The festive season is almost upon us. It is time of rejoicing, giving and making new beginnings. Before you get immersed in the festivities, it may be useful to remind yourself of your tax planning needs for the year. We are already in the third quarter of the Financial Year 2023-24. The last date for making tax saving investments for FY 2023-24 is 31st March 2024, but you should not leave tax planning for the last minute.

Why should you not leave tax planning till the last quarter?

It has been seen that many tax payers start their tax planning very late in the financial year and these leads to last minute scrambling to make their tax saving (80C) investments. You should do your tax planning now for the following reasons.

- Maximize tax savings: You should know how much to save for your 80C investments so that you can plan your expenses better so that you can avail full benefits of 80C tax savings. If you start your tax planning late in the year and do not have sufficient savings, you may have to pay more taxes.

- Avoid large tax outgo in the last quarter: For salaried people, most companies deduct tax in the last quarter of the financial year after accounting for all the deductions. If you are unable to avail the deductions, there will be a large tax outgo in the last quarter which may leave you with less money in hand for your regular expenses and savings.

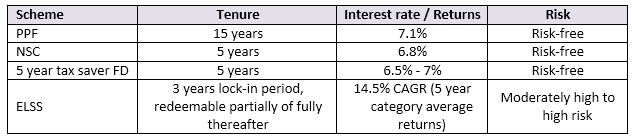

- Make informed investment decision according to your risk appetite: There are several eligible schemes for 80C tax savings with different risk return characteristics. The returns of different 80C schemes over long investment horizons can be substantially different. You should evaluate your risk appetite, financial goals and make informed investment decisions. Your Eastern Financiers financial advisor will help you in your tax planning investments.

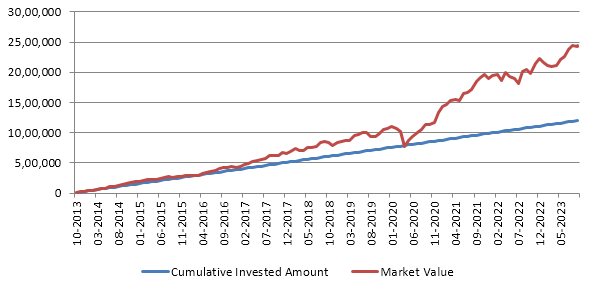

- Get higher returns: The longer your money remains invested, higher is your return. If you invest early in the year you can potentially get higher returns because you get interest or return for the entire year.

- Link tax planning with financial goals: Tax planning should not be just about saving taxes. You can also link tax planning with different financial goals so that you can get twin benefits of both tax savings and also meeting your financial goals.

How much tax you can save?

Section 80C of Income Tax Act of 1961 allows investors to claim deduction of up to Rs 150,000 from their taxable incomes by investing in certain schemes which are eligible u/s 80C. These schemes include Employee and Voluntary Provident Fund (EPF and VPF), Public Provident Fund (PPF), National Savings Certificates (NSC), 5 year tax saver bank fixed deposits, life insurance policies (both traditional and unit linked) and mutual fund Equity Linked Savings Schemes (ELSS). You can save up to Rs 46,800 in taxes by planning your tax saving investments.

How to plan your taxes?

There are various sections in Income Act, which can enable investors to claim tax deductions but we will restrict ourselves only to section 80C in this post.

- The maximum allowable deduction irrespective of income tax slabs u/s 80C is Rs 150,000

- If you are a salaried investor and contributing to EPF, your contribution to EPF will be included in 80C deduction.

- If you are paying home loan EMIs, then the principal component of the EMI payments for the year will also be included.

- If you have life insurance policies, the premium for the year will be included.

- Calculate how much deductions you can claim from the above and how much investment you need in order to claim the full benefit u/s 80C.

- Select the suitable 80C scheme to make your tax saving investments depending on your risk appetite and financial goals. In this post, we will discuss how mutual fund ELSS can you help you in tax planning and also wealth creation over long investment tenures.

What is ELSS?

Equity linked savings schemes (ELSS) are equity mutual fund schemes. Investments in ELSS are eligible for deductions from your taxable income under Section 80C of Income Tax Act 1961. There is no upper limit on investments in ELSS, but maximum deduction allowed u/s 80C is capped at Rs 150,000. ELSS funds have a lock-in period of 3 years. No redemption or withdrawal is allowed in the lock-in period. If you are investing in ELSS through Systematic Investment Plan (SIP), each SIP instalment will be locked in for 3 years.

ELSS invests in equity and equity related instruments. ELSS funds usually diversify across market cap segments and industry sectors; there are no SEBI mandated limits on market cap allocations for ELSS. Since ELSS funds are market linked investments, they are subject to market risks. You should invest according to your risk appetite and consult with your financial advisor if you need any help.

You may like to read why ELSS mutual fund is the best tax saving investment for wealth creation

Why invest in ELSS?

Please contact your Eastern Financiers financial advisor if you want to discuss your tax planning needs or contact us as at support@easternfin.com or call our customer care number 7003093592.

Suggested reading new versus old tax regime: which is better?