Markets Stress Test

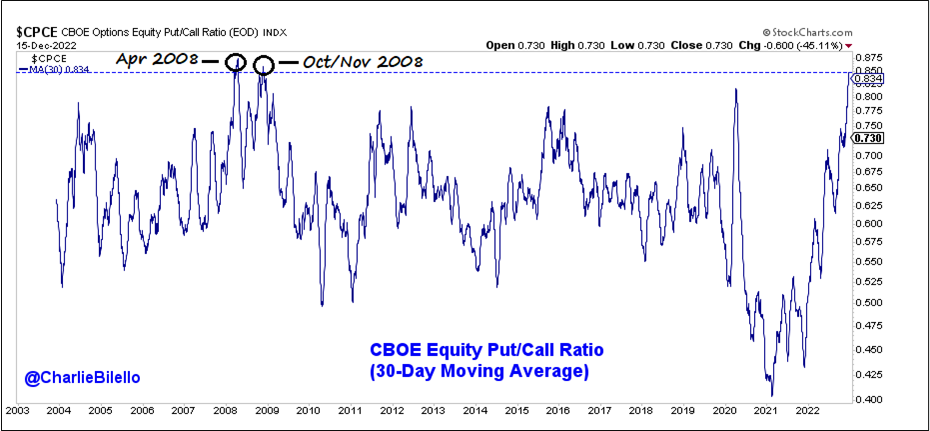

The ratio of equity puts (bearish bets) to calls (bullish bets) over the last 30 trading days has only been this high a few times in the past: April 2008 and Oct/Nov 2008 . While, flows to equity funds remain at elevated levels, investors vary of looming recession are building up protection in the portfolio via puts. Weak retail data and upcoming Earnings season could continue to keep markets volatile.

Is this the peak of fear or are we yet to see doomsday?

Asset Allocation assumes importance in a Volatile market

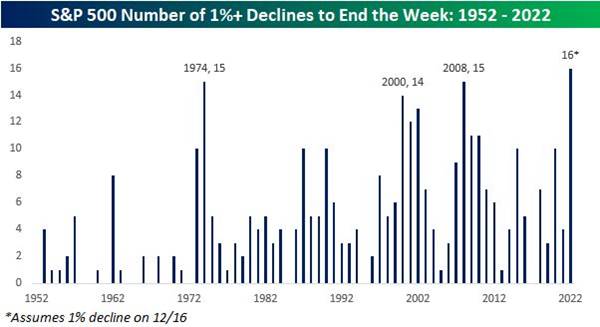

The S&P 500 is "on pace for a record number of 1%+ declines to close out a trading week" in 2022. Was 2022 just one off year due to global uncertainty issues or are we entering a new volatile era.

If later holds true, will buy & hold work in an 'investment product' work at all times or 'Asset allocation' and identifying liquidity flow holds the key?

(Chart Source: BespokeInvest)

Bretton Woods II officially ended this month

During the China Arab summit last week, China officially invited Arab nations to trade in Oil & Gas in Yuan on Shanghai exchange; a move that would not have been made unless all Arab nations 'had already' agreed as a matter of joint policy to take action accordingly.

Is this an end to ~5 decade practice of pricing oil in USD? Are these the first signs of shift of winds?

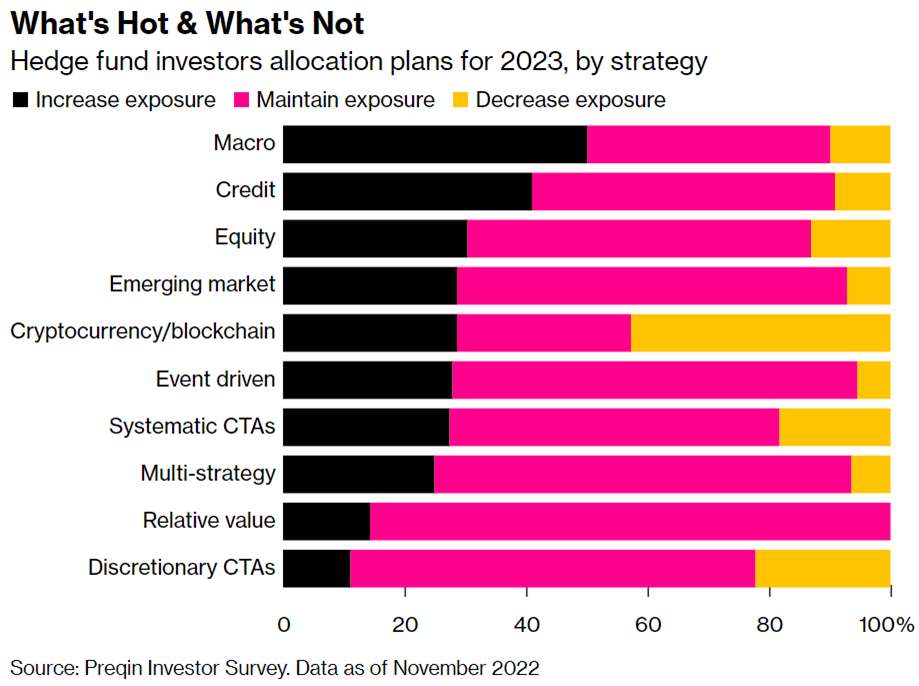

And lastly…’Macro’ dominates

The top three money pools investors want to allocate to in 2023 are macro, credit and equity.

This is in sharp contrast to pandemic years wherein Crypto, Equity dominated thanks to easy money.

Macro Investing is all about identifying the capital flow and asset classes that could be the beneficiaries of this flow.

Disclaimer

The above material is neither investment research, nor investment advice.

This document may contain confidential, proprietary or legally privileged information. It should not be used by anyone who is not the original intended recipient. If you have erroneously received this document, please delete it immediately and notify the sender. The recipient acknowledges that Eastern Financiers Ltd ("Eastern")or its subsidiaries and associated companies, as the case may be, are unable to exercise control or ensure or guarantee the integrity of/over the contents of the information contained in document and further acknowledges that any views expressed in this document are those of the individual sender and no binding nature of this shall be implied or assumed unless the sender does so expressly with due authority of Eastern or its subsidiaries and associated companies, as applicable. This document is not intended as an offer or solicitation for the purchase or sale of any financial instrument / security or as an official confirmation of any transaction.

Investment Disclaimer

Investment Products are not obligations of or guaranteed by Eastern Financiers Ltd or any of its affiliates or subsidiaries, are not insured by any governmental agency and are subject to investment risks, including the possible loss of the principal amount invested. Past performance is not indicative of future results, prices can go up or down. Investors investing in funds denominated in non-local currency should be aware of the risk of exchange rate fluctuations that may cause a loss of principal.

This document does not constitute the distribution of any information or the making of any offer or solicitation by anyone in any jurisdiction in which such distribution or offer is not authorized or to any person to whom it is unlawful to distribute such a document or make such an offer or solicitation