India takes over China - on Demographics

Active Stocks or Passive ETFs or Active Asset Allocation via Passive ETFs - Who do you think will be the winner in the coming decade?

Post GFC 'Liquidity beyond fundamentals' influenced asset allocation which led money moving to risk assets thereby chasing momentum winners. As liquidity reverses stance, will era of active investing be back?

(Chart Source: Strategas Securities)

AUM: Algos > Humans

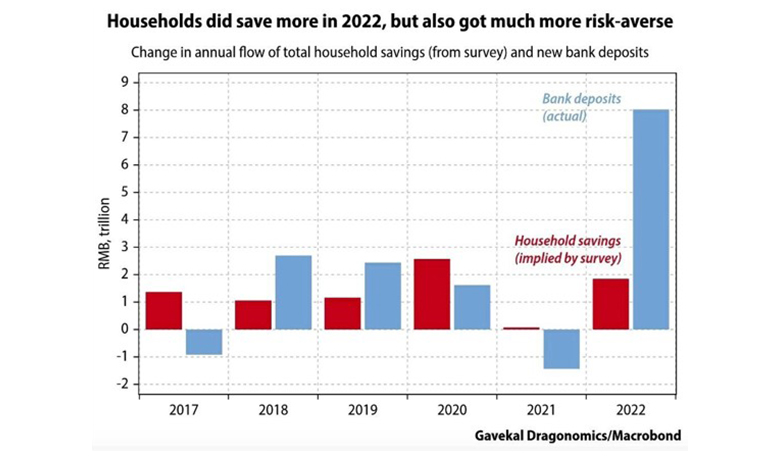

The surge in Chinese household savings is well spoken of. Infact the increase outpaces the rise in savings implied by the government surveys.

Interestingly, large part of these savings were parked in risk free bank deposits and not risker financial products. What happens to China markets if these investors had to turn a little risk averse this year?

(Chart Source: Gavekal)

BOJ - Most important part of the liquidity puzzle

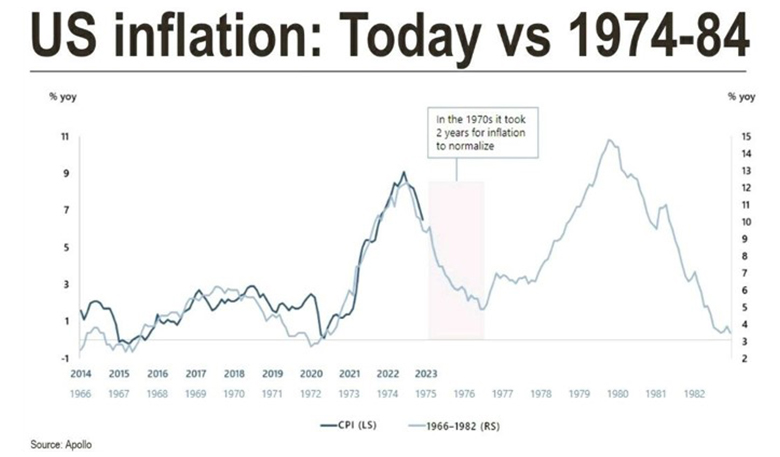

In 1974, inflation was caused by rates that had been too low for too long and by the surge in energy prices caused by Arab oil embargo.

In 2022, the rise in inflation was due to too low rates for too long, post covid logistical issues and commodity price fluctuation due to Ukraine war. This time will inflation normalize without a second wave?

(Source: Stephane Monier)

What if this is just the 'start' of Wage Inflation?

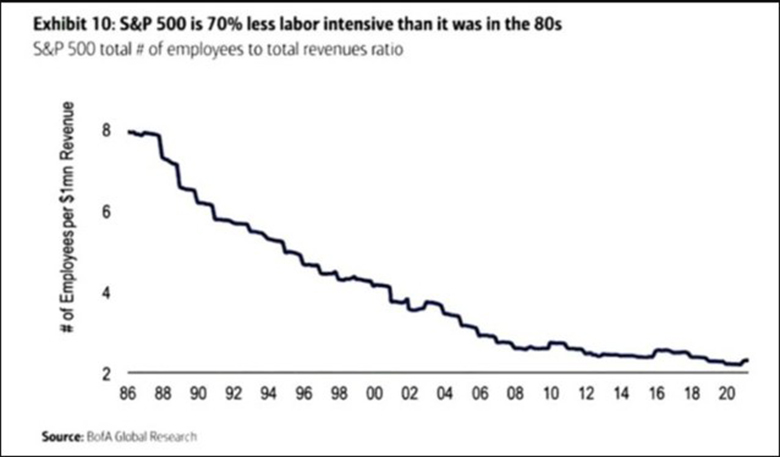

S&P 500 has become less labour intensive now vs the 1990s due to technology. Then it needed 8 employees to generate $1mn of revenue today it needs 2. While I agree to the technology part of this, but one more added reason and much bigger a reason for this is Globalization. From 1990s onwards we saw China's rise as factory of production to the World which caused change in US labour dynamics.

So does that mean if US is getting back to onshoring again and developing internal capacities, will the number of employees to generate $1mn increase to say...5? But, US employment numbers aren't showing any major weakness yet, so where will these additional employees come from?

Disclaimer

The above material is neither investment research, nor investment advice.

This document may contain confidential, proprietary or legally privileged information. It should not be used by anyone who is not the original intended recipient. If you have erroneously received this document, please delete it immediately and notify the sender. The recipient acknowledges that Eastern Financiers Ltd ("Eastern")or its subsidiaries and associated companies, as the case may be, are unable to exercise control or ensure or guarantee the integrity of/over the contents of the information contained in document and further acknowledges that any views expressed in this document are those of the individual sender and no binding nature of this shall be implied or assumed unless the sender does so expressly with due authority of Eastern or its subsidiaries and associated companies, as applicable. This document is not intended as an offer or solicitation for the purchase or sale of any financial instrument / security or as an official confirmation of any transaction.

Investment Disclaimer

Investment Products are not obligations of or guaranteed by Eastern Financiers Ltd or any of its affiliates or subsidiaries, are not insured by any governmental agency and are subject to investment risks, including the possible loss of the principal amount invested. Past performance is not indicative of future results, prices can go up or down. Investors investing in funds denominated in non-local currency should be aware of the risk of exchange rate fluctuations that may cause a loss of principal.

This document does not constitute the distribution of any information or the making of any offer or solicitation by anyone in any jurisdiction in which such distribution or offer is not authorized or to any person to whom it is unlawful to distribute such a document or make such an offer or solicitation