The 2020 Budget was one of the most eagerly awaited Budgets in recent years because this was the first full Budget of the BJP led NDA Government after it returned to power with a resounding majority last year. Investors had lots of expectations from this Budget especially in the backdrop of economic slowdown. The Budget has many far reaching implications for equity and debt investors. Following are some key highlights of the Budget:-

- Government stuck to fiscal discipline despite a slight slippage in FY 2019 – 20. Estimated fiscal deficit in FY 2019 – 20 is 3.8% and fiscal deficit in FY 2020 -21 is 3.5%. This will be positive for FPI investments in both equity and debt.

- Tax exemptions for sovereign funds investing in infrastructure to boost spending in that sector. This will be positive for infra stocks and funds.

- Important bond market reforms e.g. allowing higher FPI investments (up to 15%) in Indian corporate bonds, launching ETF for Government bonds etc. This will be positive for debt funds.

- Abolition of Dividend Distribution Tax (DDT). This will benefit companies and FPIs. It will be positive for stock market.

- Important income tax reforms e.g. new (optional) income tax regime will lower slab rates in lieu of giving up tax exemptions, taxing dividends in the hands of the investors etc.

In this article, we will focus only on the income tax changes because this will have biggest impact on retail investors and HNIs (both individual investors and HUFs).

New Income Tax Regime

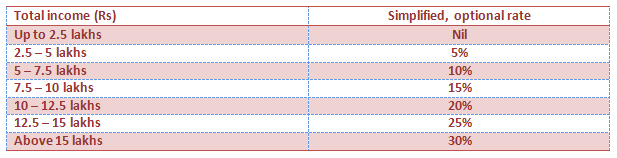

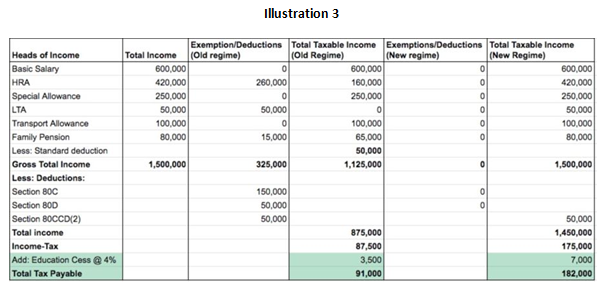

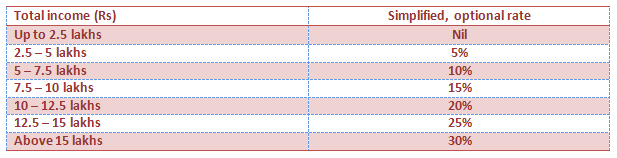

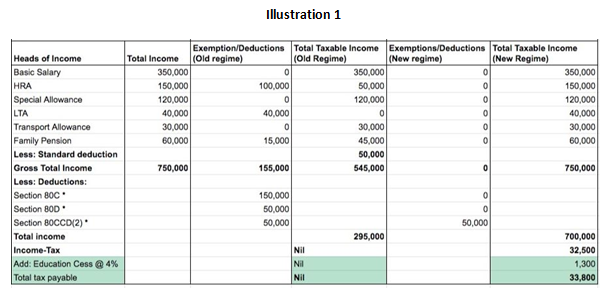

The Government has introduced an optional new income tax regime which has 7 income tax slabs as opposed to 4 slabs in the current regime. There is no change in income tax and exemptions for incomes up to Rs 5 lakh. For incomes between Rs 5 lakh and Rs 15 lakh, the Government has offered lower tax rates (please see table below). Investors should note that exemption under Section 87A for taxable income under Rs 5 lakhs in the new tax regime as well. Under section 87A if your taxable income is less than 5 lakhs then you can claim rebate on all tax payable – in effect you do not have to pay tax. This exemption is also available in the current income tax regime.

If you compare the income tax rates for various slabs in the new regime versus the old regime, your marginal tax rates will 5 – 10% lower in the new regimes. However, if you opt for the new tax regime, then you will have to forgo most of the exemptions that you were claiming under the current tax regime. In the current tax regime you can claim exemptions from your taxable income for HRA, LTA, investments / expenses u/s 80C, 80D etc. By claiming these exemptions, you can reduce your net taxes payable by a considerable amount. It is very important for investors to understand that the new tax regime is optional - you can continue with the old regime if you want to. Each investor will have to do his / her own tax calculations for the new tax regime and compare it with the old tax regime (including the exemptions mentioned above) and decide which is better for them.

Exemptions given up under new tax regime

The Government has removed 70 income tax exemptions in the new tax regime. Some of the relevant exemptions that most investors usually avail are:-

- Standard Deduction of Rs 50,000

- House Rent Allowance exemption of the lowest of (a) Actual HRA (b) 50% of salary in metro cities / 40% in non metro cities (c) excess of rent paid of 10% of annual salary

- Leave Travel Allowance on actual air (economy class) or rail travel fare of self, spouse, children and parents according to your company policy

- Section 80C e.g. exemption for Provident Fund, PPF, Life insurance premiums, mutual fund ELSS, principal prepayment in Home Loan EMIs etc up to Rs 1.5 lakhs

- Section 24 i.e. exemption for interest payment in home loan EMIs of up to Rs 2 lakhs.

- Section 80TTA i.e. tax exemption of savings bank interest of up to Rs 10,000

- Section 80D i.e. medical insurance premium of Rs 25,000 for self, spouse and children and additional Rs 25,000 for parents

- Section 80E exemption on the entire interest payment on educational loan

Please note that these are some of the common exemptions that investors usually avail of. You may be availing or can avail other exemptions depending on your personal situation. For your specific tax situation, you should discuss with your tax consultant or chartered accountant. You should refer to your Income Tax Returns (ITRs) for the last few years to see, what exemptions you were availing of and assess how much tax you were saving thereof. Thereby, you can decide which tax regime is better for you – current one (with exemptions) or new one (without exemption).

Which tax regime is better?

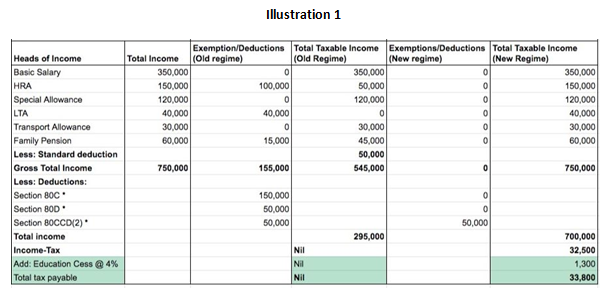

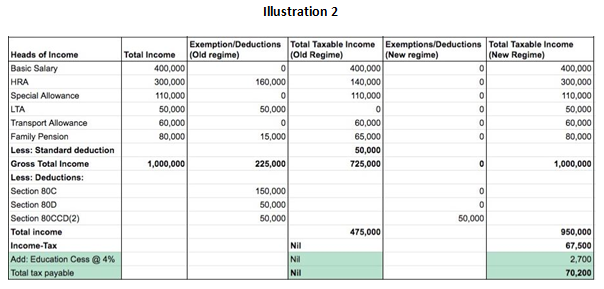

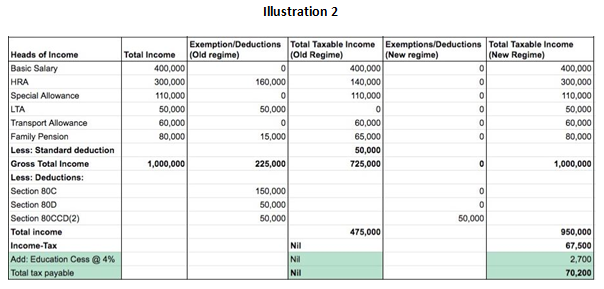

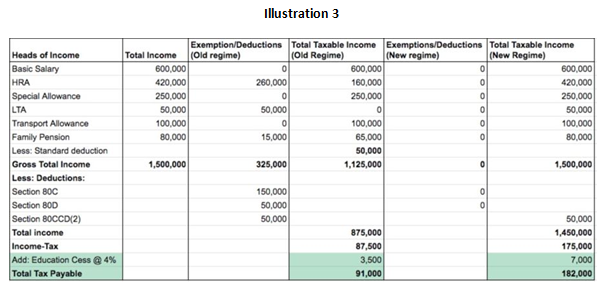

There is no general answer to this question because it will depend on tax situations of specific individuals. If you were not availing most of the exemptions mentioned above or are not in a position to avail them, then the new tax regime may be more beneficial for you. However, if you were availing most of these exemptions, then current tax regime may be more advantageous for you from a tax savings perspective. We will illustrate this with a few examples.

You can see that, continuing with the current regime may work out to be more advantageous if you were availing the exemptions. For investors in the lower tax slabs, who may not have sufficient investible funds for availing the deductions, the new tax regime may work out to be better. You should decide according to your personal situation.

Switch between regimes

Another important aspect in the fine-print of the budget is that you can switch between tax regimes in the future. In other words, just because you choose a particular tax regime for AY 2021 – 22, you do not have to stick to it forever. For example, you choose to continue with the current tax regime in AY 2021-22 (FY 2020-21). However, after a few years, if you have a wedding in your family and you are not in a position to make tax savings investments, you can switch to the new tax regime and pay less tax. In the following year, when you have sufficient investible funds again, you can again switch back to the old regime.

Dividend Taxation

Up until this financial year (31st March 2020), dividends are tax free in the hands of the investors. However, companies and AMCs had to pay dividend distribution tax (DDT) before paying dividends to investors. DDT is considered by many as regressive taxation because the same profit is taxed twice – once as corporate tax and again as DDT. In this budget the Government abolished DDT and moved to the classical system of dividend taxation, i.e. taxing dividends at the hands of the investors.

From the next financial year onwards, dividends will be added to your income and taxed as per your income tax slab. Currently, the DDT for equity oriented funds is 11.65%. So if your income tax slab rate is less than 10%, then this change will be beneficial for you. For income in higher tax brackets, this change will result in more taxes. The DDT for non equity funds (debt funds and debt oriented hybrid funds) is 29.12%. The change in dividend taxation will be beneficial for all investors whose income tax slab is less than 30%. However, for investors in the 30% tax bracket, this change will result in more tax outgo. Another major change in dividend taxation which investors should be aware of is that, the AMCs will withhold TDS @ 10% for dividend pay-outs. You should factor this in your financial planning.

Long Term Capital Gains Tax

Though there was a lot of anticipation among investors about Long Term Capital Gains (LTCG) tax before the Budget. There has been no change in LTCG taxation for either equity or debt funds in this Budget. However, in context of this tax changes

In this Budget, LTCG taxation assumes importance because of the change in dividend taxation. Long term capital gains taxed @ 10% for equity funds (for profits in excess of Rs 1 lakh) and 20% after indexation for debt funds is now significantly more attractive for investors in the higher tax brackets compared to dividends which will be taxed as per the applicable income tax slab rates of the investors.

You should make investment decisions accordingly, e.g. Systematic Withdrawal Plan (SWP) will be a far more tax efficient than dividends for those looking for regular income.

Conclusion

The Government has made one of the biggest income tax reforms in this Budget aimed at providing relief to the middle class and boosting consumption spending. While this may be good for the overall economy, the new tax regime may not be advantageous when applied to individual tax situations.

One of the most positive things about this Budget is that the Government has allowed the tax payer to decide what is best for them by giving them option to choose between the old regime (with exemptions) and new regime (without exemptions). You should decide according to your personal situation. Dividend taxation is another important change for investors who prefer dividends. You should factor the change in investment planning. We in Eastern Financiers are committed to helping you make the right financial decisions in the best interest of your family.