Will Gold be at the center of new payment currency?

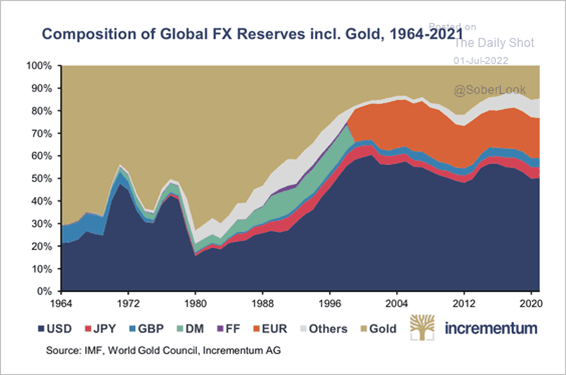

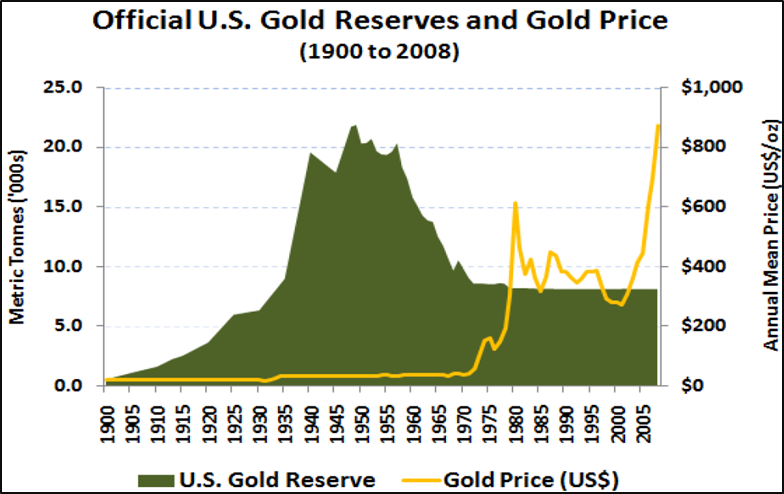

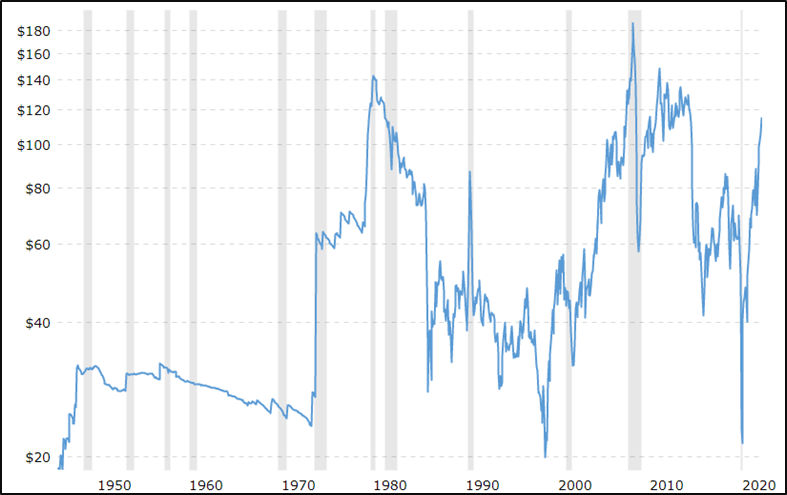

- One trend that is common across many nations: gold as a percentage of reserves has risen consistently since Q3 of 2018.

- Gold’s value has stagnated over the past 1-2 years as bitcoin and equities had taken the spotlight with an increasing fait

money.

- As Bitcoin joins Bonds and Equities towards the downward journey, will value return back to real assets?

“The third and the final stage on the new economic order transition will involve a creation of a new digital payment currency…A currency like this can be issued by a pool of currency reserves of BRICS countries..the basket could

contain an index of prices of main exchange traded commodities : Gold and other precious metals, key industrial metals, hydrocarbons, grains, sugar, as well as water and other natural resources..”

– Sergey Glazyev, Ex-Economic Advisor to President Putin

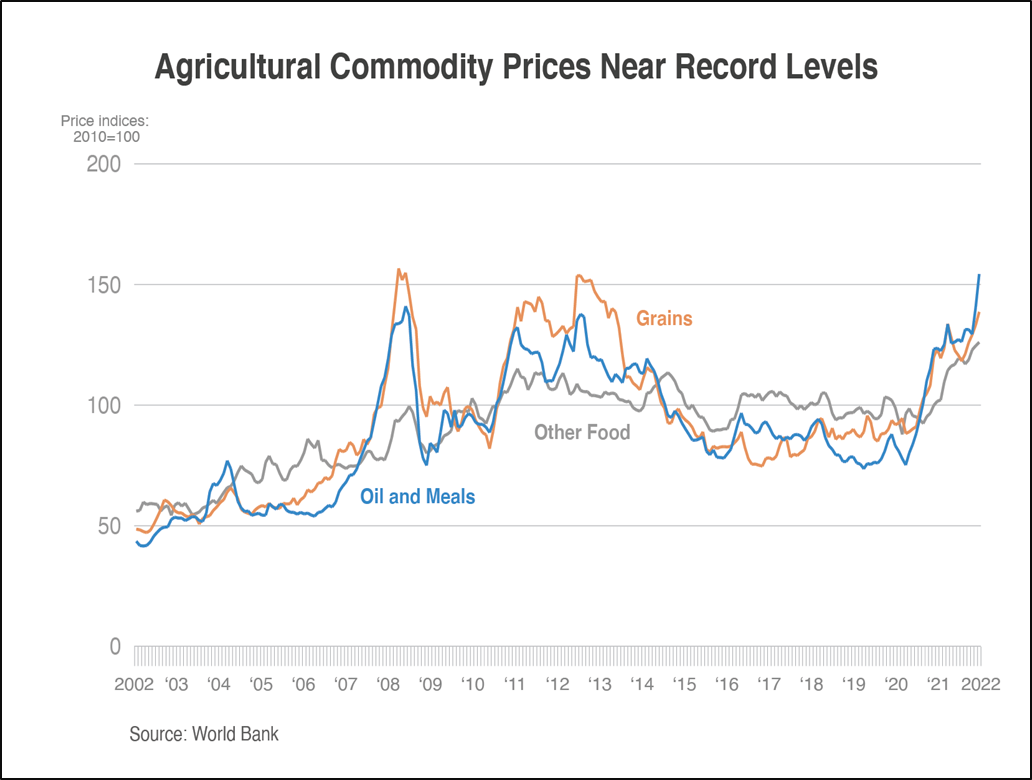

Agriculture: Will climate goals affect the farm production?

- The government of the Netherlands wants to impose new climate goals of reducing nitrogen output by 2030. In order to meet these goals, farmerswill have to downsize their businesses or shut down.

- In Norway several large food producers implemented massive price increases on food. For example the price of Pepsi Max went up by over 30%

- We are already looking at a worldwide food crisis as a result of skyrocketing fertiliser prices and the war in Ukraine (as Russia and Ukraine are major grain exporters, and that is now coming to a standstill).

- We will likely see even more expensive food next year, and unfortunately probably famines in some parts of the world. (Source: Peter Sweden)

There are agriculture themed ETFs like DBA available for investment by resident Indian investors.

US ‘Strategic Petroleum reserve’ hits nearly 40 year low

- In order to curb the oil price and thereby inflationary pressures; the U.S released a large part of their ‘Oil

Strategic Reserve’ stock thereby taking this near to 40 year lows.

- On the flipside, the western economies are shutting down gas pipelines, taxing oil companies thereby disincentivizing any additional supply

- All eyes are now on Biden’s visit to Saudi Arabia in mid-July and if Saudi agrees to pump more to stabilize supply markets.

The US Is Depleting Its Strategic Petroleum Reserve Faster Than It Looks

- What could happen here – Biden returns with a promise from Saudi to pump more oil; which cools off prices and thereby inflation prints; gives Fed some leeway to pause tightening.

- However, ensuing months show that Saudi & Opec + production do not rise as much; which may again send oil

prices back to prior highs.

There are Energy themed ETFs and ETNs like OIL, XLE, OIH available for investment by resident Indian investors.

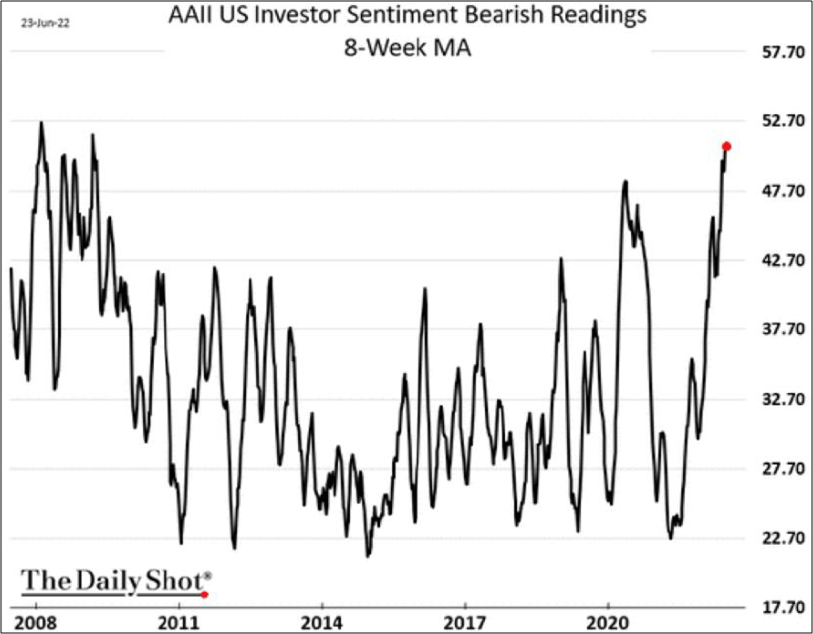

Investor sentiments hitting historic lows

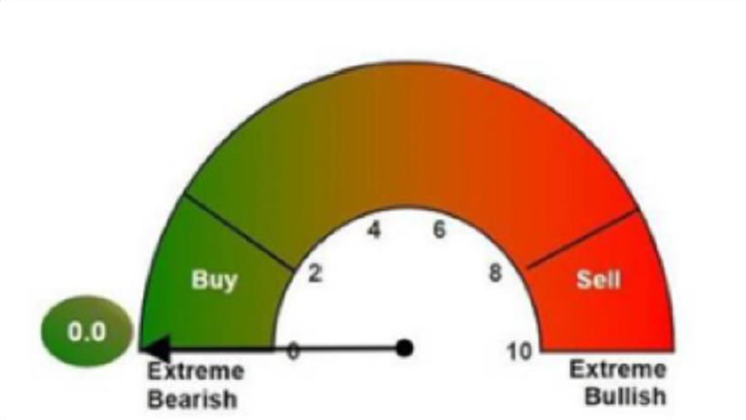

- BofA’s sentiment indicator hit ‘0’ in June’22 indicating extreme ‘bearishness’.

- Other instances where this hit zero were Aug’2002, Jul’2008, September’2011, September 2015 and March’2020.

- While not all of these dates were definite bottoms; but, these typically represents a buyer’s more than a seller’s market from a 6-12 months perspective.

- Also, US investor sentiment readings are at extreme bearishness, last seen during depths of Great financial crises

The biggest catalyst driver for higher risk asset prices over next few months would be Fed’s stance on tightening as recession fears loom. If oil prices are off for a bit that may provide Fed some breathing space.

Disclaimer

The above material is neither investment research, nor investment advice.

This document may contain confidential, proprietary or legally privileged information. It should not be used by anyone who is not the original intended recipient. If you have erroneously received this document, please delete it immediately and notify the sender. The recipient acknowledges that Eastern Financiers Ltd ("Eastern")or its subsidiaries and associated companies, as the case may be, are unable to exercise control or ensure or guarantee the integrity of/over the contents of the information contained in document and further acknowledges that any views expressed in this document are those of the individual sender and no binding nature of this shall be implied or assumed unless the sender does so expressly with due authority of Eastern or its subsidiaries and associated companies, as applicable. This document is not intended as an offer or solicitation for the purchase or sale of any financial instrument / security or as an official confirmation of any transaction.

Investment Disclaimer

Investment Products are not obligations of or guaranteed by Eastern Financiers Ltd or any of its affiliates or subsidiaries, are not insured by any governmental agency and are subject to investment risks, including the possible loss of the principal amount invested. Past performance is not indicative of future results, prices can go up or down. Investors investing in funds denominated in non-local currency should be aware of the risk of exchange rate fluctuations that may cause a loss of principal.

This document does not constitute the distribution of any information or the making of any offer or solicitation by anyone in any jurisdiction in which such distribution or offer is not authorized or to any person to whom it is unlawful to distribute such a document or make such an offer or solicitation