Gold and silver are considered to be auspicious in Indian cultural traditions since ancient times. There is a tradition of buying gold and silver on auspicious occasions like Akshay Tritiya, Dhanteras and Deepawali. There is also the tradition of gifting gold or silver to children and relatives on occasions like weddings, Annaprashana etc. Apart from its cultural importance, gold and silver are important asset classes from an investment standpoint.

Why you should invest in Gold and Silver as an asset class?

- Gold is seen as a store of economic value over the long term. Over a long investment horizon gold is supposed to retain its purchasing power and is therefore seen as a hedge against inflation. In the last 20 years, Gold gave 12.5% CAGR return which has not only beaten inflation but is considerably higher than traditional fixed income investment return.

- The last 40 years or so has seen secular decline in real interest rates globally, especially developed markets like the US. In India also, real interest rates have been secularly declining over the last 20 years. Precious metal prices, especially gold prices have negative correlation with real interest rates i.e. as real interest rates decline, gold prices go up and vice versa.

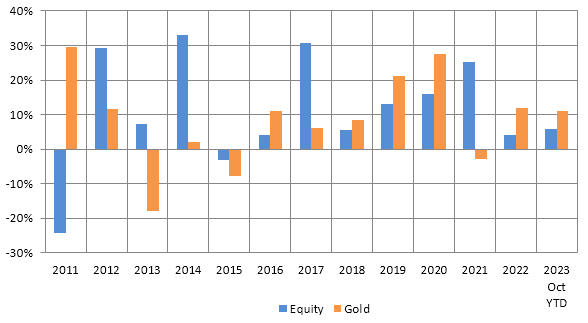

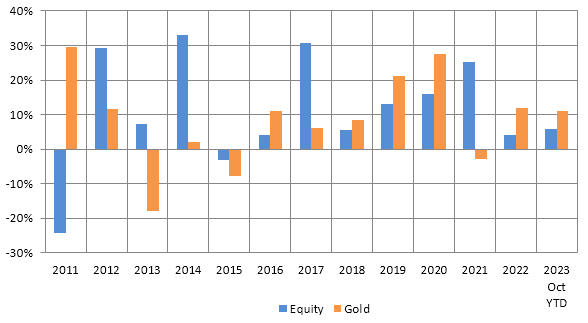

- Gold is also an important asset class for asset allocation purposes. The primary purpose of asset allocation is to balance risk and return. Historical data shows that gold is usually counter-cyclical to equities i.e. gold outperforms when equity underperforms and vice versa. Adding gold to your investment portfolio will bring more stability.

- In a market like India, gold can also be a hedge against currency risks i.e. when the INR depreciates, gold tends to appreciate in price.

- India is the second largest market for gold jewellery in the world after China. With rising affluence demand of gold is increasing in India. With rising demand, price of gold will also increase.

- Silver is also considered to be an auspicious metal in India. Apart from its use in jewellery, silver is also used in heavy and new age industries (e.g. solar panels, electric vehicles, smartphones etc). With development of new age technology, the industrial demand for silver is rising but supply is constrained. You should consider investing in silver as an asset class since it has the potential of generating capital appreciation for you over long investment horizons.

- Like gold, silver also has low correlation with equity returns and therefore is very useful asset class for asset allocation purposes. While gold is counter-cyclical to equities and tends to outperform in bear markets, it tends to underperform in bull markets when investors are ready to take more risks. However, silver tends to outperform gold in bull markets because silver demand for industrial use grows in bull markets (periods of higher economic growth).

Gold and silver as financial assets versus physical assets

The traditional way of investing in Gold and Silver in India is in the physical form e.g. jewellery, coins, biscuits, ingots etc. However, gold and silver as financial assets e.g. ETFs are much more cost efficient, highly liquid and convenient investments for the following reasons:-

- Almost all gold and silver jewellery or other articles usually have impurities. If you try to sell your gold or silver jewellery or other articles, impurities will be deducted from the value of your gold or silver.

- The cost of gold or silver jewellery or other articles includes the cost of craftsmanship (making charges for the jewellery or the article). From a financial investment standpoint, the cost of craftsmanship has no value; you only get the value of the pure metal.

- Physical gold and silver includes storage charges. Since these are valuable items, you will store them in a secure place like bank locker (especially for gold) for which you have incur storage charges like locker fee.

- Physical gold and silver are less liquid than gold or silver in form of financial assets. For selling physical gold or silver, you will have to locate a jeweller who will buy your physical assets. Some jewellers may not accept certain items. The jewellers will have their own process of determining purity and giving you a value. The price of physical gold and silver will differ from city to city. Gold or silver ETFs on the other hand, can be sold on stock exchanges on any trading day at market prices from the comfort of your home or office by using your computer, mobile app or by calling your stockbroker.

Is this a good time to invest in gold and silver?

- High inflation expectations and strong job market in the US, has led to a very cautious or even hawkish monetary policy stance of the US Federal Reserve. As a result, there in uncertainty in the financial markets about the future interest rates.

- High US bond yields is causing risk aversion and this has led to sell-off in equity markets. Emerging markets like India are affected more by risk-off sentiments.

- The war between Israel and Hamas has led to concerns about crude oil prices, especially if the conflict spreads beyond the Gaza strip to parts of the Middle East. Rising crude prices will have an impact on inflation and interest rates.

- In times of economic uncertainty, precious metals, especially gold outperforms. Gold has outperformed equity in both 2022 and 2023. We think that gold will continue to outperform in the short to medium term.

How to invest in gold and silver?

- ETFs: Gold and silver exchange traded funds (ETFs) are passive schemes, which track prices of commodities like Gold, Silver etc. Gold Exchange Traded Funds or Gold ETFs track the price of pure Gold. Gold ETFs are backed by physical Gold. One Gold ETF unit is equal to 1 gram of gold and is backed by 99.5% pure physical gold bars.

Silver exchange traded funds (ETFs) are financial instruments which track the price of pure silver. These instruments invest in physical silver or silver related instruments. Physical Silver of 30 kg bars with fineness of 999 parts per thousand (or 99.9% purity) conforming to London Bullion Market Association (LBMA) Good Delivery Standards are only permitted by SEBI for silver ETFs.

You need to have Demat and trading accounts to invest in exchange traded funds.

- FOFs: Gold and silver fund of funds (FOFs) are mutual fund schemes which invest in gold and silver ETFs. FOFs offer all the conveniences of mutual funds like liquidity, redemption with AMCs at prevailing NAVs, SIP facilities etc.

- SGBs: Sovereign Gold Bonds (SGBs) are Government Securities issued by the RBI. SGBs are denominated in grams of gold. An individual investor can buy up to 4 kg of gold through SGB every year. SGBs pay an interest of 2.5% per annum paid semi-annually. The maturity period of SGB is 8 years. Investors are allowed premature redemption after 5 years.

Contact with your Eastern Financiers financial advisors if you want to know more about investing in gold and silver.