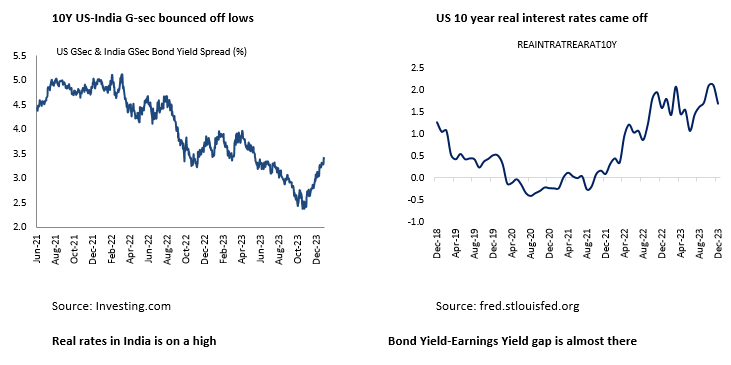

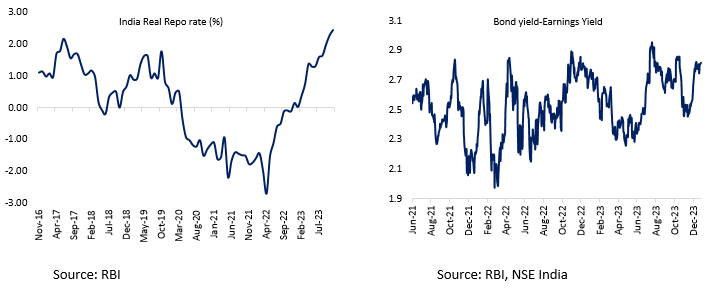

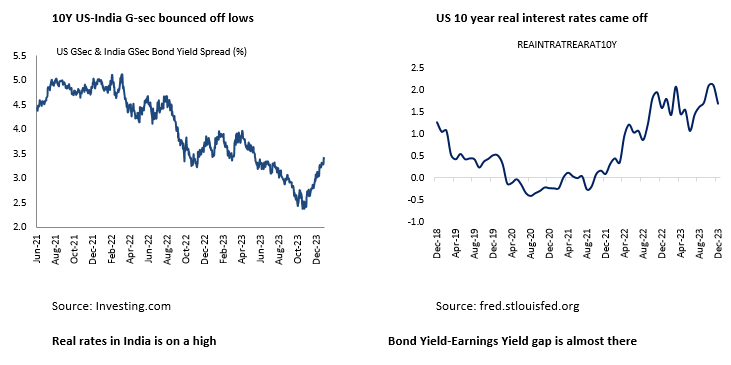

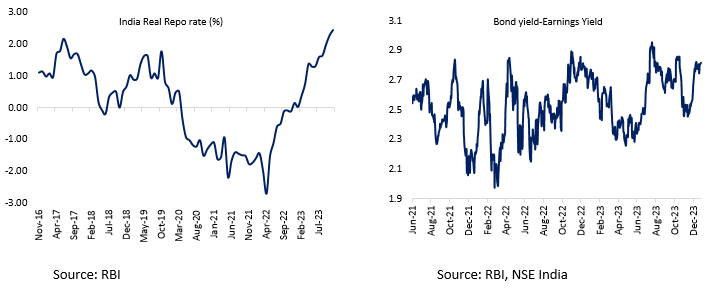

The year 2023 was certainly an eventful year and equally rewarding for investors as both Nifty and BSE Sensex claimed their new highs at the fag end of the year. However, in the hindsight, the path wasn’t a bed of roses, rather there were thorns in between. Just as always there were challenges - global inflation, peak US 10-year yield, rising crude oil prices, domestic consumption slowdown and geopolitical risks like Israel-Hamas war and continuation of Russia-Ukraine war. The fact that India remained attractive, despite decline in yield differential between US & India, also needs special appreciation of RBI, which has aptly managed the domestic rates/liquidity as well as forex reserves. There was buildup of expectations of US Fed calling on rate cuts and after maintaining status quo thrice on the trot, they eventually affirmed (in December) for 75 basis points of cuts from the current levels next year. While inflation has eased everywhere in the world, what eventually convinced Fed could be burgeoning debt service costs as U.S. federal budget deficit jumped 26% in November from a year earlier to $314 billion, stated Reuters. Besides, the 10y US real rates hitting 2% level, could have also played a part. For RBI, while there are bets of ease of rates/liquidity in 2024, the central bank remains concerned on food price inflation. On the contrary, core inflation (CPI excluding food & fuel) has eased, reflective of the monetary policy transmission. However, at the same time at the present levels of CPI and core inflation, the real rates (considering core inflation) is more than 2%, a level beyond RBI’s comfort zone. Thus, the RBI might just have to change its stance in 2024. In all probabilities, if the USD weakens, the RBI would have to reluctantly keep the Indian rupee at attractive levels (either through rates or forex intervention or both).

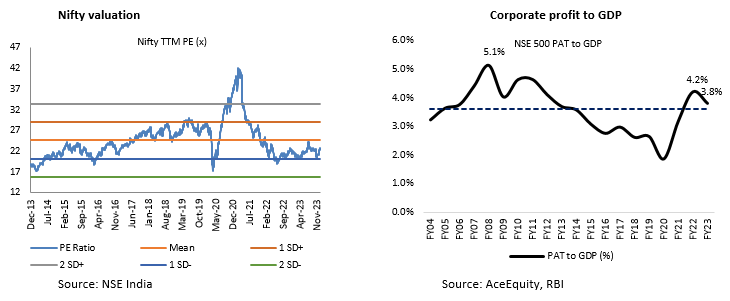

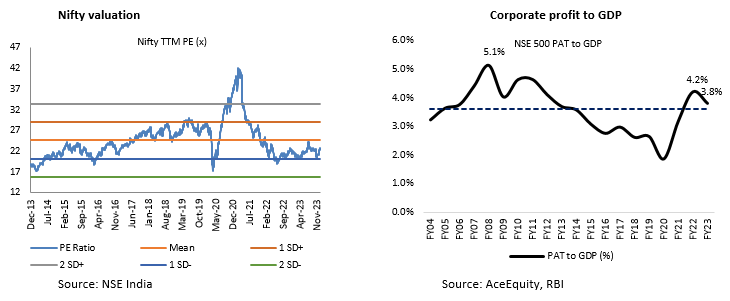

However, what’s in store for 2024? Clearly after such a brilliant rally in the domestic equity markets, the valuations are somewhat stretched especially in the midcap and small cap space while there is still comfort in the largecaps. The fact that corporate profitability to GDP has steadily improved has also justified the rally in the equity markets and will be a major driving force. The year 2024 certainly is starting with a sense of comfort in the sense that investors know what the US Fed thinks on interest rates ahead. Besides, the recent BJP wins in three of four state polls, months before national election also has provided comfort on predictions of India’s general elections in May 2024. That indeed is a big thumping force, with Mr. Modi at the helm, India has gained prominence among G20, bought Russian crude and yet skipped the ire from US, improved relations and struck deal with Saudi despite keeping a neutral stance over the Israel-Hamas war. In fact, economic ties between India and the Gulf countries dramatically increased since Modi’s arrival in power in May 2014. India’s total trade with Gulf countries has risen from $97bn in FY16 to $185bn in FY23. In a recent interview to Financial Times, Mr. Modi said that “we aspire to create conditions where everyone sees value in being in India to invest and expand their operations here.” The same article talks highly of India’s Chandrayaan-3 unmanned probe near the south pole of the Moon and hosting the world’s leading economies at a G20 summit. India is believed to have entered an Amrit Kaal and on mark to build $5 trillion economy, while critics have argued for a higher economic growth than current 6-7% annual rate to achieve the faster route to prosperity. Despite the criticisms, India is still the fastest growing economy and is an alternative to China. India’s GDP today is near where China’s GDP was back in 2007 and even at IMF’s conservative 6.3% annualized real GDP growth projection for next five years, India would become third largest economy by 2027. Thus, clearly India remains a compelling long-term case for investing in Indian equities. India is expected to reap benefits of its demographic dividend, massive infrastructure built since Modi came into power in 2014. India’s GDP growth off late has been led by government led capex while private consumption has lagged. India’s spend on digital infrastructure, implementation of GST and massively successful Unified Payments Interface (UPI) have enabled governance. Bumper GST collections and personal income taxes, have enabled the government to carry on with capex spends, until the private sector crowds in big time (probably when capacity utilization> 80%). While India has been slow to focus on manufacturing, its share of global commercial services exports jumped to 4.4% in 2022 from 2% in 2005. The present government has finally focused on manufacturing with its production linked incentive scheme (PLI) which has also attracted foreign direct investment (FDI) and the government has already tasted success in mobile manufacturing/exports. The fact that multinationals from Apple and its supplier Foxconn down seek to diversify their production away from China to hedge escalating geopolitical tensions, is a boon.

Besides, it’s not India alone which will hold general elections but U.S. and probably UK could also have one. In totality, 40 countries would vote in 2024 which means there would be promises of reforms, expenditure cuts, containing inflation and efforts to prop up economic growth. Thus, asset prices could get its necessary support in a benign interest rate environment, as policymakers will try to keep fear levels down and contain bad news. Unless tail risks play their part, supply chains warrant ease in raw material prices and together with ease in financial conditions, corporate profitability will have chance to improve further. Thus, for India, corporate profit to GDP which is already on an upscale will gain further. More importantly, this will also help in higher private capex, as the environment would be idle. The government, despite higher capex spends, has managed fiscal deficit (thanks to pick up in revenue) while current account balance remains strong. Thus, long gone are the twin deficit challenges which used to pose risks earlier. In fact, there is very little risk that challenges the hypothesis of long-term India story. Thus, the equity returns may be moderate in 2024 as we might witness intermittent corrections due to valuation concern, geo-political risks and commodity price pressures, the structural story for India remains strong.