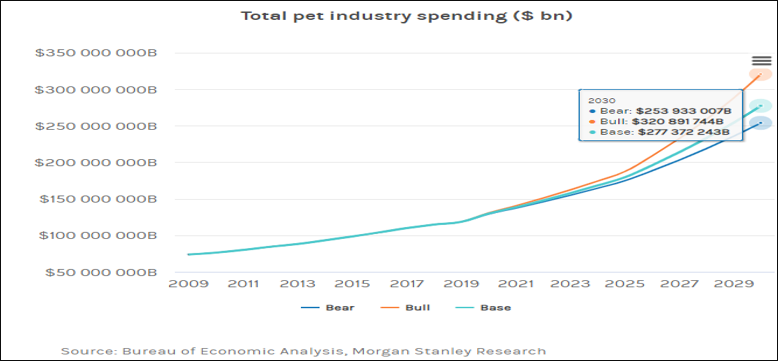

Petcare Industry: A Long –Tail Trend

- ~67% of US households have at least 1 pet, marking the highest level of pet ownership on record. In fact, pets have become staple in many U.S. households to the point that 1 in 10 pet owners are actually delaying having children to focus on their pets.(Source: ArmStrongEconomics.com)

- The average owner spends $1,380 annually per dog and $908 per cat. That amount could quickly spike if a pet falls ill or has special needs. Grooming, training, premium foods, advanced healthcare, insurance policies and boarding costs would also push this number higher for middle and upper-income owners. (Source: ArmStrongEconomics.com)

- According to Euromonitor International, pet-care market has grown by over 66% in the last decade, while the global economy has expanded by just 43%.

- Internet searches related to pet adoption for both cats and dogs increased by 250% over the first year of the pandemic.

- Factors like stay at home, higher disposable income & nuclear families are driving adoption of pets & thereby the Petcare market.

There are ETFs listed in US focused on Pet care – PAWZ available for investment by Indian resident investors.

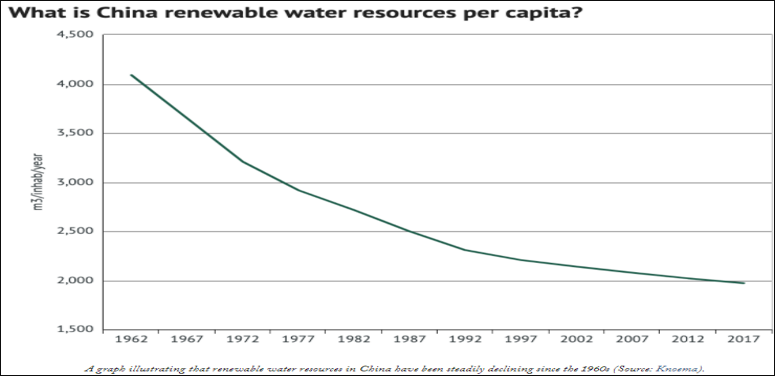

After Energy its Water now threating Supply chain disruption

- After COVID-19 disruptions, congested ports, etc.; rising Water scarcity in China can be the next one that pushes U.S. supply chains over the edge.

- With nearly 20% of global population, China has about 7% of world’s freshwater. According to a 2017 analysis in Global Risk Insights, nearly half of China’s GDP is generated “in regions that have a similar water resource per capita as the Middle East.”

- Groundwater depletion has been so significant in the areas around Beijing that parts of the city are falling into the earth by more than 14 centimeters a year.

- These water shortages are showing up in power generation, leaving hydroelectric & coal power producers struggling. Authorities have responded by restricting industrial energy consumption, resulting in major disruptions to China’s manufacturers.

- This in turn disrupts U.S. supply chains as it imports 40% of domestic clothing sales (~70% of Walmart’s store merchandise), key industrial products like steel, aluminum, polysilicon used in solar panels etc. from China; leading to rising product prices.

Shortages emerging from either supply chain issues or energy shortage or water shortage are Inflationary.

There are ETFs listed in US focused on Inflation – INFL available for investment by Indian resident investors.

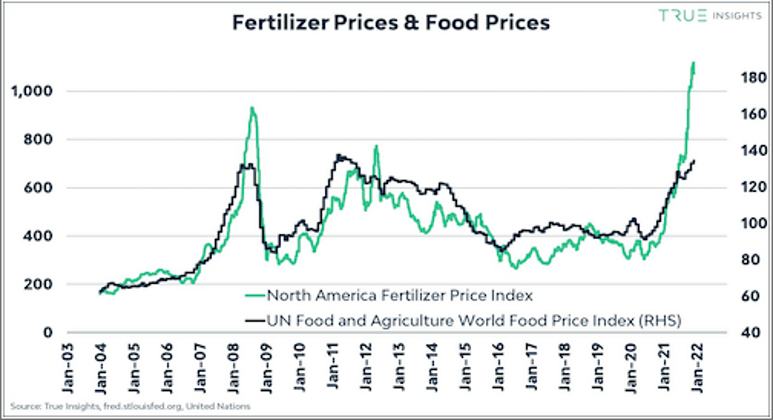

Second Order effects of ESG

Global food prices are now the highest they've been in a decade.

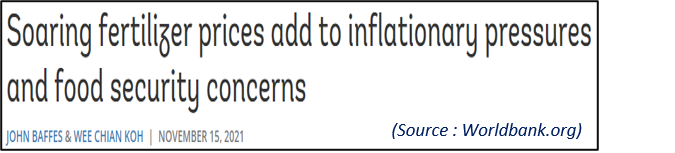

Issues leading to rising agricultural prices -

- Countries like U.S. & Netherlands focusing on taking farmland out of cultivation to reduce agriculture’s environmental impact.

- Prices for major fertilizer products have increased over 50% in the last year. High prices lead to projections of record-high production costs in 2022.

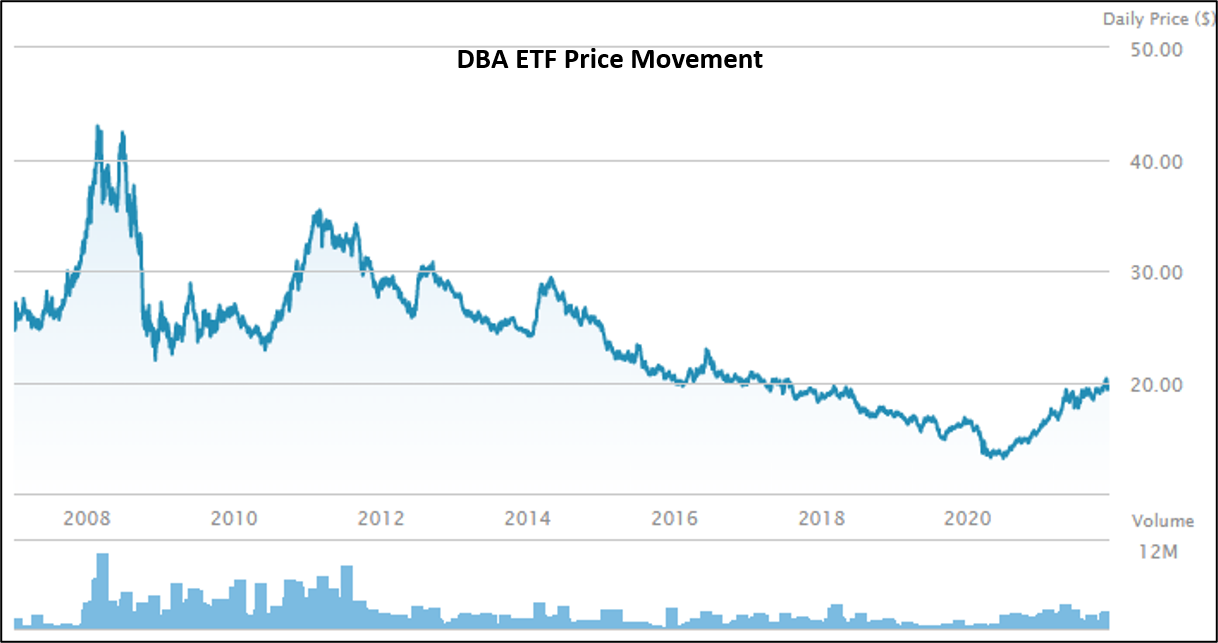

There are ETFs listed in US focused on Agriculture – DBA available for investment by Indian resident investors

Basket of Agricultural ETF are also available for investment on - https://www.stockal.com/stacks/stackdetail?name=EFAGRI

China: With positive real rates Debt servicing gets challenging

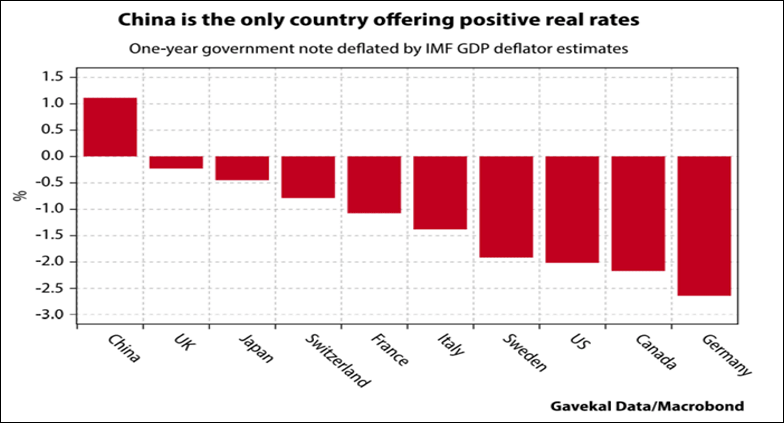

Positive Real Interest Rate –

- For decades, active managers have claimed that in boring markets, don’t expect them to outperform. If there ever was a year active management should have outperformed passive indexed strategies, 2020 (most turbulent times since the great recession) and the first half of 2021 should have been it.

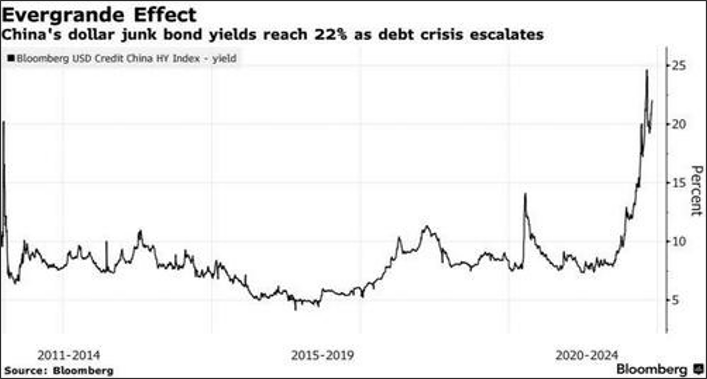

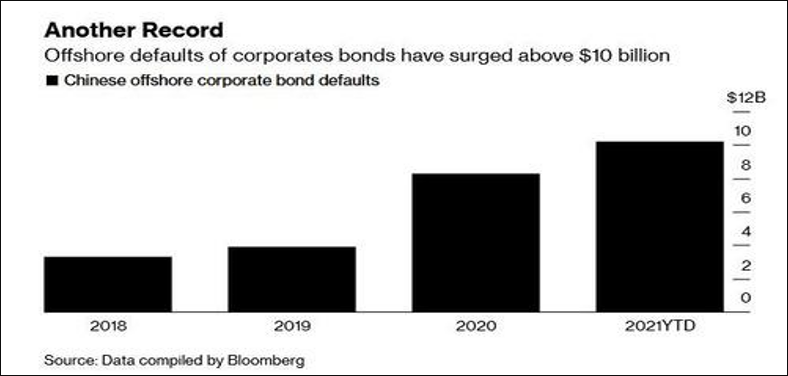

China is the only major country with positive real interest rate attracting savers since past 2 years. But, this is turning to be a nightmare for borrowers/corporates/developers with interest outgo more than the inflation in a looming Debt scenario, leading to defaults. ‘Positive Real rates leads to defaults’

Disclaimer

The above material is neither investment research, nor investment advice.

This document may contain confidential, proprietary or legally privileged information. It should not be used by anyone who is not the original intended recipient. If you have erroneously received this document, please delete it immediately and notify the sender. The recipient acknowledges that Eastern Financiers Ltd ("Eastern")or its subsidiaries and associated companies, as the case may be, are unable to exercise control or ensure or guarantee the integrity of/over the contents of the information contained in document and further acknowledges that any views expressed in this document are those of the individual sender and no binding nature of this shall be implied or assumed unless the sender does so expressly with due authority of Eastern or its subsidiaries and associated companies, as applicable. This document is not intended as an offer or solicitation for the purchase or sale of any financial instrument / security or as an official confirmation of any transaction.

Investment Disclaimer

Investment Products are not obligations of or guaranteed by Eastern Financiers Ltd or any of its affiliates or subsidiaries, are not insured by any governmental agency and are subject to investment risks, including the possible loss of the principal amount invested. Past performance is not indicative of future results, prices can go up or down. Investors investing in funds denominated in non-local currency should be aware of the risk of exchange rate fluctuations that may cause a loss of principal.

This document does not constitute the distribution of any information or the making of any offer or solicitation by anyone in any jurisdiction in which such distribution or offer is not authorized or to any person to whom it is unlawful to distribute such a document or make such an offer or solicitation