We had discussed about the tax implications of Budget 2020 in this month’s blog. In this article we like to draw our investor’s attention to one important tax change made by the Government with regards to dividends. Though we had touched upon key points of change in dividend taxation in our monthly blog, we want to discuss this topic in more detail as change in dividend taxation has substantial tax consequences for equity investors, especially for those in the higher tax brackets and investors need to make well considered investment decisions to reduce their tax obligations in light of this change.

What has changed in dividend taxation in budget 2020?

Up until this financial year (31st March 2020), dividends are tax free in the hands of the investors. However, companies and AMCs had to pay dividend distribution tax (DDT) before paying dividends to investors. DDT is considered by many as regressive taxation because the same profit is taxed twice – once as corporate tax and again as DDT. In this budget the Government abolished DDT and moved to the classical system of dividend taxation, i.e. taxing dividends at the hands of the investors.

From the next financial year (FY 2020-21) onwards, dividends will be added to your income and taxed as per your income tax slab.

Currently, the DDT for equity oriented funds is 11.65%. So if your income tax slab rate is less than 10%, then this change will be beneficial for you. For income in higher tax brackets, this change will result in more taxes. The DDT for non equity funds (debt funds and debt oriented hybrid funds) is 29.12%. The change in dividend taxation will be beneficial for all investors whose income tax slab is less than 30%. However, for investors in the 30% tax bracket, this change will result in more tax outgo. Another major change in dividend taxation which investors should be aware of is that, the AMCs will withhold TDS @ 10% for dividend pay-outs. You should factor this in your financial planning.

What is the impact of this change?

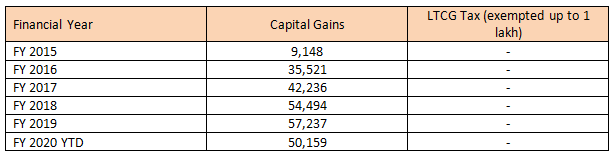

Let us illustrate this change with the help of an example. Let us assume you received a gross dividend of Rs 50,000 (before DDT). In the old DDT regime, the AMC would have to pay DDT on this before paying dividends to you. DDT rates were different for equity (11.65% including cess and surcharge) and 29.12% for debt (29.12% including cess and surcharge) funds. In the new regime, there will be no DDT. Instead the dividends will be added to your gross taxable income and taxed according to your tax slab. The table below shows the tax consequences in the old and the new regime.

You can see that for equity investors, the tax outgo increases substantially for all investors whose tax rates are in 15%+ brackets – higher your income, higher will be your tax on dividends. Debt fund investors in tax brackets lower than 30% will benefit from the change in dividend taxation, but investors in the 30% tax bracket will have to pay higher taxes even in debt funds. In light of this change in dividend taxation, investors will have to decide whether growth or dividend option is better for them.

Growth Option

In growth option, profits made by mutual fund schemes are not paid as dividends but re-invested in the scheme. When you sell or redeem your units in scheme’s growth option, capital gains tax applies.

- Short term capital gains (investment tenures of less than 12 months) in equity funds are taxed @ 15%, while long term capital gains are taxed @ 10% for equity funds (for profits in excess of Rs 1 lakh).

- Short term capital gains (investment tenures of less than 36 months) in debt funds are taxed @ income tax rate of the investors, while long term capital gains taxed @ 20% after indexation for debt.

- The Government has clarified that there will be no TDS on capital gains. If you simply compare long capital gains tax rates for both debt and equity funds with dividend tax rates as per new slab rates, then growth option is much more tax efficient than dividend option.

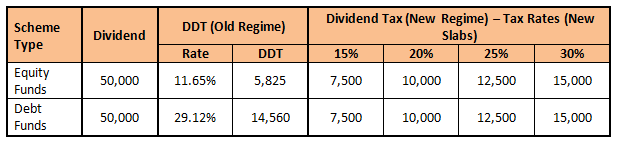

Illustration – Dividend versus Growth Option in new dividend tax regime

Let us assume, Mr.A invested Rs 10 lakhs in the dividend option of a mutual fund scheme for a period of 5 years and Mr. B invested Rs 10 lakhs in the growth option of the scheme for the same period. The ROI (annualized return) of the scheme is 10%. In the dividend option, the profits made by the scheme are paid out to investors while in the growth option the profits are re-invested in the scheme. In reality, the AMC may not pay-out all the profits as dividends and may retain some in their accumulated profits reserve, but for the sake of simplicity, we will assume that all profits are paid out as dividends. Let us further assume that both Mr A and Mr B are in the 30% tax bracket.

The table below shows, year-wise taxes for both the investors.

You can see that the tax outgo for Mr B is much lower over the entire investment tenure, even though the wealth creation in growth option is significantly more. In growth option, you stand to gain from the twin benefit of power of compounding and lower effective tax rates.

Based on our experience there are two primary reasons why investors opt for dividend options – automatic profit booking regularly and for regular cash-flows for their income needs. Though we do not recommend profit booking in mutual funds because it affects long term returns, even for the purpose of profit booking, growth option is better than dividend option because you can take advantage of the annual Rs 1 lakh tax exemption on long term capital gains tax and also lower long term capital gains tax rate in equity funds. Let us now discuss what to do, if you need regular income from your investment?

SWP Tax Advantage

Mutual fund Systematic Withdrawal Plan is a much more tax efficient option of getting regular cash-flows from your investment. Let us illustrate this with the help of an example. Let us assume you invested Rs 10 lakhs and you drew Rs 8,333 every month or Rs 1 lakh p.a. If you are in highest tax bracket you will have to pay Rs 30,000 taxes every year plus cess and surcharge if you want dividends of Rs 1 lakh every year. In total over a 5 year period you have to pay dividend tax of Rs 1.5 lakhs.

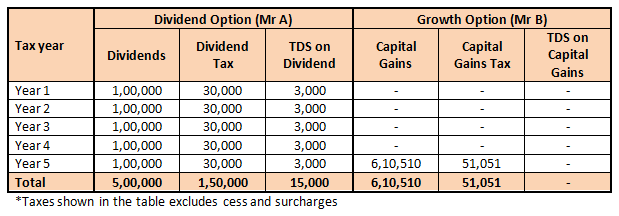

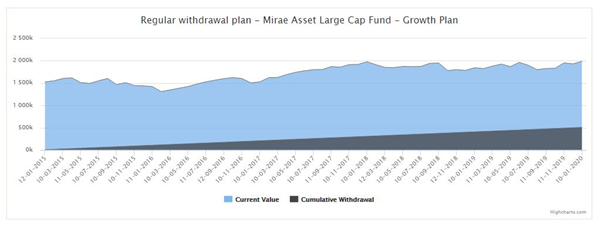

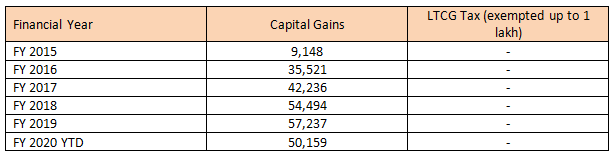

Let us now see how the SWP of Rs 8,333 every month or Rs 1 lakh p.a. worked from a lump sum investment of Rs 10 lakhs in Mirae Asset Large Cap Fund, assuming we made the investment in January 1, 2014. To avoid exit load and short term capital gains tax, we began the SWP on January 1, 2015.

You can see that with SWP, your investment value grew to Rs 20 lakhs (2X the investment amount), while you withdrew / redeemed Rs 1 lakh every year. Let us now see, how much capital gains tax you had to pay (assuming you were under the existing LTCG regime).

You can see that you had zero capital gains tax (no change in the new regime) – compare this with Rs 1.5 lakh dividend tax under the new regime.

Conclusion

In this article we have discussed the implications of change in dividend taxation. After changes in dividend taxation in this Budget growth option will be far more tax efficient than dividend option in mutual funds. Investors need to revisit their existing investments and also factor the taxation change when they make new investment decisions, so that they can make the most tax efficient investments. Our financial advisors will help you in reducing your tax obligations and maximize your wealth creation.