The spread of Coronavirus pandemic around the world has caused stock markets to crash. The Nifty fell more than 35% from its all time high and but has since, recovered some 1,000 points over the last 3 – 4 days after the US Government announced $2 trillion stimulus. Despite the relief rally over the last 3 days, the market is down nearly 30% since the beginning of this year. According to IMF, global recession has clearly begun after large parts of the world went into lockdown to contain the spread of the pandemic.

Every downturn is different

Market observers try to find historical precedence of specific market situations but investors should understand that every downturn is different. Over the past 25 years we have seen many bear markets e.g. Asian Currency Crisis, Ketan Parekh Scam, Dotcom Bubble, 9/11 terrorist attack in New York, Global Financial Crisis of 2008, US sovereign rating downgrade, China slowdown, Eurozone debt crisis etc but the length of the bear market (ranging from 9 months to 20 months), the amount of correction (ranging from 20% to 60%) were different in each case. The policy response is also different in each case. There it is very difficult to time the market. Instead, you should have amethodical approach for investing in bear markets.

What is a good level to buy equity funds?

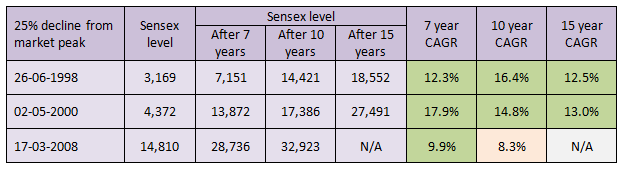

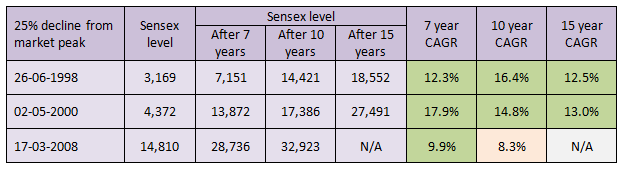

We analyzed what amount of market correction in the past led to good returns over the next 5 years or so. The table below shows how much Sensex recovered from a 25% correction from the market peak over the next 7 to 15 years. The CAGR return of the Sensex over the last 20 years is 9.2% - we can assume that this is the historical long term average return that one can expect from the Sensex.

The green boxes tell you that, you can get significantly higher long term (over 7 to 15 years) returns from the long term average if you invest at a level where the Sensex has corrected 25% from the peak.

The question in the mind of several investors is, whether the current market level is attractive? The analysis above tells that the market gave better than average returns over 7 to 15 years from 25% correction irrespective of how much markets fell in each bear market. Since the Sensex has fallen 30%, based on anecdotal evidence, we think that this presents an attractive investment level.

Suggested reading: What should you do with your mutual fund SIPs

What should you do – tactical asset allocation

We think that the current market levels offer attractive investment opportunity to tactically increase your asset allocation in equity with 7 to 10 year or longer investment tenure. There is considerable risk factors, buying on dipsis the best strategy in falling markets. Depending on your situation, you can invest a portion of your surplus cash or switch a portion of your debt funds to equity. Our financial advisors will be able to provide appropriate recommendations on equity funds depending on the evaluation of your current asset allocation, risk appetite, financial goals and our assessment of market conditions. Meanwhile if you have any question, please get in touch with your Eastern Financier’s financial advisor or email us at service@easternfin.com