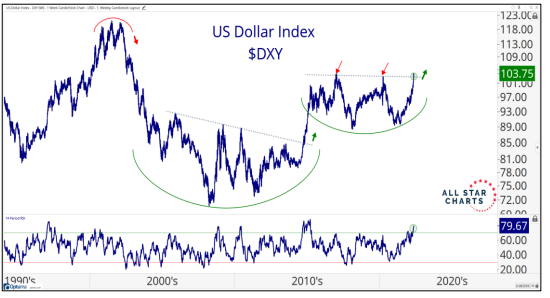

Is There a Stronger Trend Than USD?

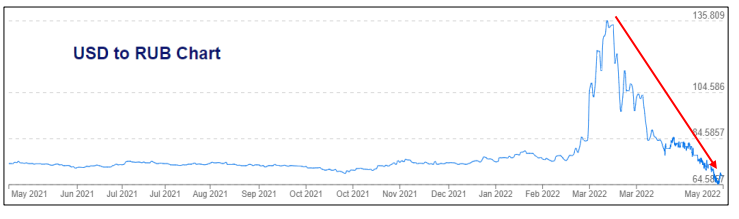

- While most uptrends have come under pressure in 2022, the US dollar has remained as strong. As we write, it on its path for its largest single-day gain since the pandemic crash more than two years ago.

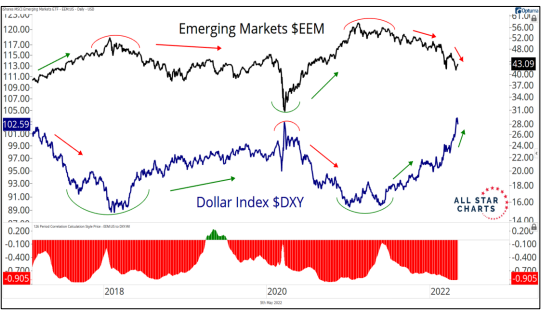

- When the dollar is rallying, risk assets like equities, commodities etc. tend to be falling. When the dollar is falling, risk assets are typically in an uptrend.

- But, DXY’s historic inverse correlation with commodities has been diverging for several quarters now as both are rallying together.

- The inverse relationship between commodities & DXY could re-establish with one bound to catch lower.Which either means;

✓ Surging US treasury bond yields cools down after a probable dovish stance by Fed given recession fears or if consumer demand expectation fall

✓ Fed continues it path to tighten if inflation prints remain concerning; leading to surging bond yields and stronger USD.

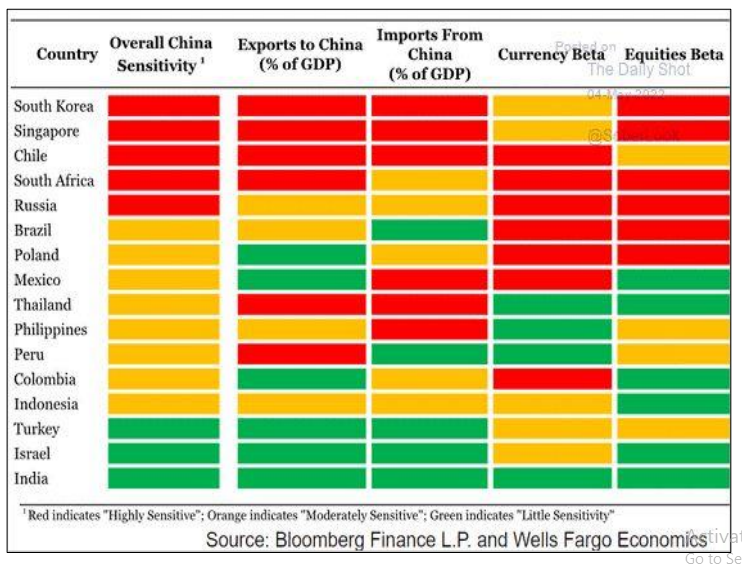

USD due to its reserve currency status creates boom and bust across globe. When USD is rising it is generally deflationary in nature & when USD is falling then it is generally inflationary/reflationary.

How have risk assets reacted to surging USD?

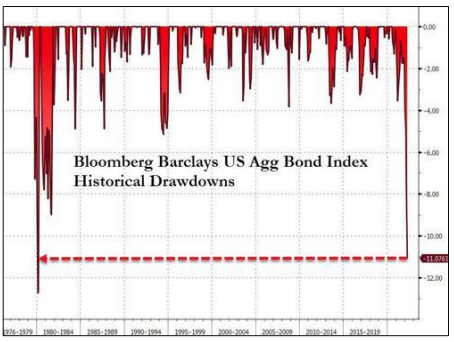

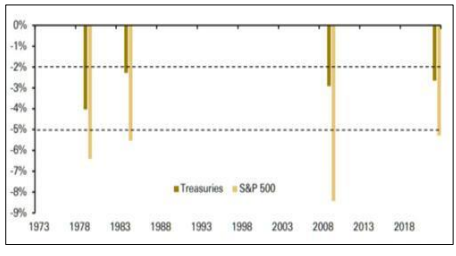

At -11%, this is the largest drawdown in the US bond market since 1980. Back then the 10-year treasury yield was at 12.6%. Today it's at 2.9%.

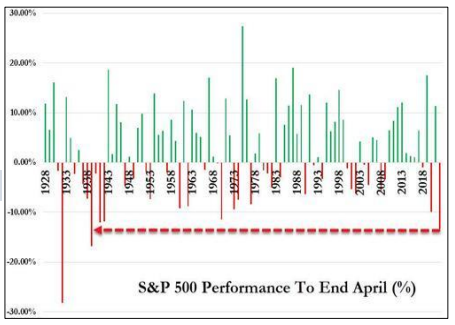

S&P is suffering its worst start to a year since the start of World War 2

4th month since 1973 when S&P is down > 5% & Treasuries down > 2%

Energy

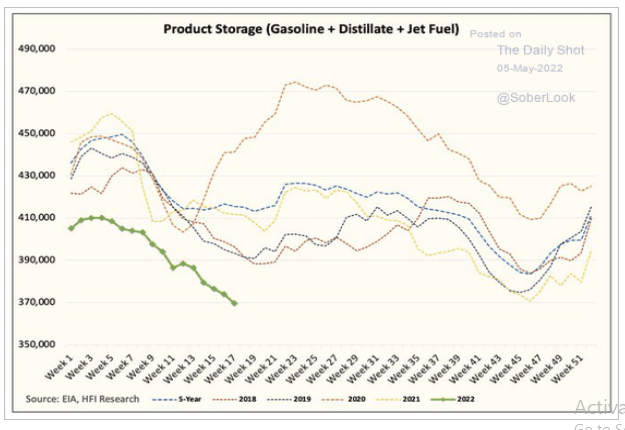

- As US refinery runs deteriorate, total refined product inventories continue to shrink.

- Even before the war started there were soaring energy prices. We saw this already past summer, when China had to shut down its steel production,ban bitcoin mining; because, all these were energy intensive and they didn’t have enough energy. World has already entered into slow moving energy crises.

- No energy capex increases are seen presently in U.S; not even Saudi. Europe kept believing on alternate energy like green revolution which failed to see the day light. So, in some sense Russia went ahead with the invasion; because they knew in a world so dependent on energy nobody would punish them.

- In this cycle, the biggest victim of all energy crisis would be Europe as U.S. is energy independent, Russia wants energy purchases to be paid in Rubles and Saudi is siding the east.

- China should be fine with Russia agreeing to supply energy in Yuan, as practically energy then is free as you

can print as many Yuan’s as you wish.

There are ETFs listed in US focused on Energy investing – OIH and XLE available for investment by Indian resident investors.

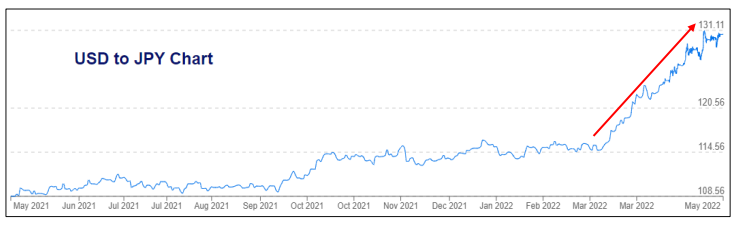

The Bank of Japan is trapped!

- U.S & EU plan to trap Russia by employing sanctions thereby inflating their economy, creating BOP crises & political unrest seems backfired as two months into the war, Japan rather than Russia seems to be trapped, with BOJ doing what ideally Russian central bank was expected to do.

- Due to higher energy, food and other commodities, Japan reported a bigger than expected trade deficit weakening the yen; there by raising costs for consumers and businesses.

- This in turn puts upward pressure on JGB yields and with Japan debt being so high, even a modest rise in yields has the effect of bankrupting the government. Resultant effect – Print more JPY to cap JGB yields from rising.

As long as Russia demands RUB for its gas, then EUR and JPY will likely to continue on the path to Balance of Payments crises and extreme currency weakness v.the USD.

Paradoxically, this will present in markets as the USD (DXY index) going up day after day.

Disclaimer

The above material is neither investment research, nor investment advice.

This document may contain confidential, proprietary or legally privileged information. It should not be used by anyone who is not the original intended recipient. If you have erroneously received this document, please delete it immediately and notify the sender. The recipient acknowledges that Eastern Financiers Ltd ("Eastern")or its subsidiaries and associated companies, as the case may be, are unable to exercise control or ensure or guarantee the integrity of/over the contents of the information contained in document and further acknowledges that any views expressed in this document are those of the individual sender and no binding nature of this shall be implied or assumed unless the sender does so expressly with due authority of Eastern or its subsidiaries and associated companies, as applicable. This document is not intended as an offer or solicitation for the purchase or sale of any financial instrument / security or as an official confirmation of any transaction.

Investment Disclaimer

Investment Products are not obligations of or guaranteed by Eastern Financiers Ltd or any of its affiliates or subsidiaries, are not insured by any governmental agency and are subject to investment risks, including the possible loss of the principal amount invested. Past performance is not indicative of future results, prices can go up or down. Investors investing in funds denominated in non-local currency should be aware of the risk of exchange rate fluctuations that may cause a loss of principal.

This document does not constitute the distribution of any information or the making of any offer or solicitation by anyone in any jurisdiction in which such distribution or offer is not authorized or to any person to whom it is unlawful to distribute such a document or make such an offer or solicitation