After giving high returns (15%+ p.a.) for the last two years, the equity market turned highly volatile this year, as high inflation and the War in Ukraine threatened to stall economic growth globally. After falling to 15,200 levels, the Nifty bounced back in June – July rising up to 18,000 levels. Over the past couple of weeks, the global markets again turned volatile after hawkish comments made by the US Federal Reserve Governor about interest rates. The Nifty has lost nearly 1,000 points falling below the psychological level of 17,000. We think that the market will continue to be volatile in the coming weeks and months, till we have visibility of end of this interest rate cycle. Once the market bottoms out, we think that Indian equities will bounce back very strongly because India is on a much stronger macro-economic footing compared to the emerging market pack. In this market condition, long term investors can benefit by using the STP route to invest in equities.

Suggested reading: India: Time to reclaim its lost heritage

What is STP?

Systematic Transfer Plan or STP is a mutual fund facility or a mechanism to transfer funds systematically from one mutual fund scheme to another. STP is usually used to transfer funds from a low risk fund (e.g. overnight, liquid, ultra short duration fund etc) to a high risk fund (e.g. equity fund) in volatile markets.

How does STP work?

Let us assume you have lump sum funds and want to invest in an equity mutual fund. But you are worried that the market may fall / continue to fall for some time. You can invest your funds in a liquid fund in lump sum. Liquid fund is a low risk fund and your investment in the liquid fund will not be affected by stock market volatility. Using STP, you can then transfer fixed amounts every month (or any other interval) from liquid fund to the equity fund of your choice; units of the liquid fund will be redeemed at the applicable NAVs on your chosen STP instalment date and the redemption proceeds will be used to buy units of the equity mutual fund at applicable NAVs.

You may also like to read: how to build and equity portfolio with gains from investment in liquid funds

Example of STP

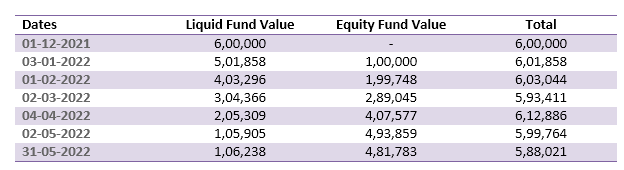

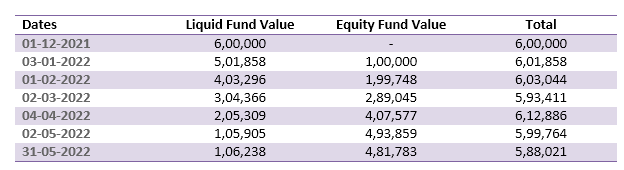

Let us assume you wanted to invest Rs 6 Lakhs on December 1, 2021 in the Nifty 50. Your market value of investment would be Rs 5.83 on May 31, 2022 (we have taken total returns). Let us examine a second case, where you invested your money lump sum in a liquid fund (we have used S&P BSE Liquid Rate Index as the proxy for the liquid fund) and set up instructions to transfer it to Nifty 50 TRI in 6 equal instalments from Jan 1, 2022 to Jun 1, 2022. The value of investments as on May 31, 2022 would Rs 5.88 lakhs. Let us see the results of your STP on a month to month basis.

Source: National Stock Exchange, Bombay Stock Exchange, EF Research, as on 31st May 2022

You can see that your total investment value in STP was higher than investment value in lump sum investments; downside risk protection. The bigger advantage of STP is that you can take advantage of market volatility through Rupee Cost Averaging in STP. Since your average cost is lower, your returns in the long term will be higher.

Points to consider in STP

- Be mindful of exit loads when planning your STP. Liquid funds charge exit loads for redemptions / STP within 1 week of investment

- Always select a low risk fund as the transferor scheme in STP e.g. overnight fund, liquid fund. A higher yield debt fund will be more volatile which will defeat the purpose of STP

- One of questions that investors ask about STP is the tenure of the STP. In this market condition you should have 3 to 6 months STP tenures. Economists are forecasting that we will see clear signs of the softening in the US economy before the end of this year and the Fed will stop hiking interest rates in Q1 of CY 2023.

- However, you should also be flexible with regards to your STP tenure. If you get a strong confirmation of market bottoming (i.e. market making higher tops) before the end of your STP tenure, then you should stop your STP and switch the balance units to your equity fund.

You may consult with Eastern Financiers’ financial advisors if you want to plan investment through STP.