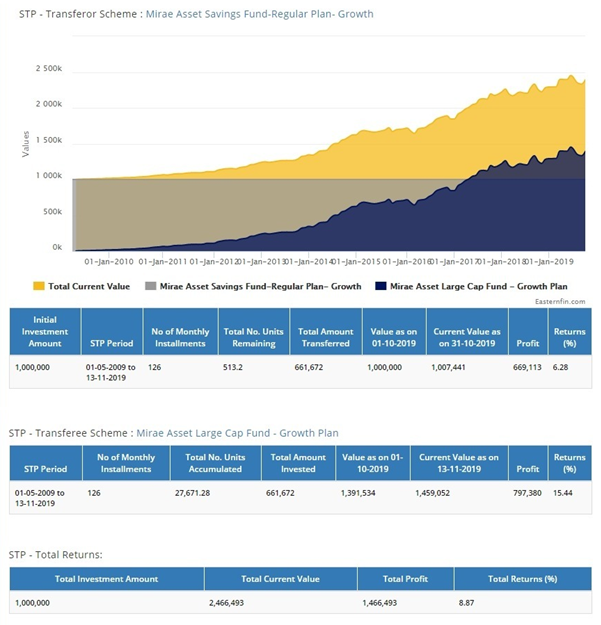

Investor ‘A’ invests Rs 10 Lakhs on 1st April 2009 in Mirae Asset Savings fund – Regular Plan – Growth option and chooses to transfer the gains from this investment to Mirae Asset Large Cap Equity Fund – Regular Plan – Growth on a monthly frequency, on 1st of every month.

The STP profit start date was 1st May 2019. The AMC started transferring the profits accumulated in a month in the liquid fund (Mirae Asset Savings Fund) to the chosen equity fund (Mirae Asset Large Cap Fund) on the 1st day of every next month. Over a period of 10+ years, the total monthly profit amounts transferred to Mirae Asset Large Cap Equity Fund – Regular Plan – Growth was Rs. 661,672 while the principal invested amount of Rs 10 Lakhs was intact in Mirae Asset Savings fund – Regular Plan – Growth option.The fund (Mirae Asset Savings fund – Regular Plan – Growth option) gave 6.28% annualized returns.

The total profit amount of Rs 661,672 transferred to Mirae Asset Large Cap Equity Fund – Regular Plan – Growth had grown to Rs 14.59 Lakhs as on date (November 14, 2019). The fund gave 15.44% annualized returns.

The total investment value as on date (November 14, 2019) is Rs. 24.66 Lakhs (Rs. 10.07 Lakhs in Mirae Asset Savings fund – Regular Plan – Growth option and Rs.14.59 Lakhs in Mirae Asset Large Cap Equity Fund – Regular Plan – Growth). The annualized return for Investor ‘A’is 8.87%.

Please see the chart below to understand it better and also see the live example along with cash flows on our website -

You can see in the above example, how Investor ‘A’ could create an equity portfolio by just transferring the gains from the original investments. Investor ‘A’ did not take much risk as he invested in a liquid fund and his original investments of Rs 10 Lakhs is still intact.

Conclusion

Investors who are risk averse and cannot tolerate erosion in their principal investment amount, transferring profits from a liquid fund (or any other comparable fund categories like, ultra-short, low duration etc.) to an equity fund can help them get moderate return (higher than FDs) without taking mush risk.

If you have a long term view on equities, you can use this method (STP - Profit Transfer) to build equity/ equity oriented portfolios without taking risk on the principal amount you invested. You can contact your Eastern Financiers Relationship Manager to understand this concept better.