Brazil – Back to the phase of Re-Industrialization

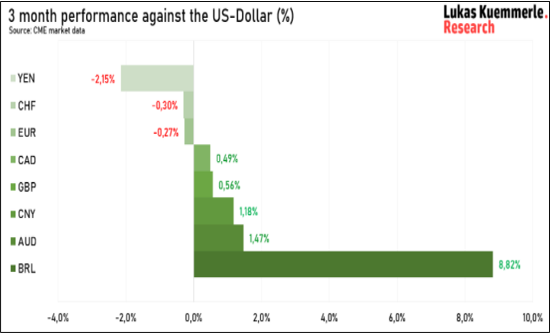

Despite being the best performer among recent industrializers until the 1970s, Brazil experienced severe macroeconomic crises in the 1980s and 1990s which culminated into stagnation, inflation & crises for commodity resource rich country.

In an attempt to reindustrialize the economy after four decades of de-industrialization, Brazil's government announced a 25% cut to its industrial tax (IPI) for most products in a move to ease inflation and help local industry recover from a pandemic downturn.

The country has BRL828 (USD161bn) of private investment commitments “to rebuild the Brazilian economy” in coming years in sectors including natural gas, oil, ports and infrastructure, in essence re-investment by private sector for the next 10 years.

Brazil’s inflation rate is slowing and consumer price gains might slow from 10% to about 5% by the end of the year after removing the pandemic incentives. Contracting the fiscal policy during the recovery phase by holding back constitutional spending cap, higher oil prices lifting royalties, taxes on corporate income; worked on slowing down the inflationary impulse.

The government debt to GDP has moved from 80.3% in December to 79.6% in January

There are ETFs listed in US focused on Brazil – EWZ available for investment by Indian resident investors

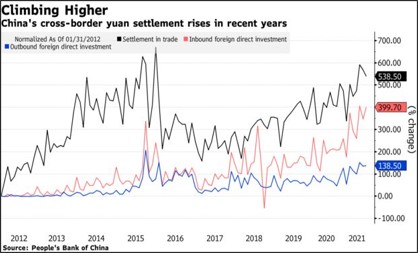

What is CIPS?

- The payments system was created to boost the global use of the yuan, which remains small compared to the size of China’s economy.

- For Chinese banks and corporates, CIPS can serve as a messaging system without the risk of exposing transaction information to the United States, BOC International said in a report in 2020.

- 17.5 per cent of trade between China and Russia was settled in Yuan in 2020, increase from 3.1% in 2014.

- Average daily transaction volume of CIPS reached 317.2 bn yuan ($49 bn) in August’21, up from about 190 bn a year ago with 1,144 indirect participating banks in 103 countries of which 531 were located within mainland China.

- CIPS counts several foreign banks as shareholders including HSBC, Standard Chartered, the Bank of East Asia, DBS Bank, Citi, Australia and New Zealand Banking Group and BNP Paribas

What is CIPS (Cross-Border Inter-Bank Payments System)? It is a payment system which offers clearing & settlement services for its participants in cross-border yuan trades. Indeed, it is a Chinese version of SWIFT, and one which most Russian banks might likely to be forced to adopt.

China will quickly brush off any threats of sanctions if it were to accept Russia banks into its orbit, it is now clear that instead of driving a wedge between Russia and the country that is true the biggest US challenger on the global scene, China, the West has succeeded into bringing the two powers even closer together while putting the fate of the world's reserve currency in jeopardy.

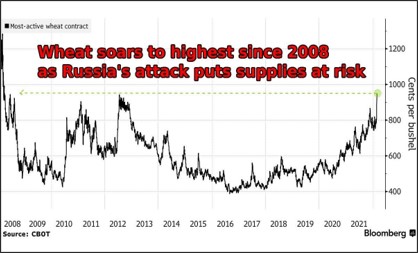

Are we heading for a Food Shock?

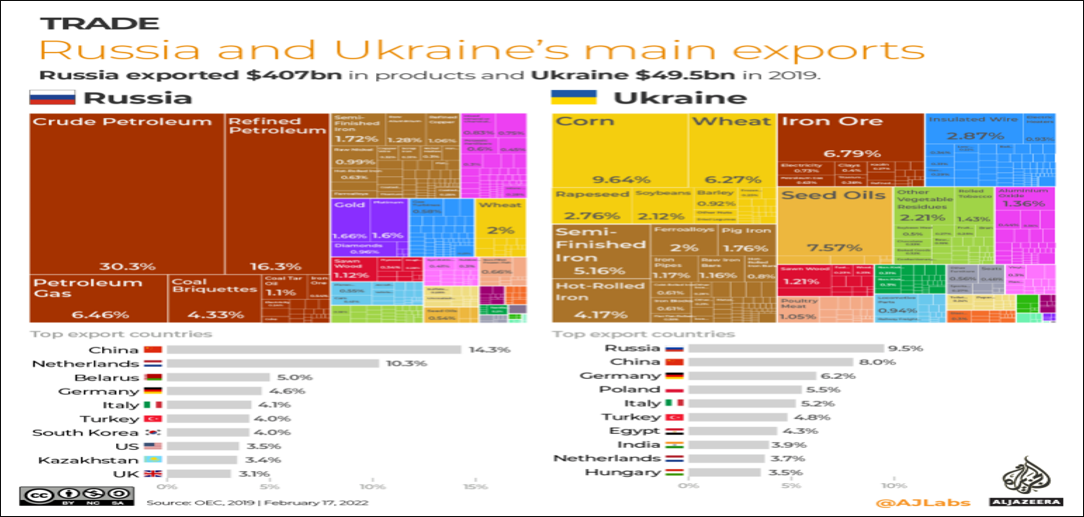

- Ukraine and Russia produce over 30% of the world’s wheat, and Ukraine is the #4 exporter of world. Russia is a major exporter of fertilizer which is important for food production of *everything*.

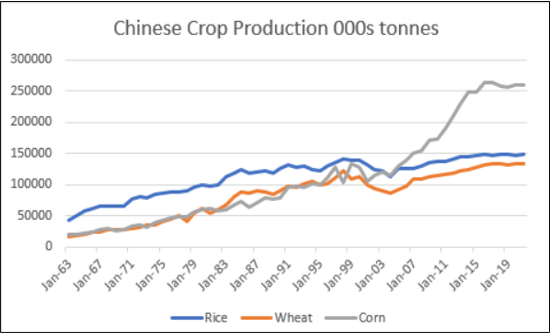

- In a separate world, after aggressive imports of course grain (corn, sorghum & barley) to rebuild its pig herd at swine flu levels, a closer look at the Chinese agricultural industry, reveals that only corn production has grown in recent years, despite the country being world’s largest subsidy payer and highest fertilizer user.

- If China is struggling to grow food production, then the security of food imports will become paramount.

- While, Russia could take care of increasing wheat imports demands from China given bilateral relations; however, for course grain China’s import demands can be met only by combining Russia and Ukraine’s exports. Only other large exporters for this are US, Brazil and Argentina where exports to China needs to be shipped, thereby reducing the security in periods of uncertainty.

As de-globalization changes the supply chain movement, instances of supply shock carry impact on pricing until market economy develops long term viable solutions.

There are ETFs listed in US focused on Agriculture – DBA available for investment by Indian resident investors

Two Major reasons which will change the World Order!

(1) – Geopolitical Risks

- The major risk for markets is just how destabilizing the Ukraine invasion becomes for world trade order and its impact on food and energy insecurity, unresolved issues like auto supply chains, chips and goods, further fueling inflation, and slowing growth. It confirms the critical effect of Geopolitics & massive shift has occurred as the world splits into new plates with their attendant conflict zones.

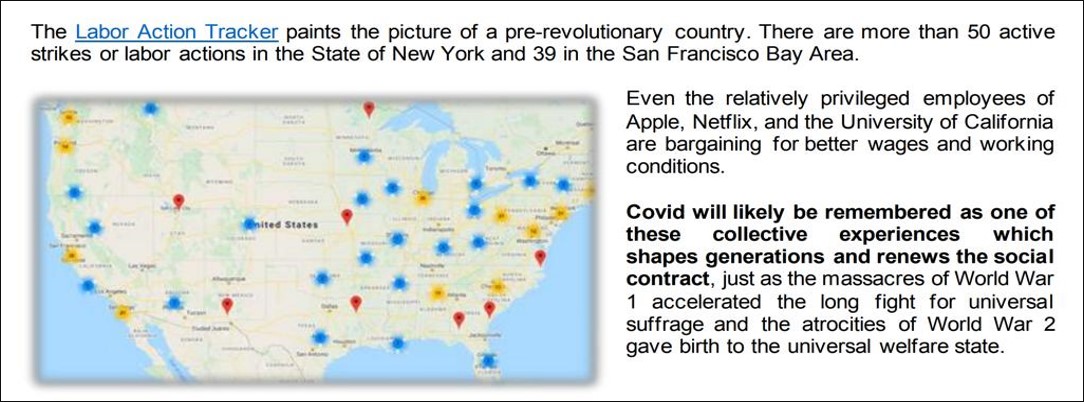

(2) - Wages

- Since December of 2020, nominal wages and salaries were up 4.5 percent, the fastest increase since 1983. Prices, however, have also risen rapidly, and so inflation-adjusted wages fell. Corporate profitability will move from Shareholders to Employees as real wages rise in an Inflationary environment. Lower profitability will further impact risk assets as value moves to business with better future costs predictability i.e. low variable high capex costs.

We are heading back to a 1967 – 1979 regime, Recession + Inflation = Stagflation.

Overweight hard assets over financial assets.

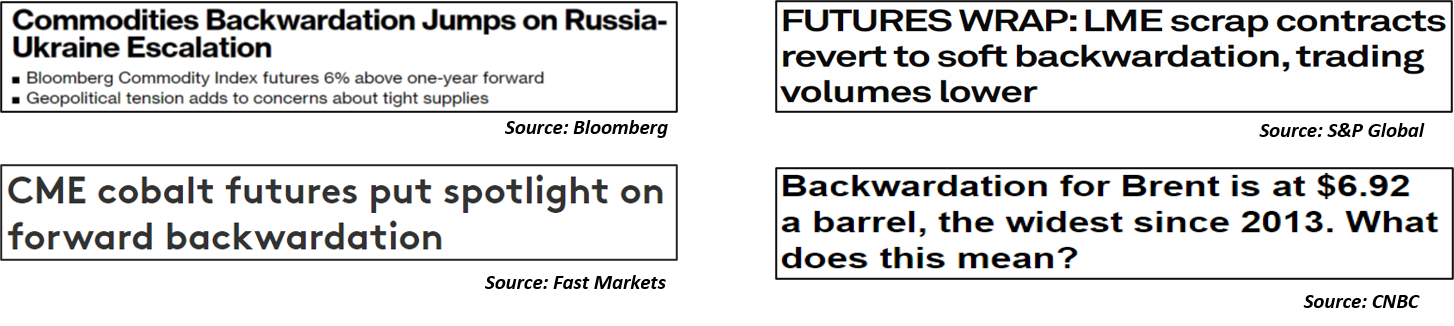

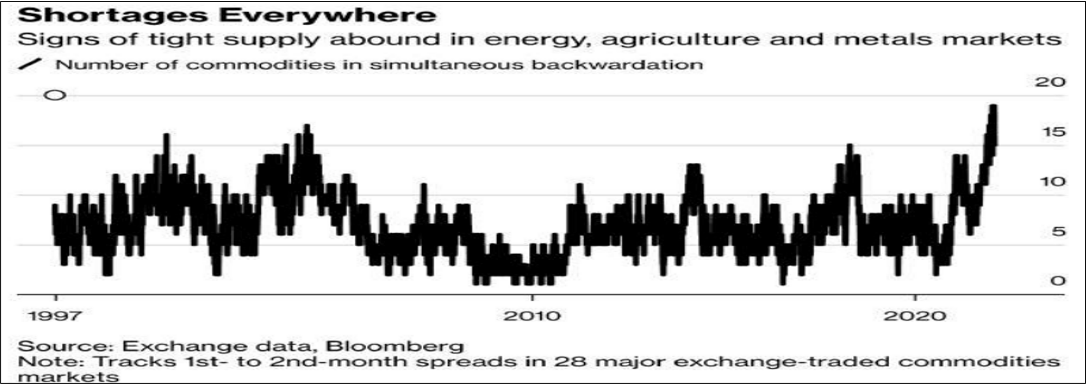

Backwardation – Why understanding this term is most important now

What does “backwardation” mean? It is when the near-month future contracts for a commodity trade at a higher price than longer dated contracts. This can be for a few reasons:

- Buyers can’t get enough supply here and now and are bidding up prices for commodities for immediate (within next 6 months) delivery.

- Buyers don’t think that the price of commodities will hold up (i.e. that the price spike is “transitory”)

It is probably a combination of both that account for the number of commodities in backwardation. In any event, this is something bizarre and “out of the ordinary.” It suggests that there is something systemic at play here rather than a short term transitory thing.

The real reason of backwardation in commodities, specially Oil is the lack of investment in fossil fuels due to the “energy transition” narrative.

Disclaimer

The above material is neither investment research, nor investment advice.

This document may contain confidential, proprietary or legally privileged information. It should not be used by anyone who is not the original intended recipient. If you have erroneously received this document, please delete it immediately and notify the sender. The recipient acknowledges that Eastern Financiers Ltd ("Eastern")or its subsidiaries and associated companies, as the case may be, are unable to exercise control or ensure or guarantee the integrity of/over the contents of the information contained in document and further acknowledges that any views expressed in this document are those of the individual sender and no binding nature of this shall be implied or assumed unless the sender does so expressly with due authority of Eastern or its subsidiaries and associated companies, as applicable. This document is not intended as an offer or solicitation for the purchase or sale of any financial instrument / security or as an official confirmation of any transaction.

Investment Disclaimer

Investment Products are not obligations of or guaranteed by Eastern Financiers Ltd or any of its affiliates or subsidiaries, are not insured by any governmental agency and are subject to investment risks, including the possible loss of the principal amount invested. Past performance is not indicative of future results, prices can go up or down. Investors investing in funds denominated in non-local currency should be aware of the risk of exchange rate fluctuations that may cause a loss of principal.

This document does not constitute the distribution of any information or the making of any offer or solicitation by anyone in any jurisdiction in which such distribution or offer is not authorized or to any person to whom it is unlawful to distribute such a document or make such an offer or solicitation