Often, you may plan to receive a regular cash flow from your investments to take care of your expenses. These could be recurring expenses like monthly fees of your children, or funds to augment your instalment on purchases made or even as a monthly income for your expenses during retirement. Whenever you want to receive an assured regular income, the first bet is generally the traditional Post Office monthly income schemes or bank term deposits. However, interest rates on Bank deposits have declined over the years causing worry amongst most investors who are concerned about the feasibility of these traditional schemes for meeting their regular income needs.

Some investors also turn to mutual funds with dividend options (Dividends are now known as IDCW - Income distribution cum capital withdrawal). However, before choosing this option for your regular income needs, you should remember that as per SEBI guidelines, fund houses can declare dividends only from accumulated profits of the scheme, and as such the dividend payout from mutual fund schemes are at the discretion of the fund houses. The dividend payouts are not guaranteed as in the case of bank fixed deposits. During market downturns, the schemes which have paid out regular dividends may not be able to declare dividends at all, since they could have depleted their reserves due to the market volatility. In such a scenario, SWP from mutual funds can prove to be a boon for you, if you are looking for regular cash flows.

What is an SWP?

SWP or Systematic Withdrawal Plan is a facility provided by mutual funds to enable systematic withdrawals of fixed amounts from your investment in the fund, as per your requirement. The withdrawals are made according to a predetermined schedule of regular intervals. The SWP is made by the systematic redemption of the required number of units at the prevailing NAV to meet the cash flow you have stipulated at the time of starting the SWP. The SWP will continue till the time there is sufficient unit balances in the scheme from where you have initiated the SWP to meet your cash flow.

How does an SWP work?

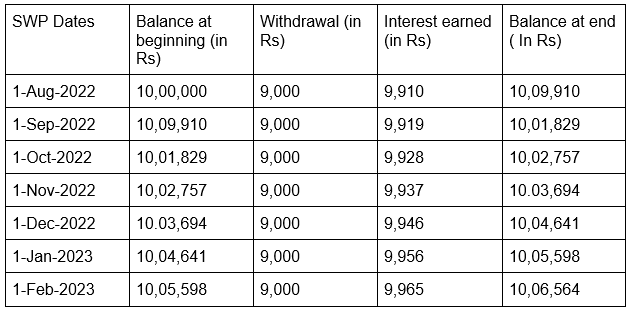

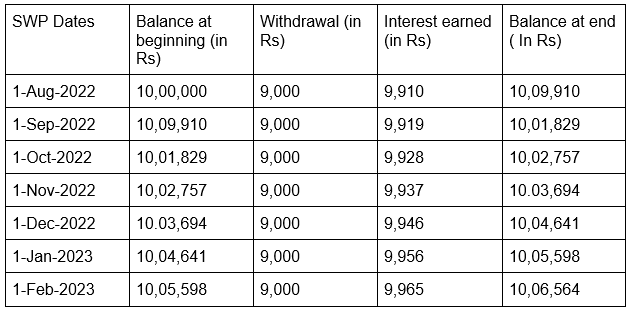

Suppose, you invested Rs 10 Lakhs in an equity or aggressive hybrid mutual fund scheme on 1st August 2022. You started an SWP of Rs 9,000 per month starting 1st September 2022.

The table below shows the cash-flows and the change in value of your investment over the first 7 months of the start of your SWP. As shown in the table, your SWP cash-flows are generated by redeeming units of your scheme, but the return earned on your investments is more than your withdrawal rate, which helps the investment to grow in spite of the monthly withdrawals. We have assumed a scheme return of 12% on your SWP mutual fund. In the scenario that the scheme return over the SWP period is higher than the withdrawal rate, the value of your investment can grow over time.

Disclaimer: The table above is purely illustrative. Mutual fund returns are subject to market movements. You should consult with your financial advisor before planning your SWP

Is SWP better than Dividends?

As explained earlier, dividends are paid out based on the accumulated profits of the AMC. Also, dividend payouts are at the discretion of the fund manager. Apart from this there are several points to consider before you can choose between an SWP or a mutual fund with dividend option, for your monthly income.

- In SWP you can opt to get fixed cash-flows at regular intervals as long as you have sufficient unit balance in your account. By planning how much expenses you will incur each month you can plan for the cash flow you need each month.

- Mutual fund dividends are paid at the discretion of the fund manager / Asset Management Company. They are not guaranteed. A scheme may change its dividend payout rate or may stop paying dividends altogether for a period of time.

- The profits from SWP cash-flows are subject to capital gains tax. Short term capital gains (in case investments are held over a period of less than 12 months) in equity or equity-oriented funds are taxed at 15% (plus applicable surcharge and cess). Long term capital gains (investment holding period of more than 12 months) of up to Rs 1 lakh in equity-oriented funds are tax free and taxed at 10% (plus applicable surcharge and cess) thereafter. Since SWPs are usually planned for long tenures, investors can avail the advantage of long-term capital gains taxation.

- Dividends paid by mutual fund schemes (both equity and debt funds) are added to the investor’s gross taxable income and are taxed as per the income tax slab rate of the investor. For investors in the higher tax brackets, SWP is more tax efficient than dividends.

In which type of fund can you start an SWP?

An SWP is best suited to a fund that can beat the market highs and lows with minimum disruptions. A Balanced Advantage Fund or Aggressive Hybrid Fund may be a good choice while starting an SWP, since it invests in both, equity and debt. Let us read on to understand how a Balanced Advantage Fund or Hybrid Aggressive Fund work:

1. The debt and equity investment ratio in these funds is dynamic and is changed to suit the market scenario. Equity allocations in these funds are reduced during bull markets when the valuations are high. On the contrary, during bear markets when valuations are low, the equity allocation in these funds is reduced.

2. These funds allocate a maximum average equity exposure of 65% and as such is less volatile compared to pure equity funds.

3. These funds usually enjoy equity taxation as the average equity holding in the portfolio is at least 65%. Long term capital gains taxation makes SWP from these funds tax efficient.

Consult your mutual fund distributor or a financial advisor to understand which fund is the best for you to start an SWP.