Deglobalization + Restocking post Covid = Supply Side Crisis + ‘Inflation’

- Globalization which gained wings in 1988-2016 post wall era, is facing reversal challenges with inflation, pandemic related lockdown & interventionist ideologies of governments.

- There will be a demand-pull capex boom in the developed world

- as companies seek to bring supply chains in house,

- as governments invest in energy security,

- as businesses seek to vertically integrate to explore operational synergies.

- Corporations recognize that demand is in a new regime led by nationalization & need to locally produce items; which, were erstwhile imported & they are investing accordingly. Rising Capex uptrend + inventory restocking will be a tailwind for growth for months to come.

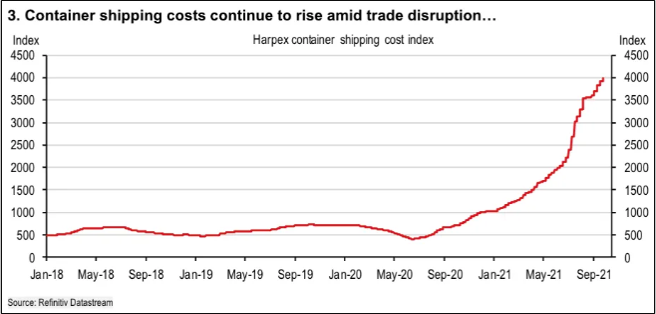

- This could trigger stock piling amongst firms affecting their ROEs amid rising shipping costs, lack of mobility across borders leading to scarcity of skilled employees, rising import substitution which may not be cost effective & tightening world labor markets.

(Source : The Cascade – Pinecone Macro Research)

The ‘trade-off’ from turning trade off will be cost-push and demand-pull ‘inflation’

There are inflation protection ETFs listed in US available for investment for Indian citizens.

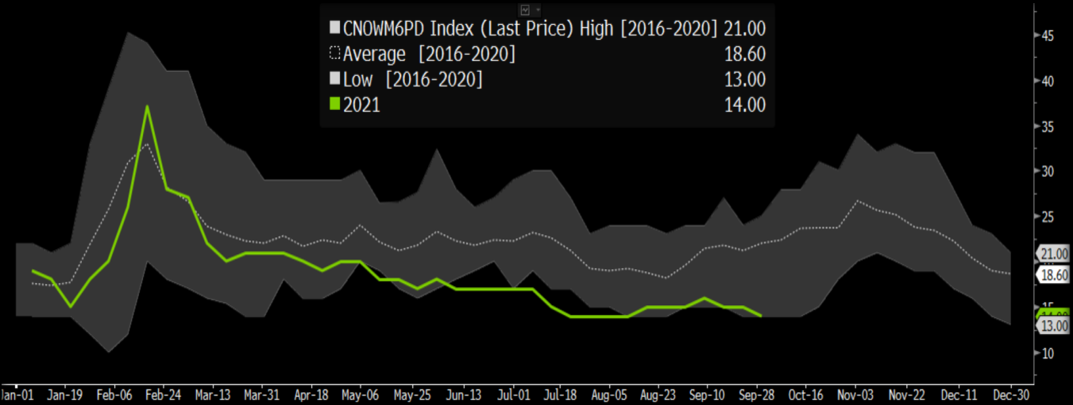

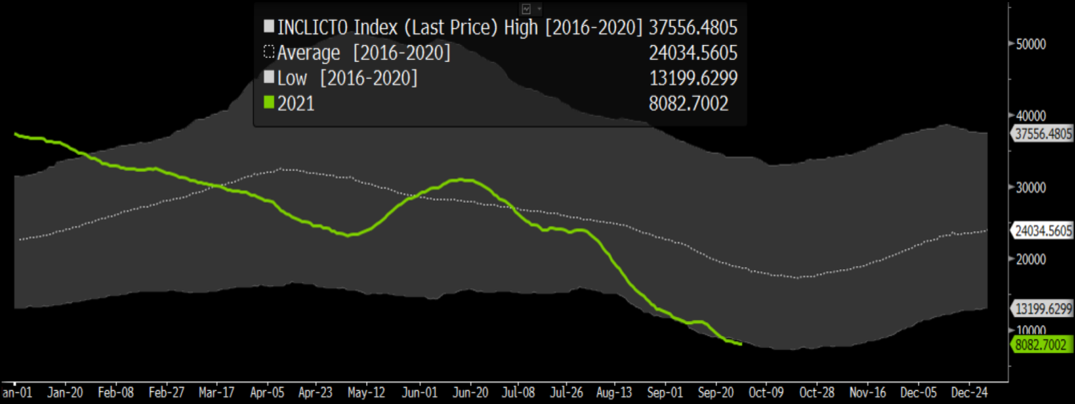

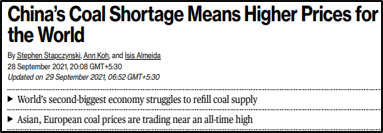

Fossil Fuel (like Coal) rises amid concerns on Fossils & clean energy focus

- With winter on the way & energy prices at record levels, economies across are competing for a finite supply of coal. China has ordered its top energy companies to secure supplies at all costs.

- If this continues economies could face crippling heating bills with governments struggling to ease inflation could lose popular support.

- Clean energy transition already under fire for low wind generation leading to Europe’s power shortage, could further be questioned.

- Spiking gas prices in UK, electricity prices in Europe, factory shut-downs in Germany - different countries same problem - they reduced ‘carbon economy’ before they had sufficiently built the ‘green economy’.

- Excluding spike in 2008, world has seen 4 decades of uninterrupted energy supply fueling growth. What if the energy crisis is the 1st crisis Fed wont be able to fix?

Coal inventories vs. 5 year average for 2 most populous countries

The dirtiest fossil fuel, which was struggling against cleaner energy sources, is now seeing its biggest comeback ever, complicating international climate talks.

Interestingly, VanEck discontinued its Coal focused ETF last year post rising concerns on fossil fuels and focus on ESG.

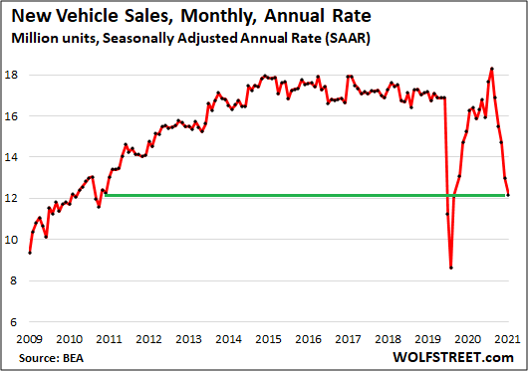

Will slowing Auto sales derail US economic growth?

- New vehicle sales have plunged as supply chain disruption, chip shortages and depleted inventories add to the pricing pressure affecting supply volumes.

- New vehicle sales in September dropped 37% from that in March this year. Monthly seasonally adjusted sales have plunged 5th month in a row lowest (outside 2 lockdown months) since June’2011.

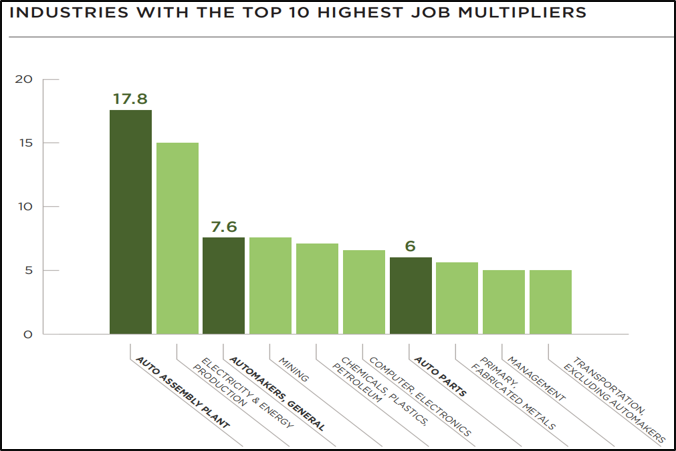

- Automakers (incl suppliers) are US’s largest manufacturing sector, responsible for 3% of GDP. No other manufacturing sector

generates as many jobs. Not only are they largest exporters in US, they also buy hundreds of billions of dollars worth of US steel,

glass, rubber, iron, and semiconductors each year. They are also among largest investors in R&D. (Source: americanautomakers.org)

- Analysts predict vehicle supply will improve mildly in the fourth quarter, and continue to improve throughout 2022, but won’t

return to “normal” until 2023 (Source: CNBC)

(Source : Wolfstreet)

(Source : americanautomakers.org)

Will the auto companies resort to reducing manpower & other variable costs in response to slowing sales. Will central bankers be able to effectively taper and raise rates in an economy affected by rising costs & slowing growth.

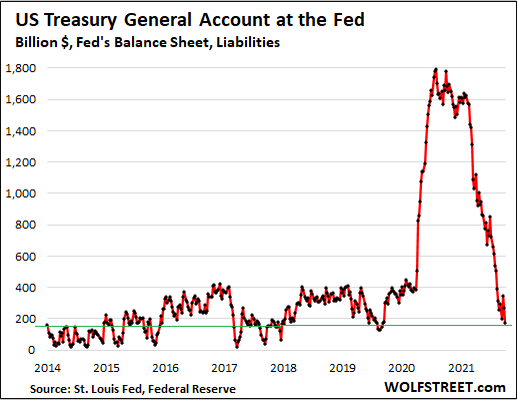

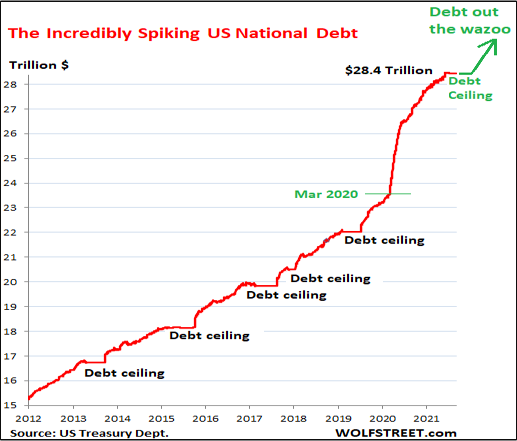

Treasury General Account – How close to zero will it get?

- If the debt ceiling isn’t raised or suspended US government would run out of cash by 18th October & ‘technically’ default on its’ debt obligations.

- While, the chances of this happening could be very minimal given stakes involved (Since 1960 debt ceiling has been raised 78 times), technically rating agency (S&P) can/may downgrade the US sovereign debt from ‘AA+’ by 20 notches to ‘D’ for default, creating havoc across asset markets.

- The first casualty as TGA moves from $1.6 trn in Jan to near zero in a week or two could be assets; where, liquidity injection played a major role in boosting returns vs. overall change in fundamental dynamics.

- Its noteworthy to observe that certain economies not particularly on friendly terms with US are diversifying their reserves to ‘Gold’ so as to not be insolvent if US were to hit a ‘technical’ default.

2020s will be a decade for real productive assets like commodities & other scarce assets. This wont be linear and there would be periods when having exposure to cash in the portfolio allows you to buy on dips & rebalance

Rate Hike…Taper…Which one comes first and WHEN?

- Bank of New Zealand joins other central banks – like the Bank of Japan, the Bank of Canada, the Bank of England, the Reserve Bank of New Zealand, and the Reserve Bank of Australia – have already either ended/throttled back their large-scale QE operations/announced rate hikes. The ECB has announced that it would “recalibrate” its QE.

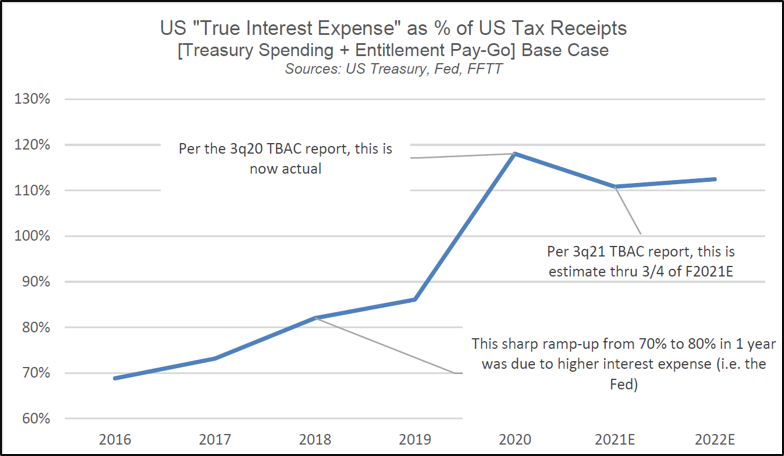

- Will Fed’s taper decision lead us back to 2013 or is this time different? Despite the Tax receipts at all time highs (aided by bubbles in virtually every asset class); US ‘True interest expense’ i.e. treasury spending + entitlements is still 111% of tax receipts.

- If Fed tapers QE without offsetting the liquidity withdrawal with swap lines or standing repo facility; then this Taper is likely to be much shorter and painful experience than 2013 leading to rising yields in global asset market and sell off in risk assets.

- Sell off in risk assets like Equities could also potentially reduce tax receipts; further detoriating the ‘real interest’ to tax receipts ratio.

- US Fiscal position is truly in unprecedented position to start a tightening cycle. Will the reserve currency continue to lag behind other central bankers in monetary tightening cycle?

Will India join other countries that are expected to hike rates in the coming months?

Will companies be able to manage rising costs, supply side issues, rising interest costs, deglobalization all at the same time and will these costs be eventually passed on to end consumers.

Disclaimer

The above material is neither investment research, nor investment advice.

This document may contain confidential, proprietary or legally privileged information. It should not be used by anyone who is not the original intended recipient. If you have erroneously received this document, please delete it immediately and notify the sender. The recipient acknowledges that Eastern Financiers Ltd ("Eastern")or its subsidiaries and associated companies, as the case may be, are unable to exercise control or ensure or guarantee the integrity of/over the contents of the information contained in document and further acknowledges that any views expressed in this document are those of the individual sender and no binding nature of this shall be implied or assumed unless the sender does so expressly with due authority of Eastern or its subsidiaries and associated companies, as applicable. This document is not intended as an offer or solicitation for the purchase or sale of any financial instrument / security or as an official confirmation of any transaction.

Investment Disclaimer

Investment Products are not obligations of or guaranteed by Eastern Financiers Ltd or any of its affiliates or subsidiaries, are not insured by any governmental agency and are subject to investment risks, including the possible loss of the principal amount invested. Past performance is not indicative of future results, prices can go up or down. Investors investing in funds denominated in non-local currency should be aware of the risk of exchange rate fluctuations that may cause a loss of principal.

This document does not constitute the distribution of any information or the making of any offer or solicitation by anyone in any jurisdiction in which such distribution or offer is not authorized or to any person to whom it is unlawful to distribute such a document or make such an offer or solicitation