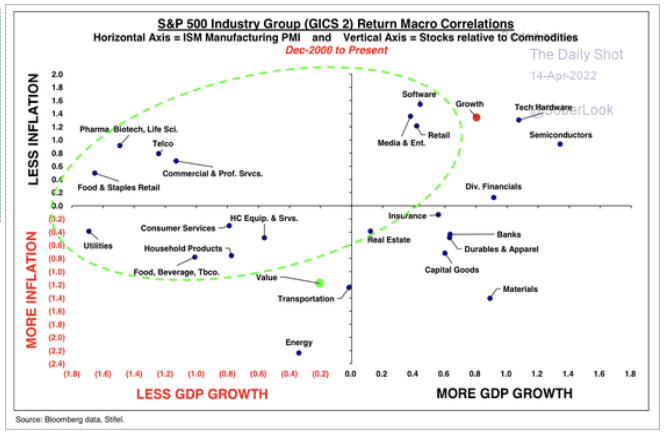

Equity sector performance during different macro conditions

- Although equities in general have performed quite poorly in high and rising inflation environments, there are potential areas that have historically

performed better at the sector level.

- High growth stocks tends to underperform in a US rate hiking cycle with inflation scares leading to investors rotate away from high-multiple tech

stocks and into sectors that hold up better in a rising rate environment. Those include financials, energy as well as industrials and real estate.

(Source: Visual capitalist)

- For instance, the energy sector, which includes oil and gas companies, is one of them. Such firms beat inflation 71% of the time and delivered an

annual real return of 9.0% per year on average.

- 2010-2020 was all above asset light + growth model. We believe next decade is all about asset heavy companies i.e., essentially industries which are capex intensive and see operating leverage kick in as volume increases. Prefer "Asset owners" for this decade

There are ETFs listed in US focused on Real Asset Investing –RAAX available for investment by Indian resident investors.

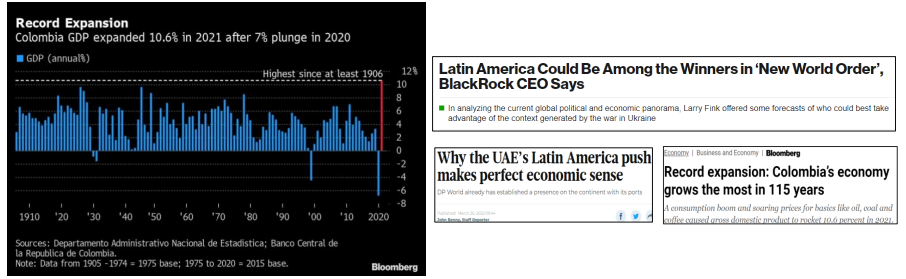

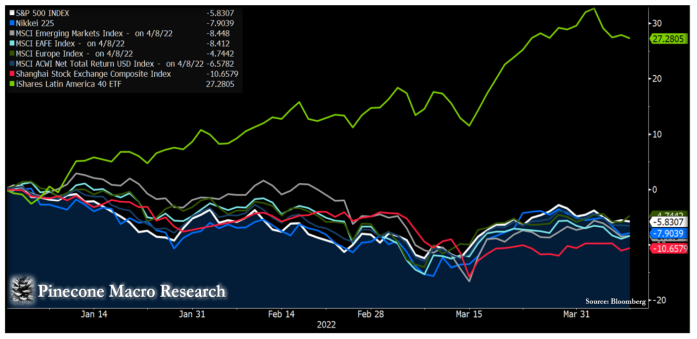

Colombia : This LATAM country grows at the fastest pace since past 115 years

If this decade is all about high commodity prices then commodity centric regions like LATAM should see positive impact as they boost exports (with currency depreciation of 2021 as an added advantage) and public revenue.

There are ETFs listed in US focused on Latin American markets – LATAM available for investment by Indian resident investors

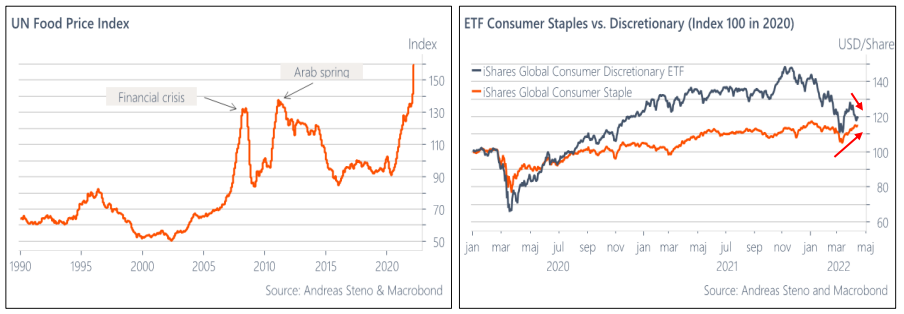

Inflation hits the Grocery store

- The current supply squeeze is one of the worst seen ever. The disconnect between demand fundamentals and food and energy prices is simply eye catching.

- The FAO’s gauge of global prices has jumped about 75% since mid-2020, eclipsing levels seen in 2008 and 2011 that contributed to global food crises.

Last month’s surge helped prices round out a seventh straight quarterly gain, the longest such run since 2008.

- The weekly earnings in U.S. are now running below trend, when you adjust for the most recent price trends, which is a massive change in scenery

when compared to 2020 and 2021.

- When necessities turn more costly, it simply means people will stop buying discretionary stuff soon. This also means that the price on everything you

need will remain high, but the price on everything you don’t need will start dropping soon.

- Will this lead to disinflationary trends on non-essentials in H2-2022 in to 2023?

There are ETFs listed in US focused on agriculture & related companies – DBA available for investment by Indian resident investors.

Economic Activity is energy transformed

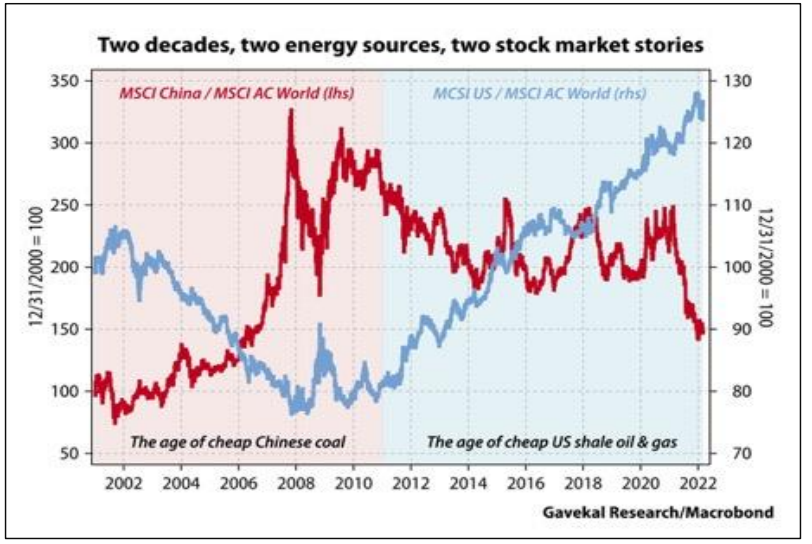

- Ultimate resource which acted as decision maker for global liquidity flow was ‘Energy’.

- Until 2000 – 2010 middle east and developing countries like China dominated era of cheap fuel which in turn reflected in their Stock market returns. (Source: CNBC)

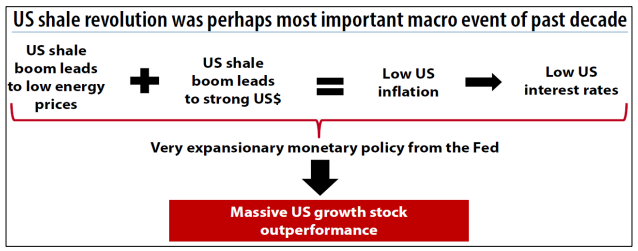

- However, past decade saw tables turned as massive US shale oil & gas exploration which led them to be energy independent. US equity index has seen unparallel journey upwards since then.

- But, after destroying much capital, the shale revolution is now over as witnessed by rising prices (on the rise even before the Ukraine invasion ) and lower production. (Source: CNBC)

There are ETFs listed in US focused on Energy Investing – OIH available for investment by Indian resident investors.

Will Fed rate hike be fast paced?

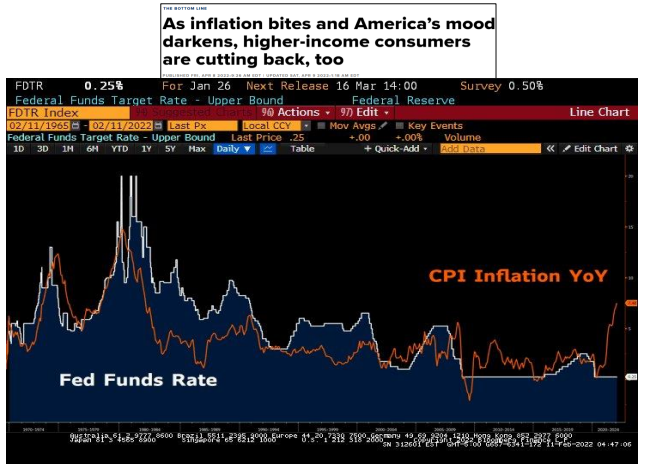

Current inflation prints of ~8.5% is the highest reading seen since the past 40 years. Market expectations are like the last time, Fed would hike rates to combat inflation, although this might lead to rise in unemployment with recession fears. Three reasons on why this time is different -

- With the highest inflation numbers on record, last seen 40 years ago, the Fed cannot raise rates sharply like it did in 1980 to fight inflation as even modest increase will impact US Debt/GDP simultaneously affecting both US interest expense outflow and tax receipts with lower GDP prints due to rate hike induced recession.

- U.S. is data driven economy and latest numbers indicate that consumer spending has been slowing down (Consumerspending is ~70% of US GDP)

- Fed minutes mention that they were prepared for 50 bps hike last time but had to trim this down due to situation in Ukraine. Will global instability rise due supply side issues after Russia sanction and will this force the reserve currency to slow down on the pace of hike (Egypt is dependent on wheat from Russia/Ukraine, Europe on energy imports from Russia).

While 50 bps of hike in May seems priced in, but Fed will keenly watch consumer spending data before

talking about a June hike

Disclaimer

The above material is neither investment research, nor investment advice.

This document may contain confidential, proprietary or legally privileged information. It should not be used by anyone who is not the original intended recipient. If you have erroneously received this document, please delete it immediately and notify the sender. The recipient acknowledges that Eastern Financiers Ltd ("Eastern")or its subsidiaries and associated companies, as the case may be, are unable to exercise control or ensure or guarantee the integrity of/over the contents of the information contained in document and further acknowledges that any views expressed in this document are those of the individual sender and no binding nature of this shall be implied or assumed unless the sender does so expressly with due authority of Eastern or its subsidiaries and associated companies, as applicable. This document is not intended as an offer or solicitation for the purchase or sale of any financial instrument / security or as an official confirmation of any transaction.

Investment Disclaimer

Investment Products are not obligations of or guaranteed by Eastern Financiers Ltd or any of its affiliates or subsidiaries, are not insured by any governmental agency and are subject to investment risks, including the possible loss of the principal amount invested. Past performance is not indicative of future results, prices can go up or down. Investors investing in funds denominated in non-local currency should be aware of the risk of exchange rate fluctuations that may cause a loss of principal.

This document does not constitute the distribution of any information or the making of any offer or solicitation by anyone in any jurisdiction in which such distribution or offer is not authorized or to any person to whom it is unlawful to distribute such a document or make such an offer or solicitation