From less than $3 per capita income at the time of independence in 1947, India’s per capital GDP has grown to ~$2000 in these 75 years. Trends of transformation seen at a very large scale as over past 15 years more than 300 mn of people have been lifted out of poverty; the fleet of change that isn’t seen anywhere else in the world, except China. While, the building blocks to development had been placed consistently over the years; there is something significant happened over past 2 years which has accelerated this progress.

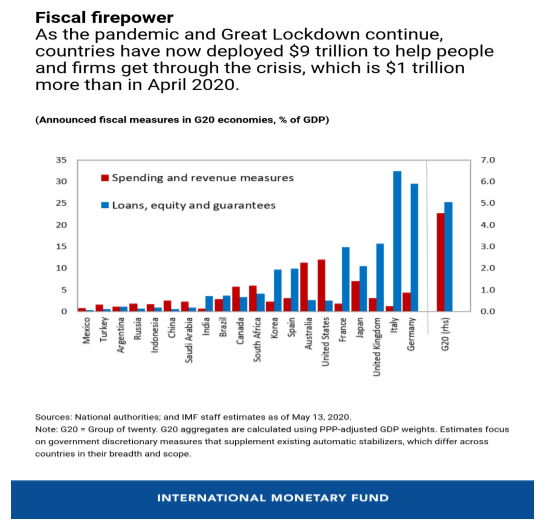

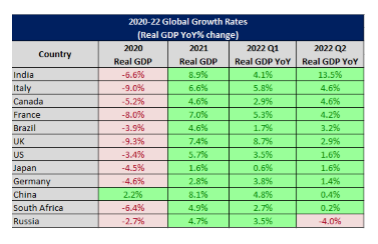

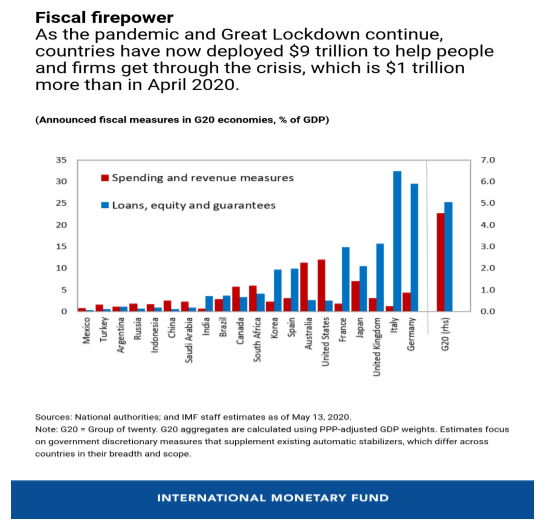

Pandemic Stimulus: Unlike G7 economies which spend anywhere between 19-35% of GDP (US - 26%, Japan - 53%, UK - 18%, Germany - 35%, Canada 20%) on stimulus; India was widely criticized for spending just 3.5% of GDP on pandemic relief.

While all other economies - both advanced and emerging - focused their policy primarily on stimulating demand by handing out pay checks to masses, India’s policy focused on enhancing both demand and supply. Crucially, India identified early that the Covid pandemic would also negatively impact aggregate supply. So, along with protecting demand side by direct benefit transfers to vulnerable via leveraging Aadhar and Jan Dhan bank accounts; India recognized supply side issues like financial leverage and provided sovereign loan guarantees for lending to small and medium enterprises by banks and the urban poor by microfinance institutions.

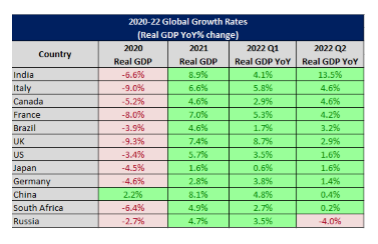

India’s relatively better macroeconomic fundamentals in COVID-19 due to clarity of policy and courage of conviction to be different from the rest, bearing fruits of hardship two years down the line. Advanced economies primarily undertook Demand-side measures and are facing 4x their normal inflation. If India had followed the same policy as in GFC or as other economies did in Covid, India would have had 18-20% inflation.

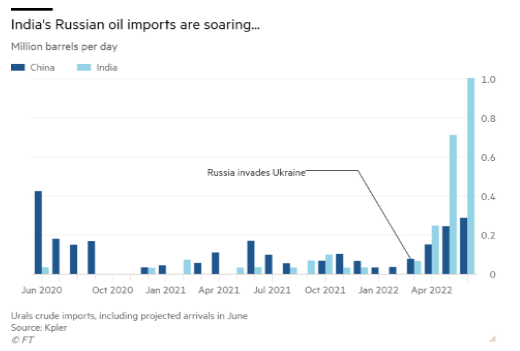

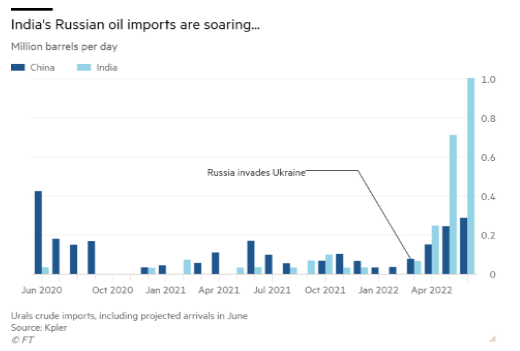

Energy security: India is the third-largest importer of oil—importing more than 80% of the oil it needs. Following Russia sanctions; India took advantage of discounted Russian oil prices to ramp up oil imports from Russia at a time when global energy prices have been rising. At peak of sanction India was buying oil at ~$30 discount from Russia via bilateral deals in Ruble/INR; which led to Russian oil imports jumping to 12-13% vs 0.2% of total oil imports earlier.

Now with crude prices down globally combined with discounts from Russian oil procurement, instead of passing the low procurement cost benefit completely to consumers, Indian government undertook revisions (both upward and downward) in excise duty component periodically to balance inflation pressure as well as fiscal impact (rise in taxes boosts central government revenue & helps to maintain fiscal balance). In India, around 80 of every 100 passenger vehicles sold are entry-level two-wheelers, running on petrol, so a reallocation of household budgets to deal with higher fuel prices has kept discretionary spending under check.

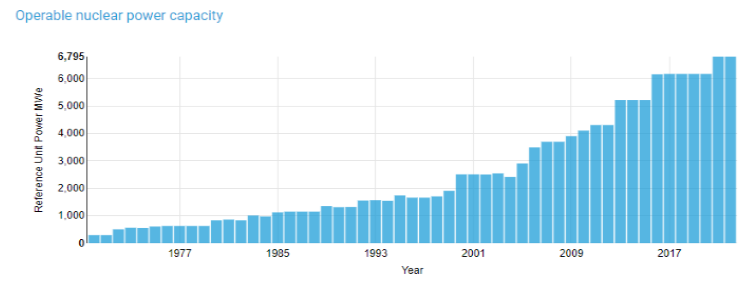

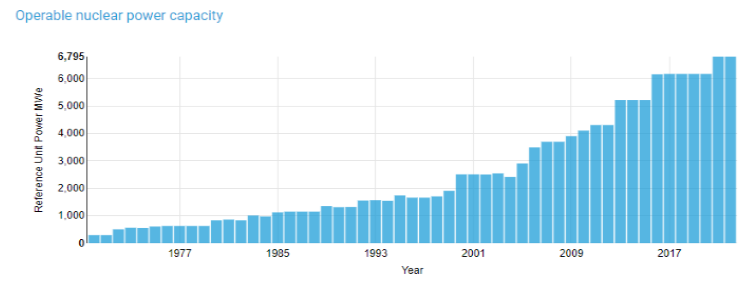

Having said that, yet India’s dependence on imported energy poses challenges to satisfy rising demand. As per BP LLC - energy demand will rise by 156% between 2017 to 2040 in India. India’s nuclear power could provide a reliable solution to power demand as against wind & solar that is not available round the clock & are cost inefficient. Government plans to triple its nuclear power generation capacity in the next decade from 22 reactors of 6,780 megawatt presently to 22,480 megawatt by 2031. In the long run, the country is planning to increase contribution of nuclear energy to 25% of the total power capacity.

(Source: World Nuclear Association)

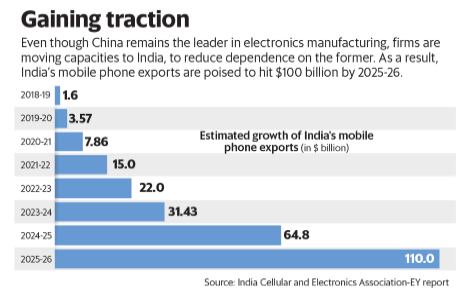

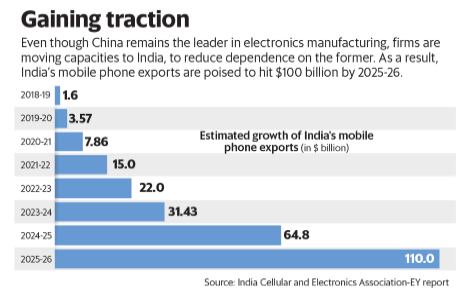

Manufacturing: Back to basics i.e., industrialization and manufacturing exports taking over service, will be an important driver to India’s growth story next decade; buoyed by government’s robust policy thrust, initiatives like production-linked incentives (PLIs) and fresh investments that are pouring into the country’s core industrial sectors (13 sectors are mapped under PLI scheme with outlay of $47.8 bn and expected production increase of $500bn in next 5 years). India is among top four destinations for relocation of American companies. As per India commerce secretary “There is a global demand to move out of China, dependency is 80-90%. That's why many nations are eager to sign FTAs with India, they're an important part of our trade strategies”

- Apple to manufacture Iphone14 from India, looking to diversify their manufacturing base beyond China for iPhone. In India mobile phone production has increased fivefold in the past five years and the country is on track to emerge as a global exporting hub of mobile phones

- Manufacturers like Samsung, Wistron, and Foxconn are shifting production to India because of strong manufacturing and R&D capabilities

- Going forward, chemicals, pharmaceuticals, electronics, automotive, industrial machinery, and textiles (among others) are expected to propel India’s manufacturing exports to $1 trillion by FY28, according to Bain & Company.

- In pharmaceuticals, India’s manufacturing cost is about 30%– 35% lower than that of the US and Europe.

- Indian steel is becoming globally competitive, with availability of cheap raw material (iron ore), new and innovative techniques, and a low cost of manufacturing, with strong capabilities in technology for high-end machinery

- US market share in India’s merchandise exports has increased from 10.1% in FY2011 to 18.1% in FY22. As world’s major consumer looks to find a replacement for its manufacturing operations, India due to its demographics and diplomatic ties stands to benefit from this.

- Opening up sectors for private players which was earlier closed like defense, space, mining etc.

- Vast expansion of public services like direct benefit transfers, subsidies for LPG, basic healthcare system, Labour law reforms to enable job creation in manufacturing.

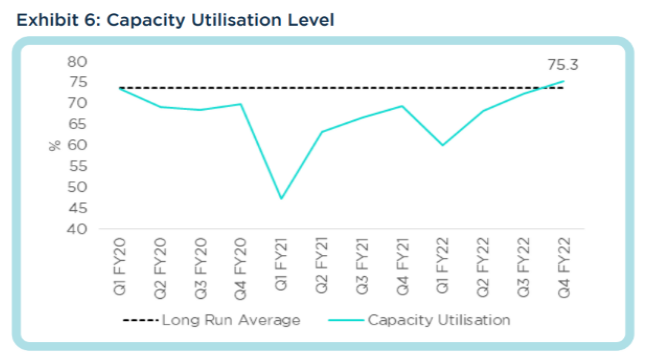

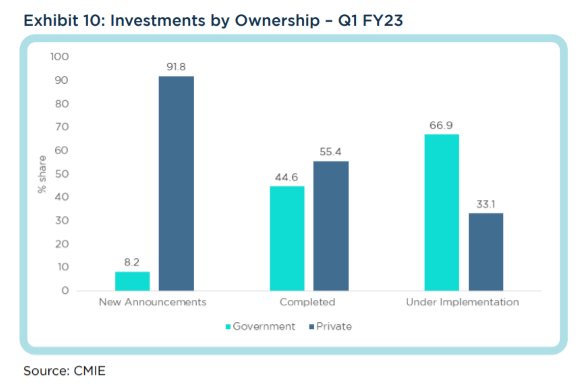

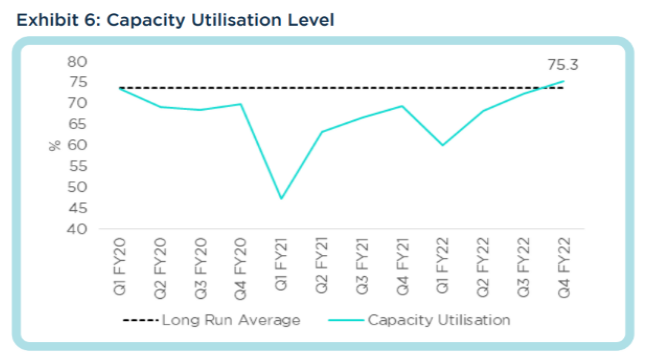

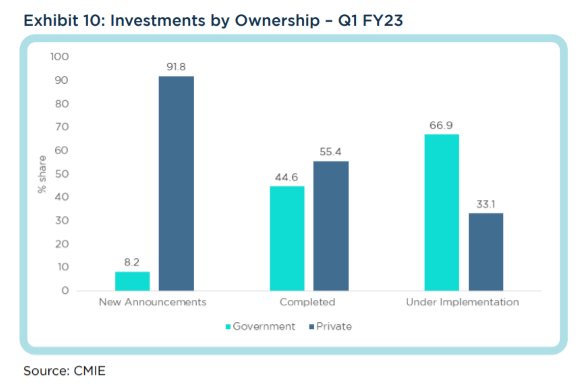

- Capex: Capacity utilization climbed to 75.3% in FY22, above the long-run average of 73.7%. This needs to be maintained between 75-80% to fuel fresh investments in the economy. Projected next five years capex is six times higher than last five years. The Indian government has budgeted a 35% year-over-year (YOY) increase in capex for FY23 to ~ $100 billion

(Source: Care Edge)

India’s exports have seen tremendous growth over the last two years, with a compound annual growth rate (CAGR) of 15%, rebounding from 5-10% in the pre-pandemic years. As per a recent Morgan Stanley report, India will account for 22% of global growth in the current year.

Concrete building blocks: Jan Dhan accounts - No other country has been able to achieve/install 5 million micro-ATMs in rural areas without brick-and-mortar bank branches, Aadhar - inked to hundreds of federal and state government programs, has enrolled 99.5% of all Indian adults, UPI, rapid increase in Mobile for business >> Increase in Financial inclusion (Rural India driving more than half of the internet usage in the countries. 346 mn Indians are engaged in online commerce)

Food Security: According to Food and Agriculture Organization (FAO), India is among the leading producers of milk, pulses and jute, rice, wheat, sugarcane, groundnut, vegetables, fruit and cotton.

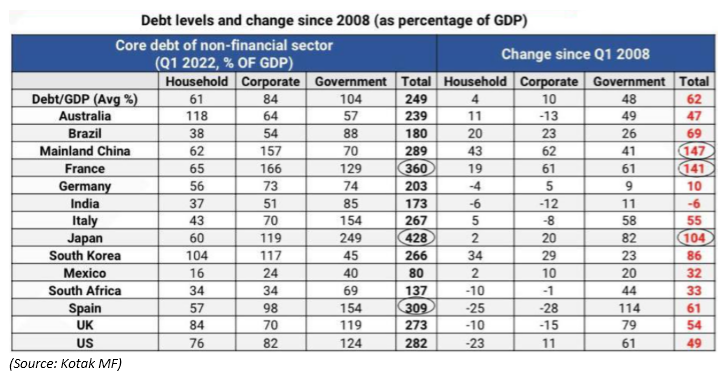

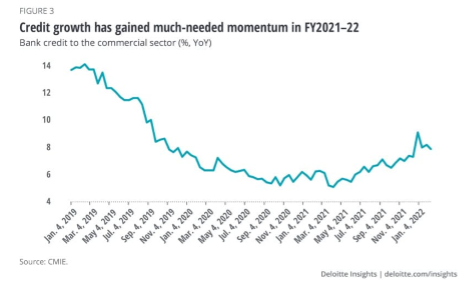

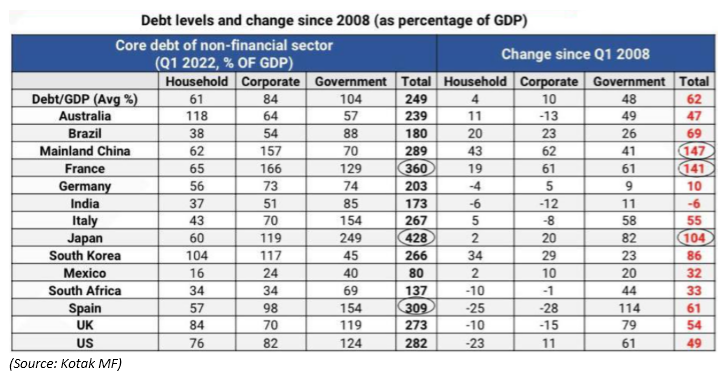

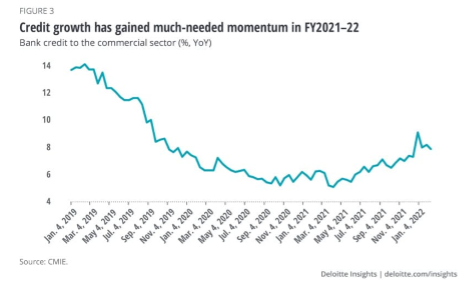

Credit Growth after a decade of clean up exercise: Debt in advanced economies, since the GFC has increased quite substantially without increase in productivity levels which lead to anemic growth.

India being an outlier here, spent large part of the decade in clean-up exercise by - Introducing Bankruptcy law in 2016, stringent bank licensing policies for new entrants, privatizing/revival of banks, operationalization of bad bank from Jun-2022 etc. Banks now have healthier balance sheets & provisions compared to the levels seen earlier. These steps in right direction led to rise in credit growth of banks to a near 9 year high of 15.5% Y-o-Y in August’2022; highest since Nov’2013. This increase in credit is also a result of rise in household borrowing, inventory rebuilding and also capacity creation as capacity utilization is hitting 75% across some industries and is likely to rise further in FY23.

India’s household debt/ GDP is rising fast; but, still closer to 40% as against average of 100% for comparable economies.

Effective Corporate tax rate slashed from 35% to 26%. Tax cut contributed to 19% of top-line of 4000 listed companies (Report by SBI). Ambiguous retrospective amendment to taxation which discouraged foreign investment have been cleaned up.

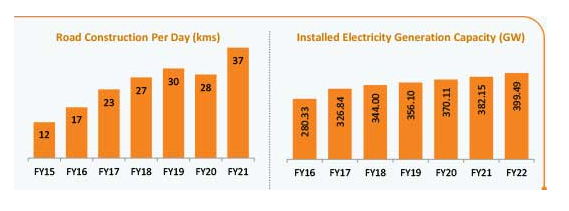

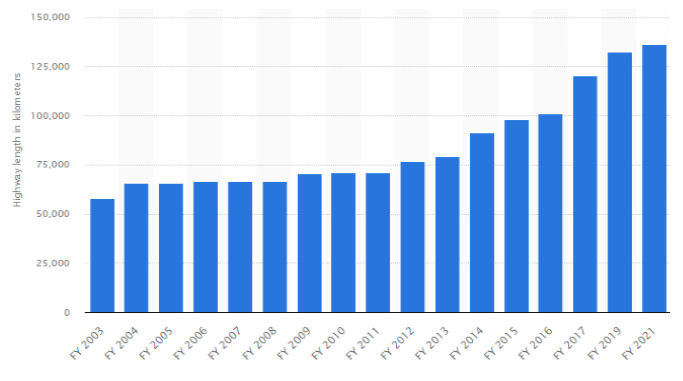

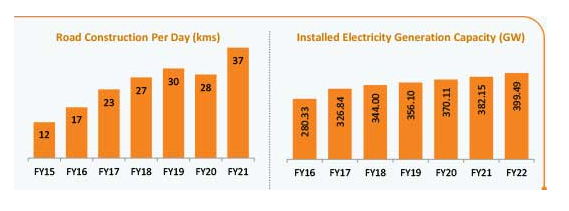

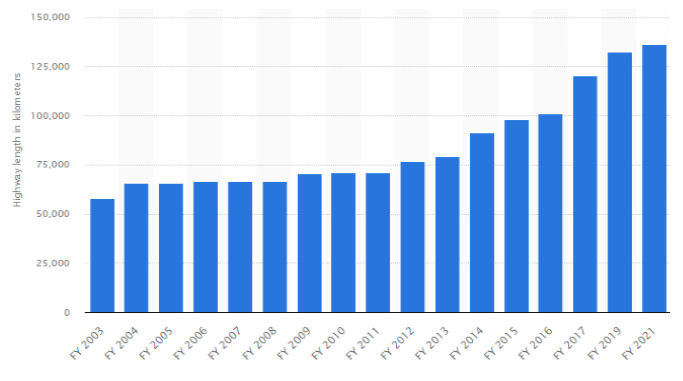

Infrastructure: Investment in Railways & Roads => ↓ logistics costs; investment in power => cost of production ↓ in manufacturing. Roads and highways, railways and defense remained the top three major areas of capital expenditure.

(Source: IBEF)

(Source: Statista)

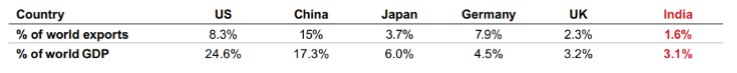

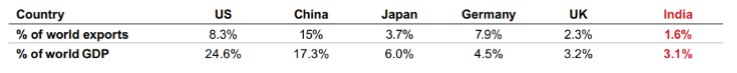

Fourth Industrial Revolution: Despite having the sixth-largest economy in the world, contributing to 3.1% of the GDP, India’s export contribution to global trade is still only 1.6%.

(Source: Bain & Company)

Now, envisage a scenario wherein developed nations like UK and Europe face slowdown due to energy issues and China no more wants to be the global factory of manufacturing goods. Emerging nations like India with better demographics, low cost of production, business pro policies stand to gain advantage.

Similarly, global portfolio allocation to India is miniscule at 0.2% of overall portfolio. If the opportunity and growth strikes in India over next 10-15 years and if global allocation had to increase to just mere share of India’s GDP to global GDP i.e., 3% there is a huge capital flow that can be envisaged if all parameters strike well.

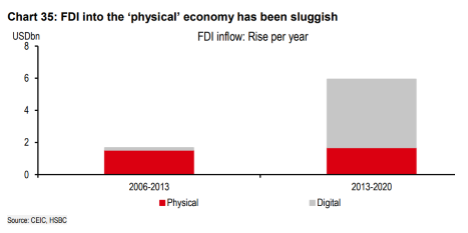

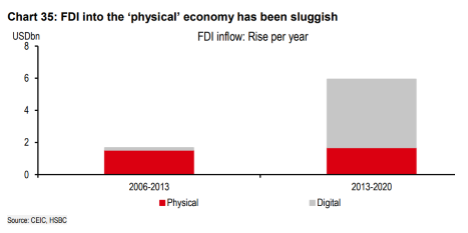

FDI into new-age tech firms has been rising (50% of FDI inflows are going into digital sector), but FDI into the physical economy can help ease the supply-side constraints that the overall economy faces. As trends reverse n favor of physical FDI, we could see money moving to ‘real’ economy from ‘financial’ economy.

Valuations: The 12-month forward price-to-earnings (P/E) multiple for the Nifty50 Index is around 20.6x - 82 per cent higher than 11.3 per cent for the MSCI EM Index. India’s dollar market capitalization is down 1.4% this calendar year against a 14% drop in global market capitalization. One of the many reasons for high premium is double digit expected GDP growth highest amongst peers’ nations. Over 2022-23, India’s growth will average 7%, the strongest among largest economies, contributing 28% and 22% to Asian and global growth - Morgan Stanley

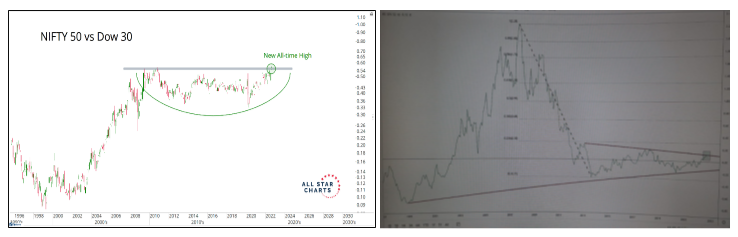

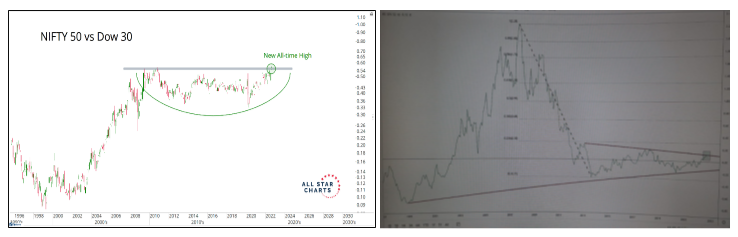

Nifty v/s Sp500 - After huge outperformance from 1999 to 2007 followed by absolute underperformance from 2008 to 2013, Nifty relatively went sideways from 2014 till date. Now the ratio line is on the verge of breaking out in favor of Nifty.

Risks

- Recession - In this globalized world, recession is also exported. The recent fall in global commodity prices and consequent easing of input prices are supportive of investment uptick. However, the volatility in commodity prices remains a challenge.

- Sharp upward surprise in Oil prices - High oil prices raise concerns of an increase in inflation and current account deficit, which may eventually hit the economic growth of the country. If the crude oil price remains above $100 a barrel during 2022-23, it will considerably upset India’s Budget math. $10 per barrel increase in oil price will raise inflation by roughly 49 basis points (bps) or increase the fiscal deficit by 43 bps (as a percentage of GDP) if the government decides to absorb the entire oil price shock - RBI, 2019 memo.

- Job Creation: Biggest Challenge, biggest opportunity - The unemployment rate which was already high going into pandemic increased further and now remains at 7 - 8% in recent months. Only 40% of working age Indians are employed, down from 46% five years ago - CMIE. Another worry is the steady retreat of working women in India - from a high of nearly 27% in 2005 to just over 20% in 2021, according to World Bank data.

- Trade protection i.e., import barriers are high today than they were a few years ago; while government has opened up with the economy for foreign investment but hasn’t opened up for bilateral foreign trade

Conclusion

India story is about much more than demographic opportunity and rising middle-class. The country is ready to reap the benefits of pandemic stimulus prudence, rising infrastructure growth (nearly 7,000 projects across different sectors costing above INR 100 Crore per project and totaling INR 111 Lakh Crore), corporate balance sheet clean up and China plus one allocation. Though India’s private capex cycle has been slow to gather pace, the outlook for coming quarters looks positive. With capacity utilization rising coupled with an improving demand scenario, we could expect the private investment cycle to accelerate.

Cold war between East vs. West will change the globalized world and the manner in which trades took place in past 40 years. As countries look at sourcing from multiple partners and/or on-shoring; India’s diplomatic position in world politics stands as an advantage which could bear fruits in the next decade. Having said that, India is not immune to challenges rising from global disruption, oil volatility, domestic political stability; however, at this juncture the country seems to be cleanest dirty shirt.