Dear Investors,

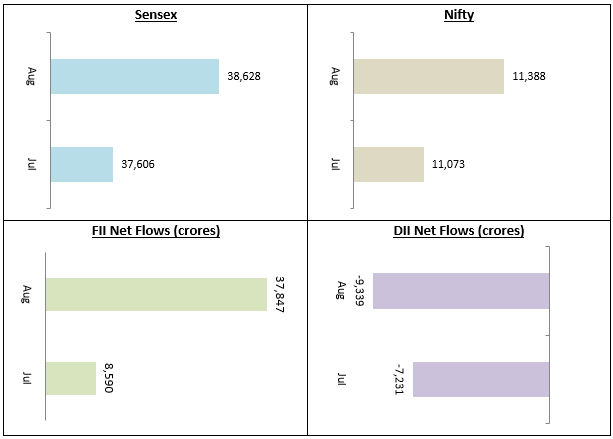

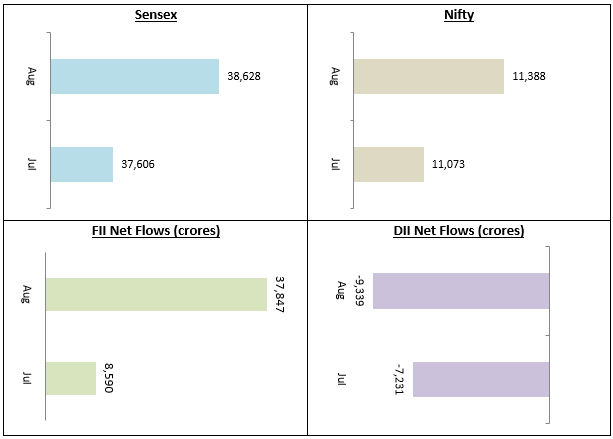

Stock market continued its winning streak for the third consecutive month though the gains were lower compared to what we saw in June and July 2020. Nifty closed the month at 11,388 around 3.8% higher than July close. Sensex closed August at 38,628. FIIs continued to remain bullish about Indian markets with net purchases of nearly Rs 37,850 crores in the month of August. DIIs continued to be net sellers in August. While stock market remained bullish, the news on the economic front was not good. As per data released by the Government, India’s GDP contracted by 23.9% in Q1. While the magnitude of GDP contraction surprised a few, the stock market took this news in its stride with Nifty remaining mostly range-bound in the 11,200 to 11,800 range.

As mentioned in my previous letter to you, we will not do month on month Index of Industrial Production (IIP) growth comparison till the COVID – 19 situation stabilizes because the sequential growth / decline numbers would be meaningless. Suffices to say that industrial growth continues to contract and this is not likely to change till economic activity is restored to pre-COVID levels.

The Government has also hinted another round of fiscal stimulus. We will keep a close watch on the situation and keep you informed on significant developments. WPI inflation eased further in August, but food prices have increased due to supply disruptions caused by COVID related restrictions. Retail inflation spiked in August but is well below RBI’s target rate. We expect RBI to continue its accommodative monetary policy in the coming months.

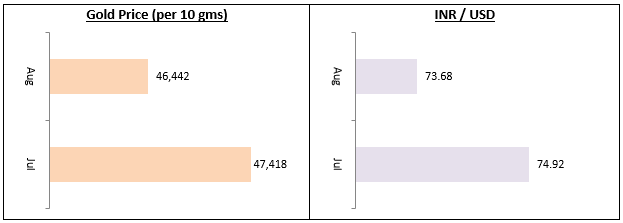

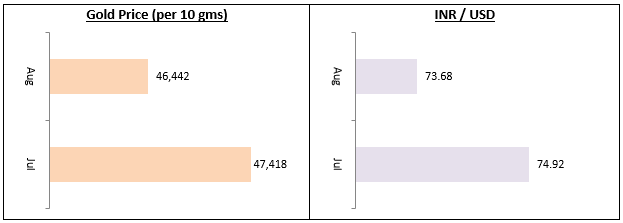

Domestic price of gold eased a little in August after months of rallying, but it is too early to say whether the Gold rally has topped out. Goldman Sachs and Fitch forecasts India’s GDP to contract in FY 2021. Even though Gold prices have risen more than 20% in the last 12 months, we believe that it can go even higher in the coming months due to the economic risks. There was some good news on the currency front in August, as the Rupee eased a bit against the US Dollar. You may like to read Is this a good time to invest in Gold ETFs

I will not devote a lot of time to Q1 corporate earnings in this letter. As expected due to the strict and prolonged lockdown, majority of Nifty companies reported lower sales and earnings in Q1. Though we expect Q2 corporate earnings to be better than Q1, we do not expect substantial earnings recovery till the COVID situation stabilizes.

As far as broader markets are concerned, midcaps outperformed Nifty / Sensex by a wide margin in August. I had mentioned several times in my letters to you this year that, midcap valuations were looking attractive after the deep correction over the past 2 years. We are seeing buying interest in the midcap segment. Accordingly, you can allocate a portion of your equity portfolio to midcap funds or multi-cap / large & midcap funds with significant allocations to midcap funds. We recommend investing in midcap or multi-cap funds through SIP / STP route. If you have surplus funds, you can also take advantage of market corrections to invest lumpsums in midcaps from time to time. At the same time, you should maintain sufficient large cap exposure to provide stability to your portfolio and limit downside risks in case of adverse market movement for any reason.

As far as debt funds are concerned, given the economic slowdown in India and the policy intent of RBI, we think that we are in slightly prolonged lower interest rate regime (interest rates on a downward trajectory). Longer duration funds like medium duration, medium to long duration, long duration and dynamic bond funds can continue to give good returns in the future. However, given the uncertainty in macro environment, yields can be volatile in the short term. You must have long investment tenures (3 years plus) for these funds. For conservative investors, Corporate Bond Funds and other high credit quality shorter duration accrual based debt funds can be good investment options. With liquid fund yields falling, liquid or ultra-short duration funds are likely to give lower returns than what they gave in the past. These funds will be suitable for 3 months to 1 year investment tenures.

We look forward to serving your financial needs with our array of products. As always, we assure you of our best services. Please provide us your valuable feedback so that we can further improve our services to serve your financial and investment planning needs.

Happy investing,

Ajoy Agarwal,

(Managing Director)