The last month or so has been terrible for stock markets around the world. March has been particularly bad with the Nifty falling 2,733 points (down nearly 25%) and there are still 13 days remaining in this month. Average SIP returns of multi-cap mutual funds over last 3 to 5 years are negative – average SIP returns of even large cap funds (considered to be least risky about equity schemes) are also negative over last 5 years. Naturally, many of you are very anxious and also stressed - what should you do with your Mutual fund SIPs?

Bear markets in the past

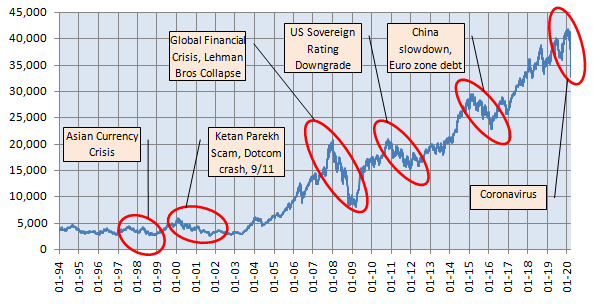

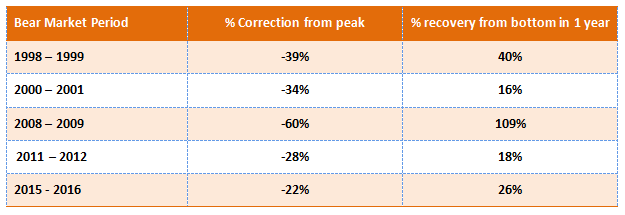

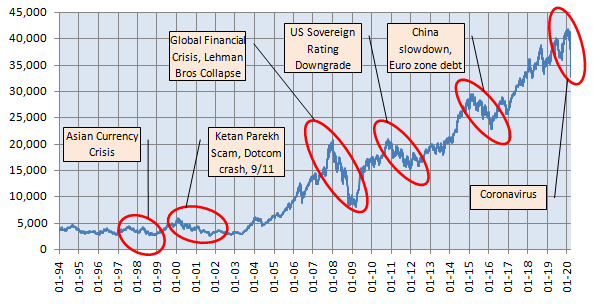

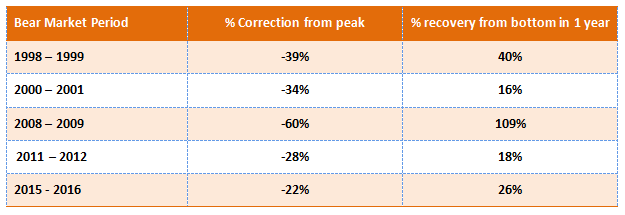

Bear market usually constitutes a fall of 20 - 25% from the market top. Since Nifty has already corrected more than 30% from the top, we are definitely in a bear market. Many of you are experiencing a severe bear market for the first time, but we have seen even more severe bear markets in the past 25 years, as much as 35 - 60% corrections. Yet the Sensex has multiplied nearly 10 times in the last 25 years.

Bear markets do not last very long

Unless you have urgent need of liquidity, all it takes to survive even the severest bear market is a little bit of patience. The typical length of a bear market is 12 – 24 months:-

- Asian Currency Crisis (1998 – 99) – 9 months

- Ketan Parekh Scam, Dotcom bubble, 9/11 – 20 months

- Global Financial Crisis (2008) – 14 months

- US Sovereign Ratings Downgrade (2011 – 12) – 9 months

- China slowdown, Eurozone debt crisis (2015 – 16) – 11 months

Bear market crash is the worst time to redeem

A big (25 – 30%) correction can cause investor panic reaction but it is the worst time to redeem because you may be redeeming at a price lower than cost price and make a permanent loss. If you are a little patient (bear markets do not last very long) and let the market recover a little, you will see substantial price recovery in a relatively short time.

Bear market is the best time for your SIPs

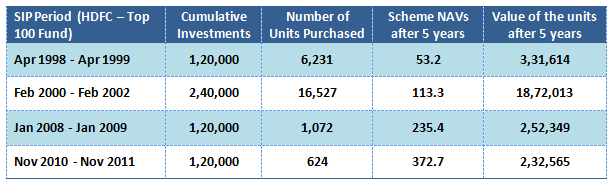

One of the biggest advantages of investing through SIP in bear markets is that you will invest at lower and lower prices which will bring the average cost of purchase down – this is known as Rupee Cost Averaging.

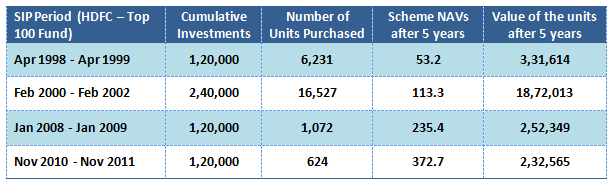

The table below shows the growth of Rs 10,000 monthly mutual fund SIP investments made for 1 – 2 years in HDFC Top 100 Fund (just an example) during bear market periods in 5 years.

If you stop your SIP in bear market, you will deprive yourself of the opportunity to lower your average cost of purchase and thereby, lose substantial returns in the long term (as can be seen in the table below).

What to expect?

- Past bear markets were caused by global downturns caused by an economic cyclicality, interest rate scenarios, asset bubbles, currency / trade wars etc. For the first time, a novel virus is causing an economic slowdown. This is a completely new situation and we do not know what to expect.

- From the experience in China, we know that the disease can be contained in a few weeks or months. Governments of all countries including India are trying to fight this disease on a war footing. Instead of panicking, let us wait to see how things unfold over the next few weeks.

- Despite a worldwide count of more than 200,000 Coronavirus cases, the count in India is only 147 (as on 18th March). Most businesses are running as usual. The market crash is due to global factors and not India specific ones. So the market recovery, whenever it takes place, is expected to be swift.

- Rumour mongering usually gets to its peak in situations like these. We have seen this in all past bear markets. But based on our past experience with many bear markets, when the scariest doomsday scenario is painted and fear is at its peak, the market rebounds.

What should you do?

- Stock markets go up and down, but your financial goals do not change. Do not pay heed to daily market movements or rumours and simply stick to your financial goals.

- Systematic investing will in fact help you benefit from volatility. Continue with your SIPs and you will benefit in the long term.

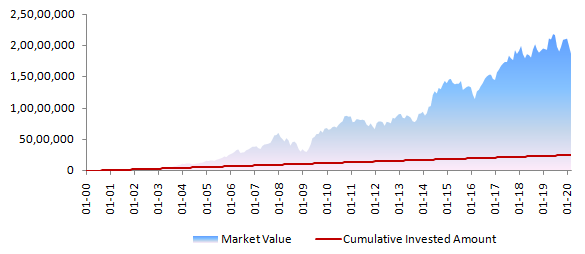

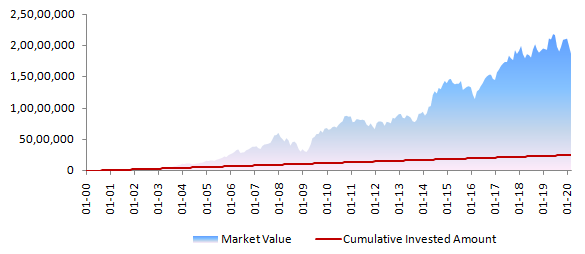

- Despite multiple bear markets (35 to 60% corrections), SIPs have created substantial wealth for investors over long periods.Monthly SIP of Rs 10,000 in HDFC Top 100 over the last 20 years would have grown to nearly Rs 1.9 Crores with a cumulative investment of only Rs 24 lakhs – The fund gave 17.68% annualized return in the last 20 years.

- The age old virtues of patience and discipline, taught by your parents and grand-parents will be your biggest friends in these times.

- Get in touch with your Eastern Financier’s financial advisor if you need any help or guidance. We have experience of dealing with these situations in the past and can advise you on how to get the best results according to your specific needs.