Exchange traded funds (Exchange traded funds) are very popular in developed markets. Exchange traded funds were first developed in the US in the early to mid-nineties and have been gaining rapid popularity since then. In the last 10 years global ETF AUM has been growing at a CAGR of nearly 20% (source: Statista, as on 31st December 2020). It is a remarkable growth rate, especially in light of the fact that, most of the exchange traded funds AUM are in developed markets. Though it may take several years, given the long history of mutual funds, Exchange traded funds are poised to eventually overtake actively managed mutual funds.

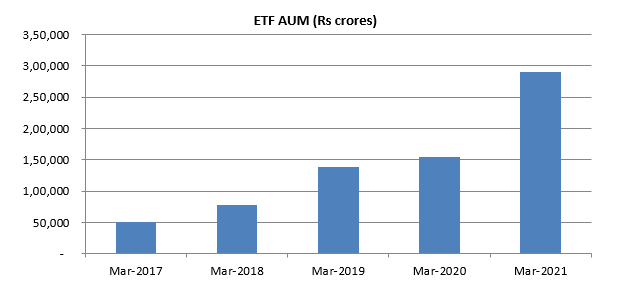

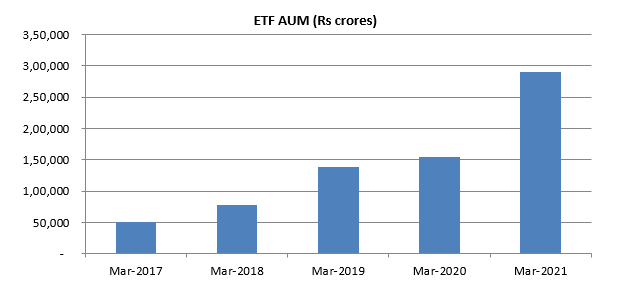

Exchange traded funds are also gaining popularity in India at an accelerating pace. As per AMFI data, ETF AUM (including Gold ETF) has grown at a CAGR of 42% over the last 5 years ending 31st March 2021. The COVID-19 crisis seems to have provided an impetus to Exchange traded funds, with ETF AUM nearly doubling in the last one year (ending 31st March 2021).

Source: AMFI

What is Exchange traded funds?

Exchange traded funds invest in a basket of securities which replicate a particular index. For example, a Nifty 50 ETF will invest in all the 50 stocks which constitute the Nifty 50 index. Each stock in a Nifty 50 ETF has the same weight as the index constitute. For example, if stock A has 5% weight in the index, the same stock will also have 5% weight in the index ETF. Exchange traded funds also replicate the price of commodities like Gold. Exchange traded funds are listed in stock exchanges and trade just like shares of listed companies.

Benefits of Exchange traded funds

- The cost or Total Expense ratios (TERs) of Exchange traded funds are much less than the cost (TERs) of actively managed mutual funds. Lower cost can result in significantly higher returns over long investment horizons due to compounding effect.

- Fund managers of actively managed mutual funds have to be overweight / underweight on certain stocks / sectors relative to the benchmark index in order to beat the index. This gives rise to unsystematic risks in addition to market risk. There is no unsystematic risk in Exchange traded funds – only market risks.

- Most indexes which Exchange traded funds track are market capitalization weighted indexes e.g. Nifty, Sensex, Nifty 100, BSE 100 etc. In market cap weighted indexes, underperformers get lower weights and outperformers get higher weights. Naturally such Exchange traded funds also have lower allocations to underperformers and higher allocation to outperformers.

Different types of Exchange traded funds

Unfortunately there is less awareness among investors about different type of Exchange traded funds; most investors think Exchange traded funds are limited to Nifty, Sensex and Gold. However, there are several types of Exchange traded funds across different asset classes e.g. equity, debt, international equity, commodities (gold) etc.

- Stock Index Exchange traded funds: These are the most common type of Exchange traded funds. They track stock indexes e.g. Nifty, Sensex, Nifty Next 50, Nifty Midcap 150, BSE 500 etc. Among the index Exchange traded funds, Nifty and Sensex are the most popular Exchange traded funds.

- Sector Exchange traded funds: These are also equity or stock Exchange traded funds but they track sector indexes like Nifty CPSE, Bank Nifty, Nifty Private Bank, Nifty PSU Bank, Nifty Infra, Nifty India Consumption, Nifty IT etc.

- Strategy Exchange traded funds: These are also equity or stock Exchange traded funds but they track strategy indexes like Low Volatility, Dividend Opportunity, Quality, ESG etc.

- Bond Exchange traded funds: They primarily invest in Government Securities, State Development Loans and PSU bonds etc. and track relevant indexes e.g. Bharat Bond Index, Nifty G-Sec Indexes etc.

- Liquid Exchange traded funds: They invest in money market securities just like liquid funds and track relevant indexes S&p align="justify" BSE liquid rate, Nifty 1 day rate etc.

- International Exchange traded funds: These Exchange traded funds track international indexes. Currently there are only two Exchange traded funds tracking international indexes - Nippon India ETF Hang Seng BeES and Motilal Oswal Nasdaq 100 ETF (MOFN100)

- Commodity Exchange traded funds: The only commodity Exchange traded funds in India currently are Gold Exchange traded funds. These Exchange traded funds are backed by physical gold. Gold Exchange traded funds is a safe, secure and efficient way of investing in Gold.

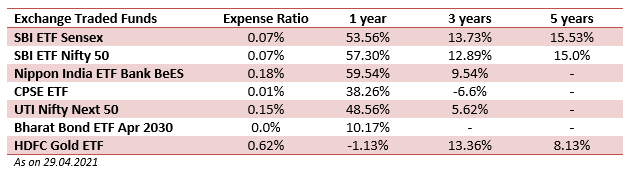

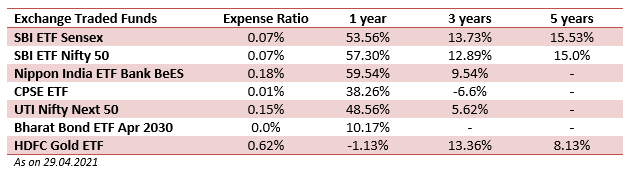

ETF Performance – Top Performing Funds

In the table below we have shown performance of Exchange traded funds from some popular ETF sub-categories. Please note that we are showing only one fund from each sub-category. As mentioned earlier the only difference in performance of two funds tracking the same index will be due to TERs.

As on 29.04.2021

Important points to note about Exchange traded funds

- You need to have a demat and trading account to invest in Exchange traded funds

- Unlike actively managed mutual funds, Exchange traded funds do not aim to beat the market benchmark index; they only aim to track / replicate the performance of the index.

- The underlying portfolio of two Exchange traded funds from two fund houses tracking the same index is the same

- However, the TERs of two Exchange traded funds from the two fund houses tracking the same index can be different.

- Expense ratios (TERs) have a direct impact on ETF performance. You should select an ETF with lower expense ratio.

- Unlike mutual funds where NAVs are declared at the end of the trading session, you can buy / sell Exchange traded funds at real time market price (current market price) at any point of time during the trading session.

- The current market price (CMP) of an ETF may be different than the declared NAV of the ETF. While the NAV of an ETF can serve as useful reference point, it is important to note that you can buy / sell Exchange traded funds in the stock exchange only at the CMP (bid / ask, buy / sell) price and not the NAV.

- The difference between the NAV and CMP of an ETF depends on the trading volumes and liquidity of the said ETF.

- While Exchange traded funds are usually bought or sold in stock exchanges, you can also invest and / or redeem your ETF units with the fund house (AMC) provided you invest or redeem in lot sizes specified by the AMCs. The lot sizes are usually quite large; larger than average retail investment ticket size.

- Unless you will be redeeming in lot sizes, you need to be mindful about liquidity of an ETF before investing in it. You should not be in a situation where you do not find sufficient buyers in the exchange when you are trying to sell or you are forced to sell at price much lower than the NAV because of low liquidity. You should consult with your financial advisor about the trading volumes / liquidity of your ETF before investing.

Exchange traded funds can provide solutions for different investment needs. Please contact your Eastern Financiers’ financial advisor to know more about ETF investments.